Common questions about entering income and deductions in a Partnership return (Form 1065) in ProSeries

by Intuit•6• Updated 10 months ago

This article will assist you with entering information from partnership Schedule K-1 into 1065 return in Intuit ProSeries.

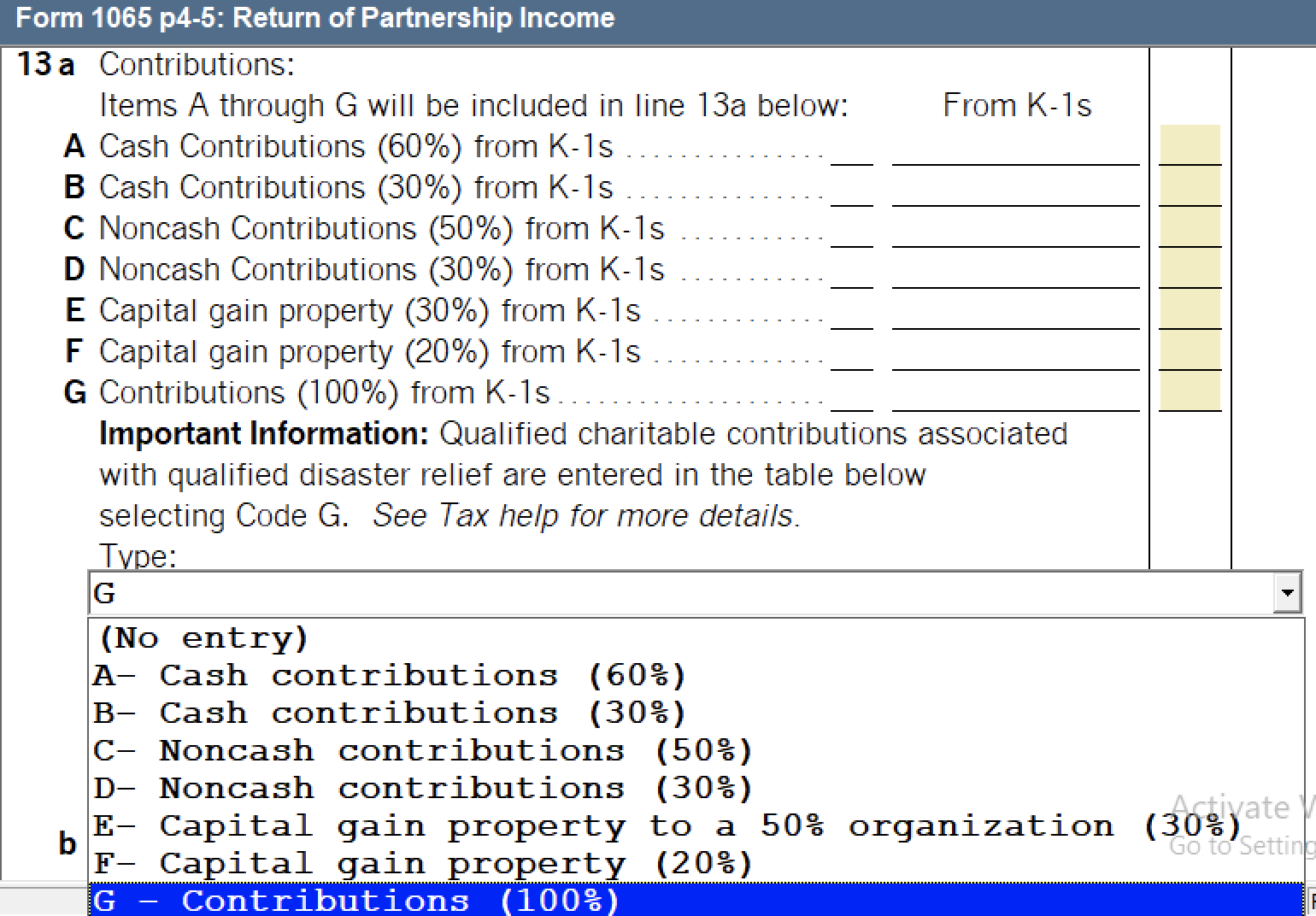

To enter information from a partner K-1 that the partnership received, complete the Worksheet to Enter Partner's Share of Income, Deductions, Credits, etc. (K-1 Partner).

Follow these steps to access the worksheet:

- Press F6 on your keyboard to bring up Open Forms.

- Type in "KP" and press Enter to highlight the applicable worksheet.

- Select an existing K-1 Entry Wks-Partnership to open, or select Create a new copy.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- General information about Form 1065 in ProSeries Professionalby Intuit

- COVID-19 relief: How to apply changes to returns in ProSeriesby Intuit

- Common questions about Form 8903 and domestic production activities deductions in ProConnect Taxby Intuit

- How to enter and calculate the qualified business income deduction, section 199A, in ProSeries on Form 8895by Intuit