How to allocate partnership CA 1231 gain/loss in Lacerte

by Intuit• Updated 10 months ago

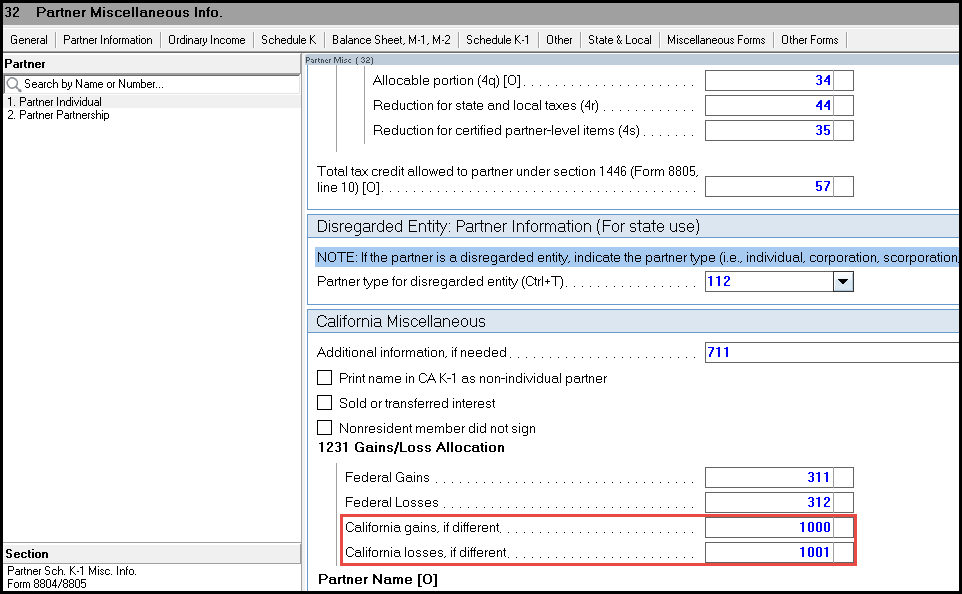

Starting in 2019, the following input fields have been introduced to the California Miscellaneous section of Screen 32, Partner Miscellaneous Info. within the Partnership module of Lacerte. These input fields are located under the 1231 Gains/Loss Allocation subsection.

Follow these steps to allocate CA 1231 gain/loss in the Partnership module:

- Go to Screen 32.1, Schedule K-1 Miscellaneous.

- Select the applicable Partner from the left navigation menu.

- Scroll down to the California Miscellaneous section.

- Locate the 1231 Gains/Loss Allocation subsection.

- Complete any applicable fields in this subsection.