Common questions about California amended individual returns (Form 540X) in Lacerte

by Intuit•3• Updated 1 month ago

In this article, you can find answers to frequently asked questions about amending a California individual return (Form 540X):

How do you amend a California individual return?

- Go to Screen 59, Amended Return (1040-X).

- In the section Return(s) to Amend, select the Federal/state return(s) to amend (Ctrl+T) (MANDATORY) dropdown menu.

- Select the box labeled California.

- Select OK.

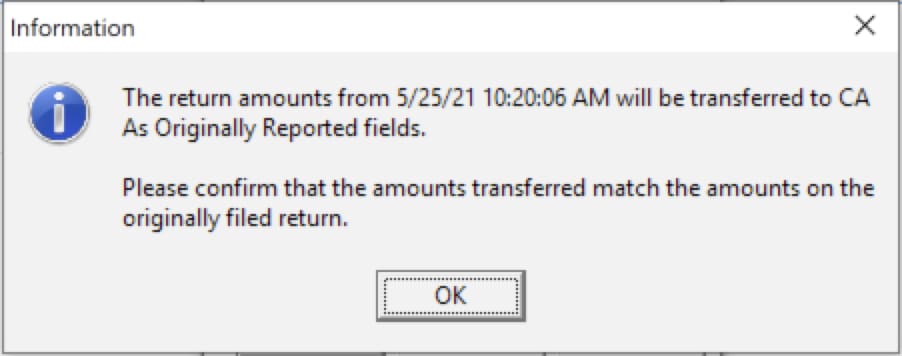

- In the Information pop-up window, select OK.

- Under the Amended panel, select California (Sch X).

- Enter all applicable information in the following fields on the Schedule X:

- Overpaid tax on original return (code 1)

- Tax paid with original return (code 2)

- Penalties (code 3)

- Interest (code 4)

- Make changes in the appropriate screens to show the amended changes.

If you're looking for how to amend a different return type, select an option here:

Related topics:

More like this

- Common questions about California amended individual returns in ProConnectby Intuit

- Amending an individual 1040X for a return not created in ProConnect Taxby Intuit

- Common questions about Form 1040 electronic filing miscellaneousby Intuit

- Common questions about Amended Returns in ProConnect Taxby Intuit