Marking a return as "Non-Paid Preparer" or "Self-Prepared" in ProSeries

This article will show you how to mark individual and business returns as "Non-Paid Preparer" or "Self-Prepared" in ProSeries. Select the applicable tax type below for insructions.

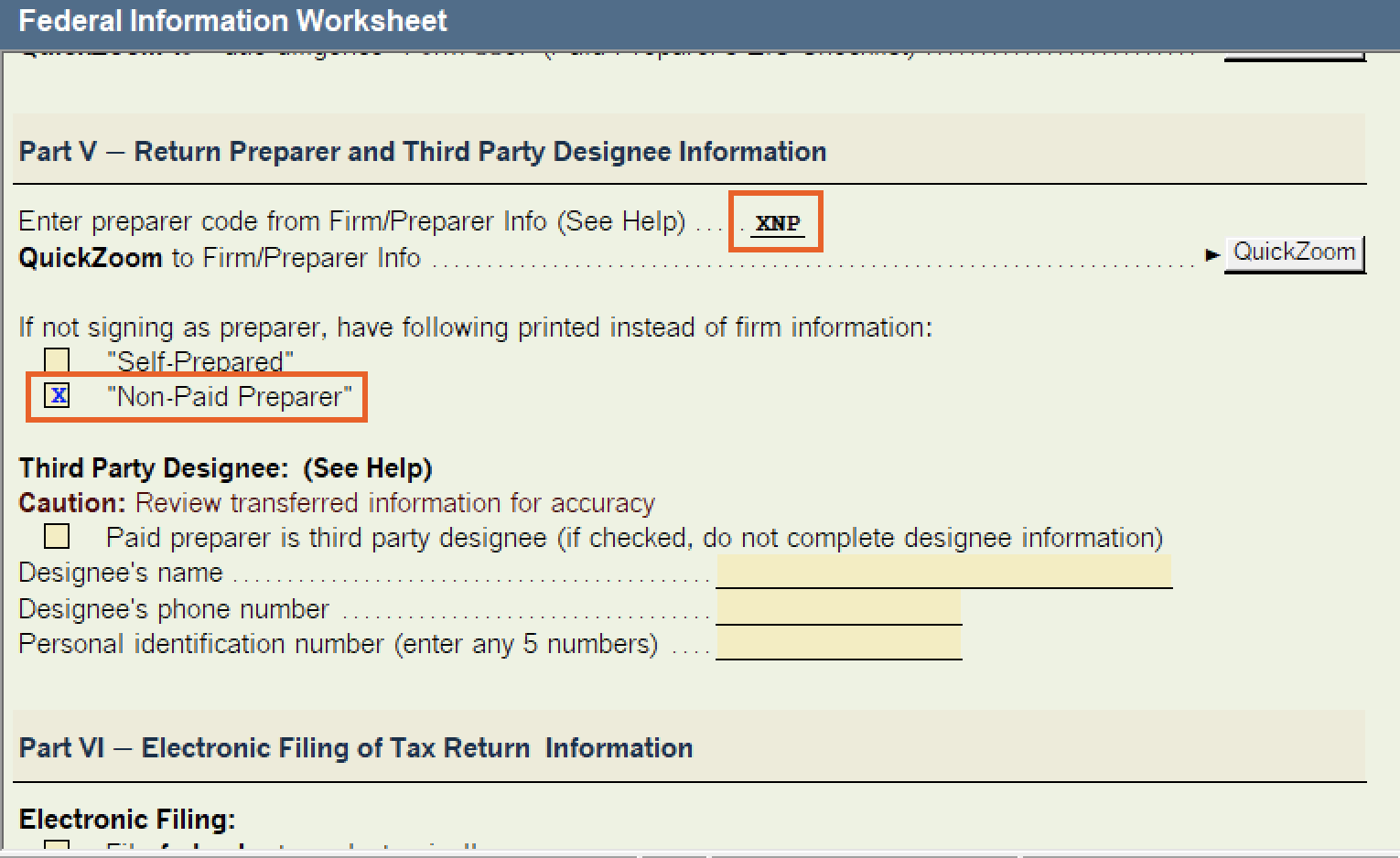

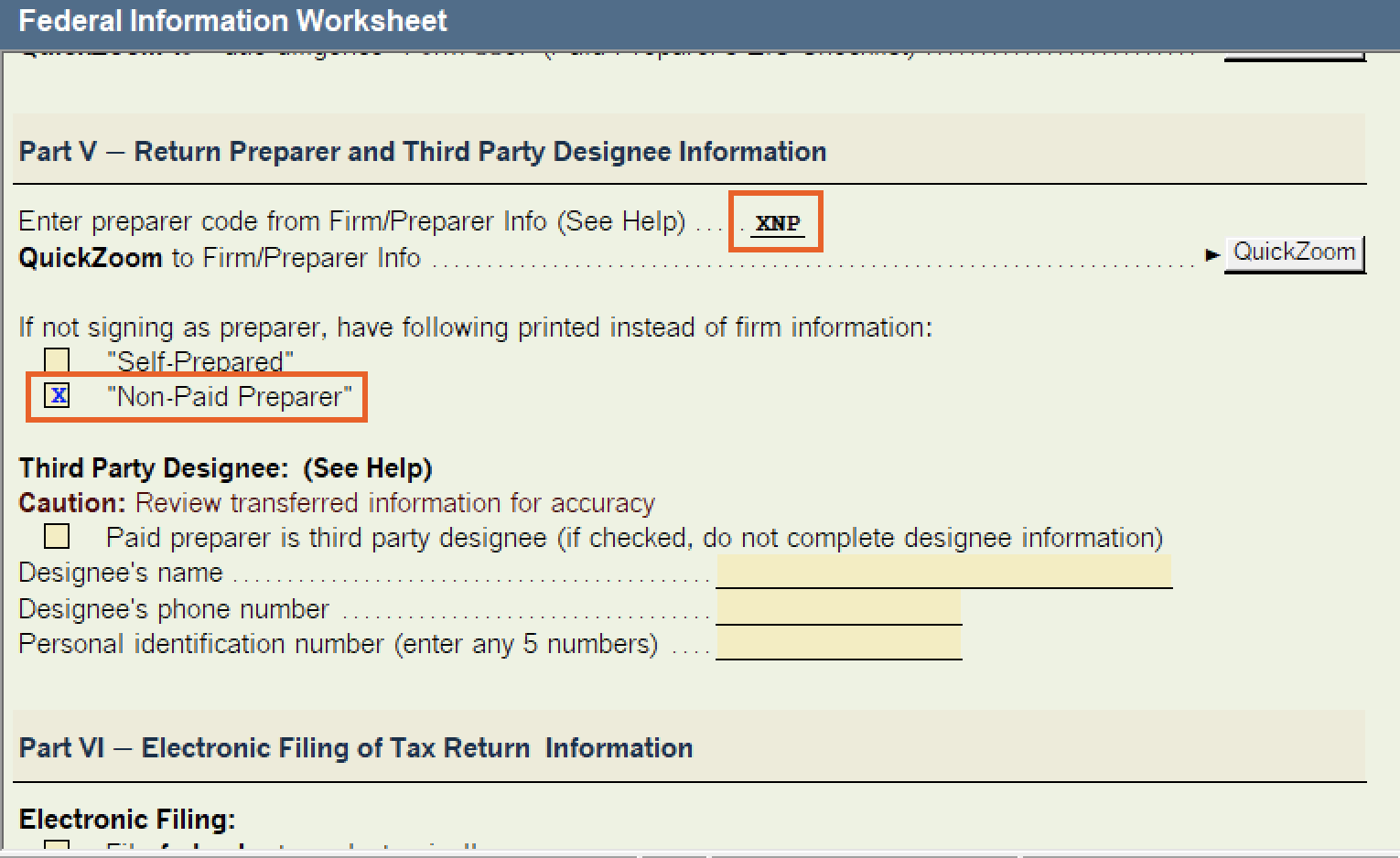

Follow these steps to mark a 1040/1040-NR return as Non-Paid Preparer:

- Open the client return.

- Go to the Federal Information Worksheet.

- For Form 1040, go to Part V - Return Preparer and Third Party Designee Information.

- For Form 1040NR, go to Part IV - Filing Information.

- For Non-Paid Preparer, check the box labeled Non-Paid Preparer or enter XNP as the Preparer Code.

