Preparing a TX Combined Return in Lacerte

by Intuit•3• Updated 1 month ago

Table of contents:

| ‣ How do I prepare a TX Combined Return? |

| ‣ Individual only |

| ‣ On a combined report, the Tcode cannot print "Initial" even if it is specified on the Texas Franchise Tax screen |

How do I prepare a TX Combined Return?

- Create and Complete each Subsidiary Affiliated Member's Texas Franchise Return.

- Go to one of Subsidiary Affiliates returns.

- Go to the Texas Franchise Tax screen:

- Individual - Screen 54.431

- Partnership - Screen 43.431

- Corporate - Screen 51.431

- S-Corporate - Screen 49.431

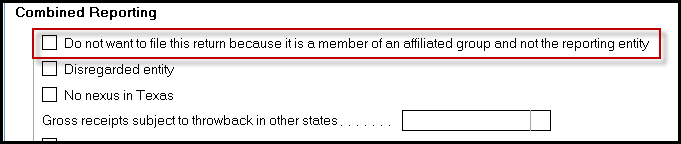

- Check the box Do not want to file this return because it is a member of an affiliated group and not the reporting entity under the Combined Reporting subsection.

Note: By checking the box at the top of the screen Export Public information Report, Lacerte will trigger a special section of the client letter that says Texas Franchise Tax Report is for informational purposes only, for 1040 filers, this triggers a separate TX only letter. Lacerte will print "DO NOT FILE" on the Texas report. The client letter will also say to mail Form 05-102 as this must always be filed separately by each affiliate. - Click on the Export button under the Texas Franchise Tax section.

- Click on Finished once the Export is complete.

- Repeat Steps 2-5 for each subsidiary.

- Go to the Reporting Entity's client file (parent).

- Go to the Texas Franchise Tax screen:

- Individual - Screen 54.433

- Partnership - Screen 43.432

- Corporate - Screen 51.433

- S-Corporate - Screen 49.433

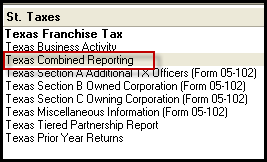

- Click on Texas Combined Reporting from the left navigation panel.

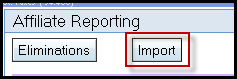

- Click on the Import button.

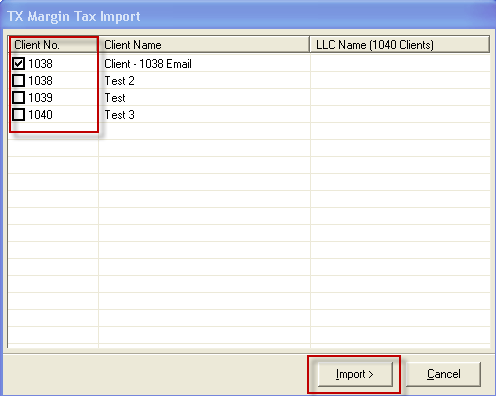

- Click Next on the TX Margin Tax Import wizard.

- Check the box for each Affiliate apart of this Combined return under the Client No. column.

- Click on Import.

- Click on Finish once the Import is complete (this should add each affiliate to the Texas Combined Reporting screen).

- Click on the Eliminations button to enter any eliminations.

Individual only:

- Go to Screen 54.431, Texas Franchise Tax.

- Check the box LLC is the parent of combined Texas Franchise Report to generate the combined returns for the reporting entity.

Lacerte will do the following:

- Completes Form 05-166, Texas Franchise Tax Affiliate Schedule.

- Completes Form 05-165, Texas Franchise Tax Extension Affiliate List (if the extension is also triggered)

- Produces a Combined Report schedule that shows the income, expenses, credits from each affiliate, any eliminations and the combined totals of each item. This combined info carries to the reporting entity's franchise report.

Note: The Export/Import functionality will only work for affiliates that have also been created within Lacerte as separate client files. Lacerte will export/import from any module to any module for combined reported (Individual, Partnership, S Corporate, Corporate). You can manually enter each affiliate by clicking on Add from the bottom left navigation panel on the Texas Combined Reporting screen.

On a combined report, the Tcode cannot print "Initial" even if it is specified on the Texas Franchise Tax screen

When the box "LLC is the parent of combined Texas Franchise Tax Report" is checked on the Texas Franchise Tax screen (screen 54.431, code 203), only "Annual" will print on the Tcode. This is true no matter what is indicated on the "Type of report: blank=annual, 1=initial, 2=final" field (screen 54.431, code 224).

Texas Franchise Tax Report Form instructions, page 4, state: "A combined group will not file an initial report. For the period that a combined group exists, the combined group will file only annual reports regardless of whether the reporting entity or any or all of the members of the combined group would have been required to file an initial report if filing as a separate entity.".