Modifying the Tax Summary in Lacerte

by Intuit•1• Updated 1 year ago

In Lacerte, it isn't possible to override descriptions or amounts in the tax summary. However, the Notes screen can be used to record any alterations for the following year's return.

Notes screens by module

The Notes screen numbers in each module are as follows:

- Individual - Screen 47

- Partnership - Screen 34

- Corporate - Screen 42

- S Corporation - Screen 39

- Fiduciary - Screen 51

- Exempt Organization - Screen 62

- Estate - Screen 36

- Gift - Screen 13

- Benefit Plan - Screen 22

Suppressing prior year information on the Tax Summary

Prior year information can be removed from the Tax Summary either by not importing it from the prior year during the proforma process or by suppressing it in the current year.

To prevent prior year information from transferring during the proforma process:

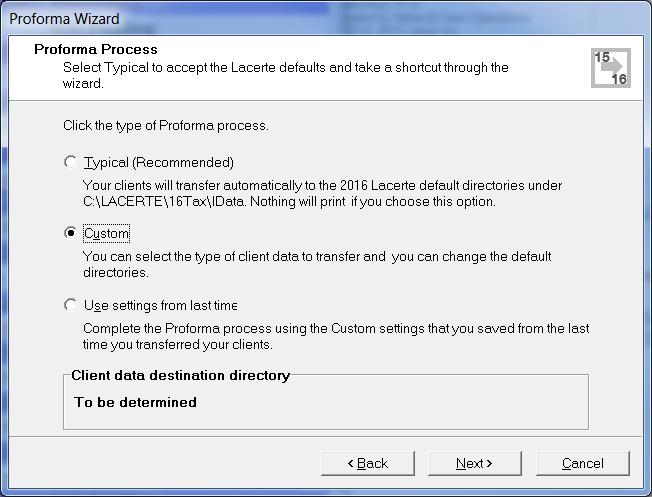

- Select Custom in the Proforma Wizard Proforma Process screen.

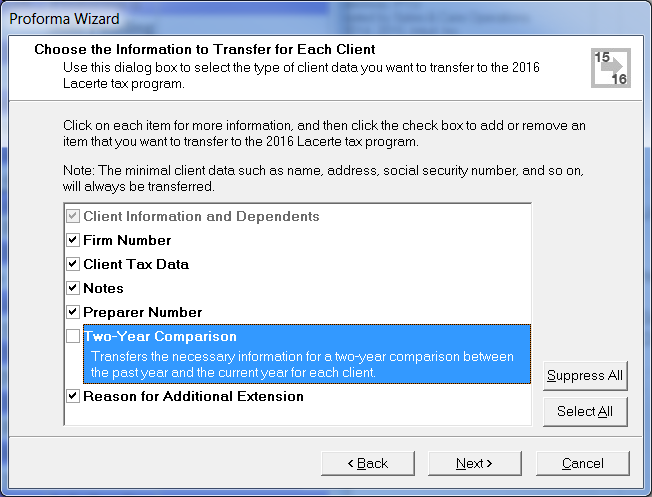

- Clear the Two-Year Comparison box in the screen for Choose the Information to Transfer for Each Client.

If prior year information is already transferred to the current year client, you can suppress it from the Tax Summary:

- From the Settings menu, select Options.

- On the Tax Return tab set 2-year Comparison to No.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Using the Tax Summary in Lacerteby Intuit

- Using the Tax Summary in ProConnect Taxby Intuit

- Common questions about the benefit plan summary annual report (SAR) in Lacerteby Intuit

- How to resolve Lacerte errors "Exception in InitProcessing - Catastrophic Failure" and "Exception Dispatching Message ID: 1127"by Intuit