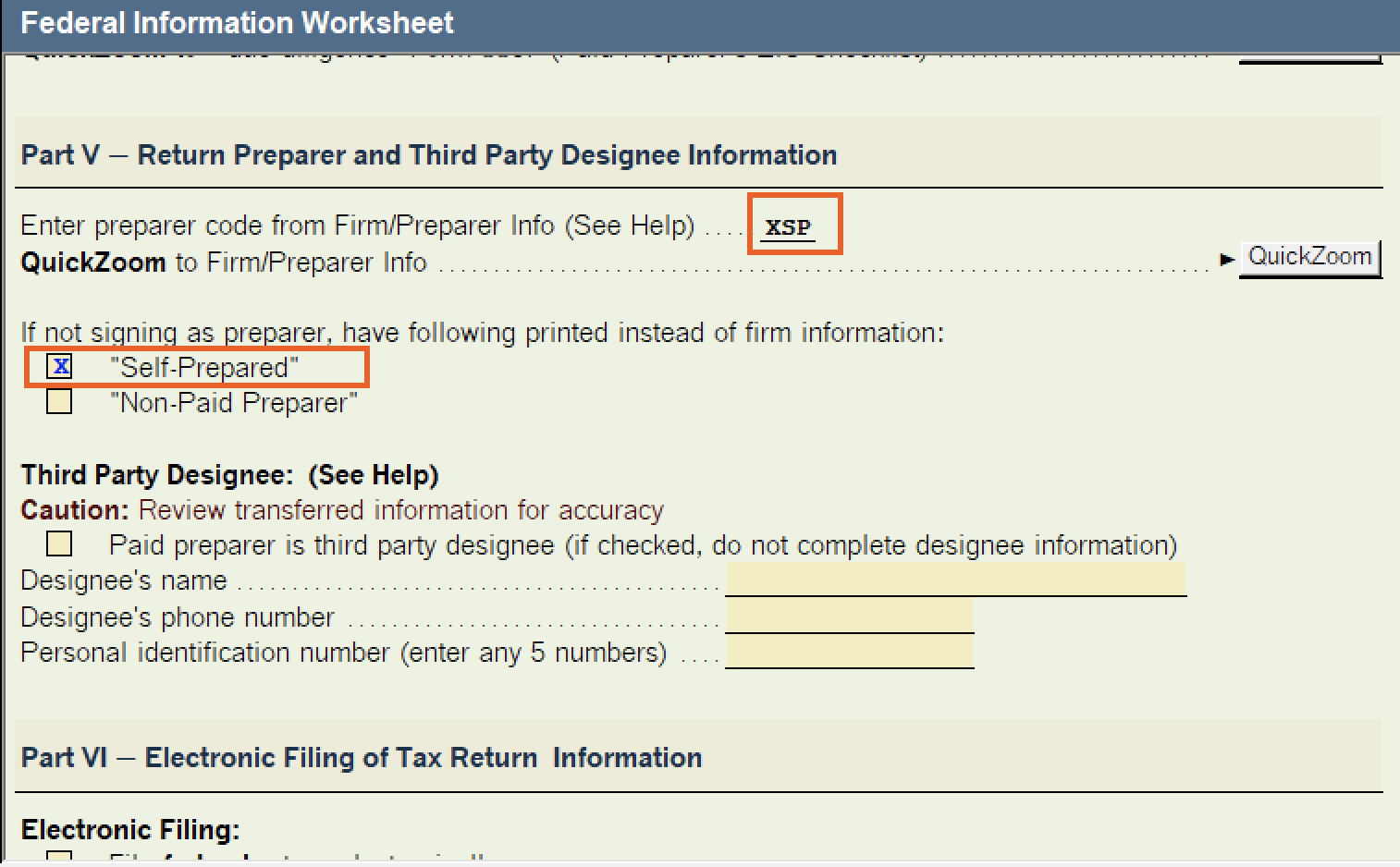

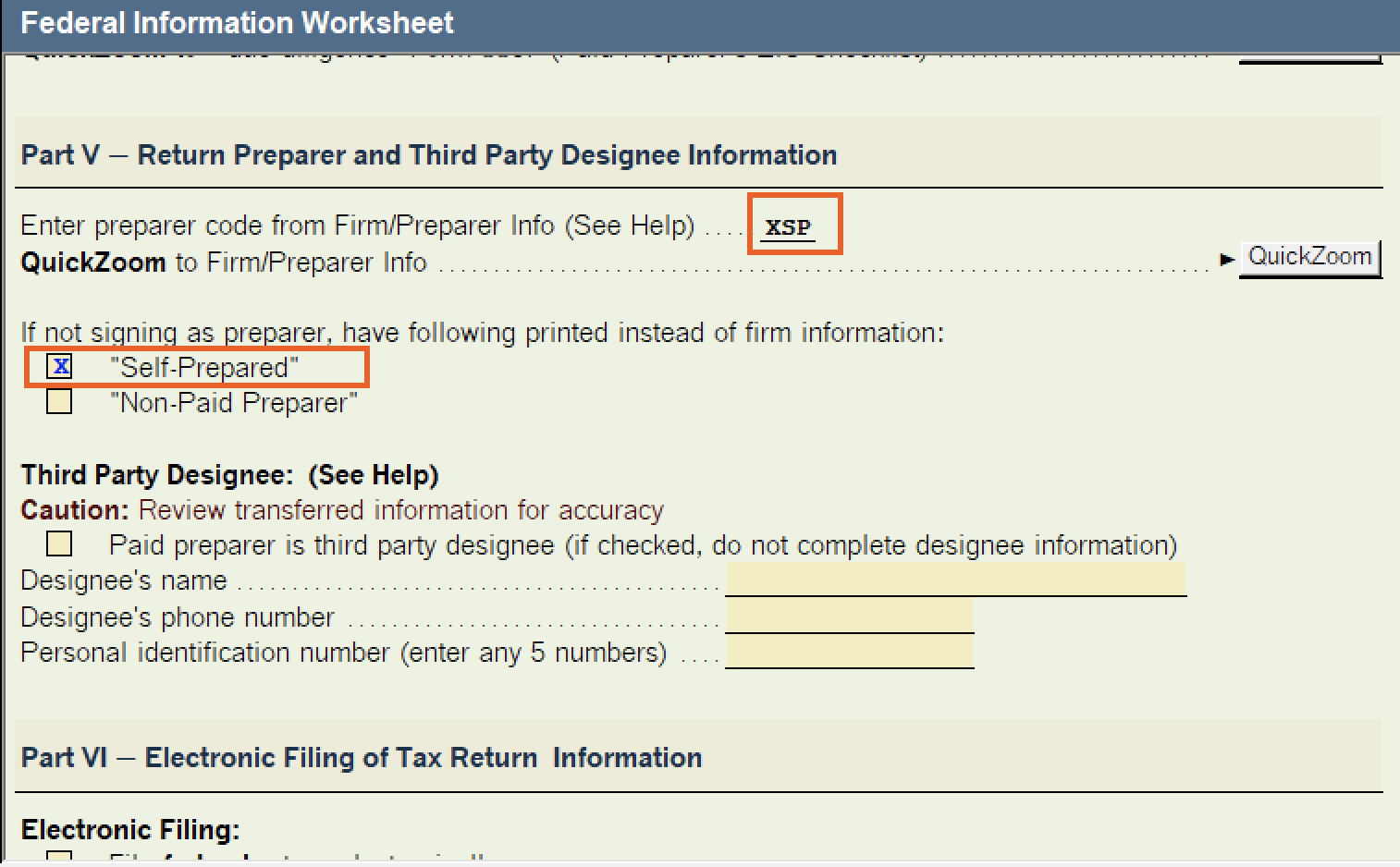

Follow these steps to mark a 1040/1040-NR return as Self-Prepared:

- Open the client return.

- Go to the Federal Information Worksheet.

- For Form 1040, go to Part V - Return Preparer and Third Party Designee Information.

- For Form 1040NR, go to Part IV - Filing Information.

- For Self-Prepared, check the box labeled Self-Prepared or enter XSP as the Preparer Code.

Follow these steps to mark the state return as Non-Paid Preparer or Self-Prepared:

- Open the state return.

- Go to the [State] Information Worksheet.

- Scroll down to the Paid Preparer Information section.

- Enter the applicable Preparer Code:

- For Non-Paid Preparer, enter XNP.

- For Self-Prepared, enter XSP.

Follow these steps to mark a business return as Non-Paid Preparer:

- Open the client return.

- Go to Page 1 of the applicable form:

- Form 1120

- Form 1120-S

- Form 1065

- Form 1041

- Form 706

- Form 709

- Scroll down to locate the Paid Preparer's Use Only section.

- Enter XNP in the small box to the left under Preparer's Signature.

Follow these steps to mark a business return as Self-Paid Preparer:

- Open the client return.

- Go to Page 1 of the applicable form:

- Form 1120

- Form 1120-S

- Form 1065

- Form 1041

- Form 706

- Form 709

- Scroll down to locate the Paid Preparer's Use Only section.

- Enter XSP in the small box to the left under Preparer's Signature.

Follow these steps to mark the state return as Non-Paid Preparer or Self-Prepared:

- Open the state return.

- Go to the [State] Information Worksheet.

- Scroll down to the Paid Preparer Information section.

- Enter the applicable Preparer Code:

- For Non-Paid Preparer, enter XNP.

- For Self-Prepared, enter XSP.