Generating Louisiana composite and PTE return in ProSeries

by Intuit•1• Updated 3 months ago

For more PTE resources, check out our dedicated Tax topics page where you'll find a list of all PTE states and the respective content for each.

New for Tax year 2024

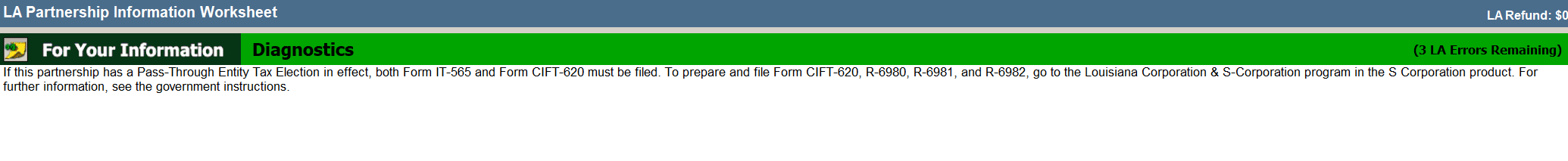

Beginning in tax year 2024, it's no longer possible to prepare both the Louisiana IT-565 and the CIFT-620 in the Partnership Module. You will need to prepare the IT-565 in the Partnership program.

To prepare the Louisiana Forms CIFT-620, R-6980, R-6981, and R-6892, go to the Louisiana Corporation & S-Corporation program in the S-Corporation product.

For Tax year 2023

In prior years, the Louisiana composite return was a separate filing type, and used form R-6922. During tax year 2023, the composite return was incorporated into the main form (IT-565). Page 9 of the form being Schedule 6922, and pages 10-12 report any credits attributable to the composite return.

ProSeries will complete Schedule 6922 when at least one partner qualifies for filing a composite return.

To generate Schedule 6922:

- Open the Louisiana Partnership Information Worksheet.

- On Part II - Tax Year Information and Filing Information check the No box for Entity is filing a pass-through entity (PTE) tax election for this tax year.

- On the Schedule K-1 Worksheet ProSeries will automatically check Yes or No based on the tax instructions for all partner types except for a Disregarded Entry.

- If a Disregarded Entry is not marked as a corporate partner the Include in composite return box must be manually completed.

- The Schedules A or B will automatically calculate and the Schedule 6922 will automatically complete.

Generating form CIFT-620:

The process for generating a Louisiana corporate income tax return for electing PTEs is the same as in prior years.

- Open the Louisiana Corporation Information Worksheet.

- Scroll down to Part II - Information Needed to Complete Louisiana Corporation Return.

- To generate the R6980 check Yes to Entity is filing initial pass-through entity (PTE) tax election in the current year.

- To generate the R6981 check Yes to Entity has already filed a pass-through entity (PTE) tax election.

Revenue account required for e-file

We can’t e-file returns without a Louisiana revenue account number. If your client doesn’t have one yet, they should go to the LaTAP website to register and receive a revenue account number.