Entering meals and entertainment expenses in ProSeries

by Intuit•2• Updated 2 months ago

When entering meals & entertainment expenses, enter the total amount before any limitations have been applied.

ProSeries will automatically calculate the allowable deduction based on the stated limitation.

To enter the meals & entertainment expenses on Schedule C:

- Press F6 on your keyboard to bring up Open Forms.

- Type in "C" and press Enter to open Schedule C.

- Scroll down to the Part II - Expenses section.

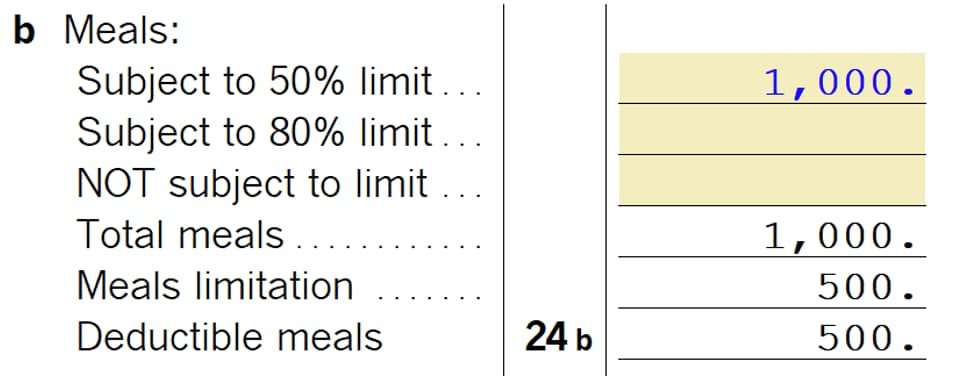

- Enter meals & entertainment expenses on line 24b according to the limits listed.

To enter the meals & entertainment expenses on Form 1065:

- Go to Form 1065 p.1-3.

- Scroll down to the Meals & Entertainment Smart Worksheet.

To enter the meals & entertainment expenses on Form 1120:

- Go to Form 1120 p.1-2.

- Scroll down to the Meals & Entertainment Smart Worksheet.

- Enter meals & entertainment expenses on lines A-D according to the limits listed.

- The allowable percentage of your entries will transfer to line 26.

To enter the meals & entertainment expenses on Form 1120-S:

- Go to the Other Deductions Worksheet.

- Enter meals & entertainment expenses on lines A-D according to the limits listed.

- The allowable percentage of your entries will transfer to line 20 as Other Deduction on the 1120-S page 1.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Entering Nondeductible Expenses for an S-Corporation in Lacerteby Intuit

- Specially allocating meals and entertainment for partnership Schedule K-1, Line 18c in Lacerteby Intuit

- How to enter unreimbursed partnership expenses for Schedule Eby Intuit

- Specially allocating meals and entertainment for partnership Schedule K-1, Line 18c in ProConnect Taxby Intuit