How to complete Form 7203 and resolve diagnostic 56844 in ProConnect Tax

by Intuit•5• Updated 1 month ago

For more Schedule K-1 resources, check out our Tax topics page for Schedule K-1 where you'll find answers to the most commonly asked questions.

Table of contents:

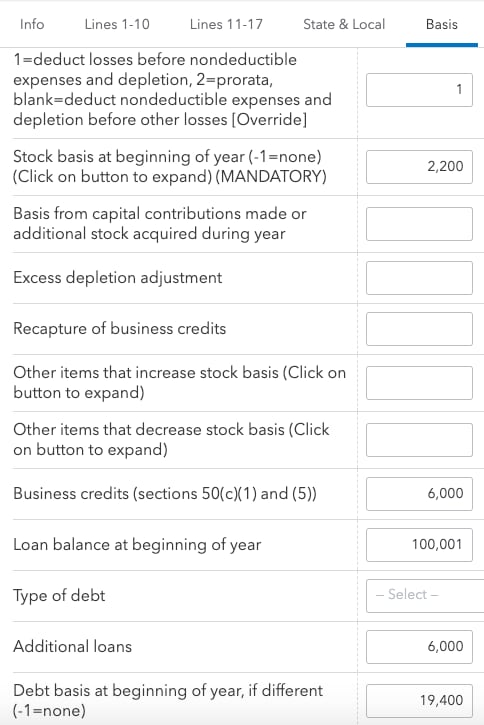

To enter basis limitation info in the individual return:

- Go to Input Return ⮕ Income ⮕ Passthrough K-1's ⮕ S-Corp Info (1120S K-1).

- Select the Basis tab.

- In the Basis Limitation (7203) section, enter your client’s Stock basis at beginning of year to print on line 1.

- This entry is mandatory to generate the form.

- The program will automatically calculate many of the increases and decreases based on your K-1 entries. You may need to enter the following items in this section, which aren’t automatically calculated:

- Basis from capital contributions made or additional stock acquired during year for line 2.

- Excess depletion adjustment for line 3j.

- Recapture of business credits for line 3l.

- Other items that increase stock basis for line 3m.

- Business credits (sections 50(c)(1) and (5)) for line 8c.

- Other items that decrease stock basis for line 13.

The program will only produce Form 7203 for K-1s where your client is claiming a loss, received a distribution, disposed of stock, or received a loan repayment. Other activities will still generate a Basis Limitation Worksheet to keep for your records.

To enter shareholder debt basis:

If your client only has one loan to the S-Corporation:

- Go to Input Return ⮕ Shareholder Information ⮕ Shareholder's Basis (7203)

- Enter the Loan balance at beginning of year, if any.

- Select the Type of debt.

- Enter any Additional loans made during the year that increased the outstanding balance of this loan.

- Enter the Debt basis at beginning of year, if different from the loan balance at the beginning of the year.

- If applicable, enter the amount of Adjustments to debt basis.

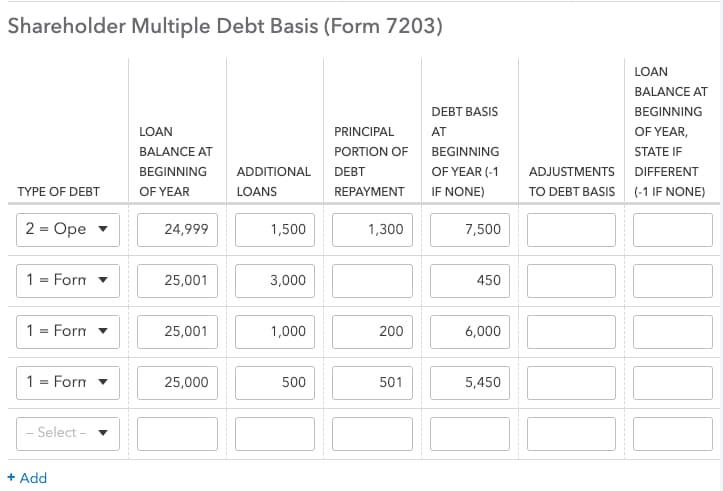

If your client has multiple loans to the S-Corporation:

- Go to Input Return ⮕ Shareholder Information ⮕ Shareholder's Basis (7203)

- Enter the total beginning balance for all loans in Loan balance at beginning of year.

- Leave the Type of debt blank.

- Enter the total of all Additional loans made during the year.

- Enter the total Debt basis at beginning of year, if different from the total loan balance at the beginning of the year.

- If applicable, enter the total Adjustments to debt basis for all loans.

- Use the Shareholder Multiple Debt Basis grid to enter the details of each loan:

- Select the Type of debt.

- Enter the Loan balance at beginning of year.

- If applicable, enter Additional loans made during the year.

- If applicable, enter the Principal portion of debt repayment.

- Enter the shareholder’s Debt basis at beginning of year, if different from the loan balance at the beginning of the year entered on this line.

- Verify that your grid totals equal the amounts you entered in steps 1-6.

Multiple debt basis example

If your client had more than three debts, additional form(s) 7203 will generate to show the loan details.

Attaching Form 7203 to the tax return and resolving diagnostic Ref 56844:

ProConnect Tax will generate a critical diagnostic (Ref #56844) reminding you to attach this form as a PDF for e-filing. To generate the form as a PDF:

- Go to the File Return tab.

- Select Partial Print on the left side of the screen.

- Check the box for 7203.

- Select the Create PDF button.

- Press Download PDF. The form will open in a new tab, where you can save it to your computer.

- Go to the Input Return tab.

- On the left-side menu, select General, then select Electronic Filing.

- Select the e-file PDF/Miscellaneous screen.

- Select the e-file Attachment hyperlink at the top right.

- Select the Attach PDF button.

- Locate the PDF on your computer in the window that appears.

- Select Open.

- Edit the Description of file (if desired).

- In the Link to form (defaults to main form) drop-down, select Form 7203 to clear the diagnostics.

See here for more help attaching a PDF to the return.