How to enter unreimbursed partnership expenses for Schedule E in ProConnect

by Intuit• Updated 1 month ago

This article will help you enter unreimbursed partnership expenses (UPE) in an individual return to print on Schedule E, line 28, and understand why UPE may be generating on a return.

Entering UPE directly

If you don't need ProConnect to calculate the amount of UPE, or if your client's Schedule K-1 reported an unreimbursed expense that isn't automatically calculated by the program, you can enter the UPE directly as an adjustment. This adjustment won't override any UPE generating from other screens or entries in the return; it just increases the amount reported on Schedule E, line 28.

Follow these steps to directly enter UPE:

- Select Income on the left-side menu, then click on Passthrough K-1s.

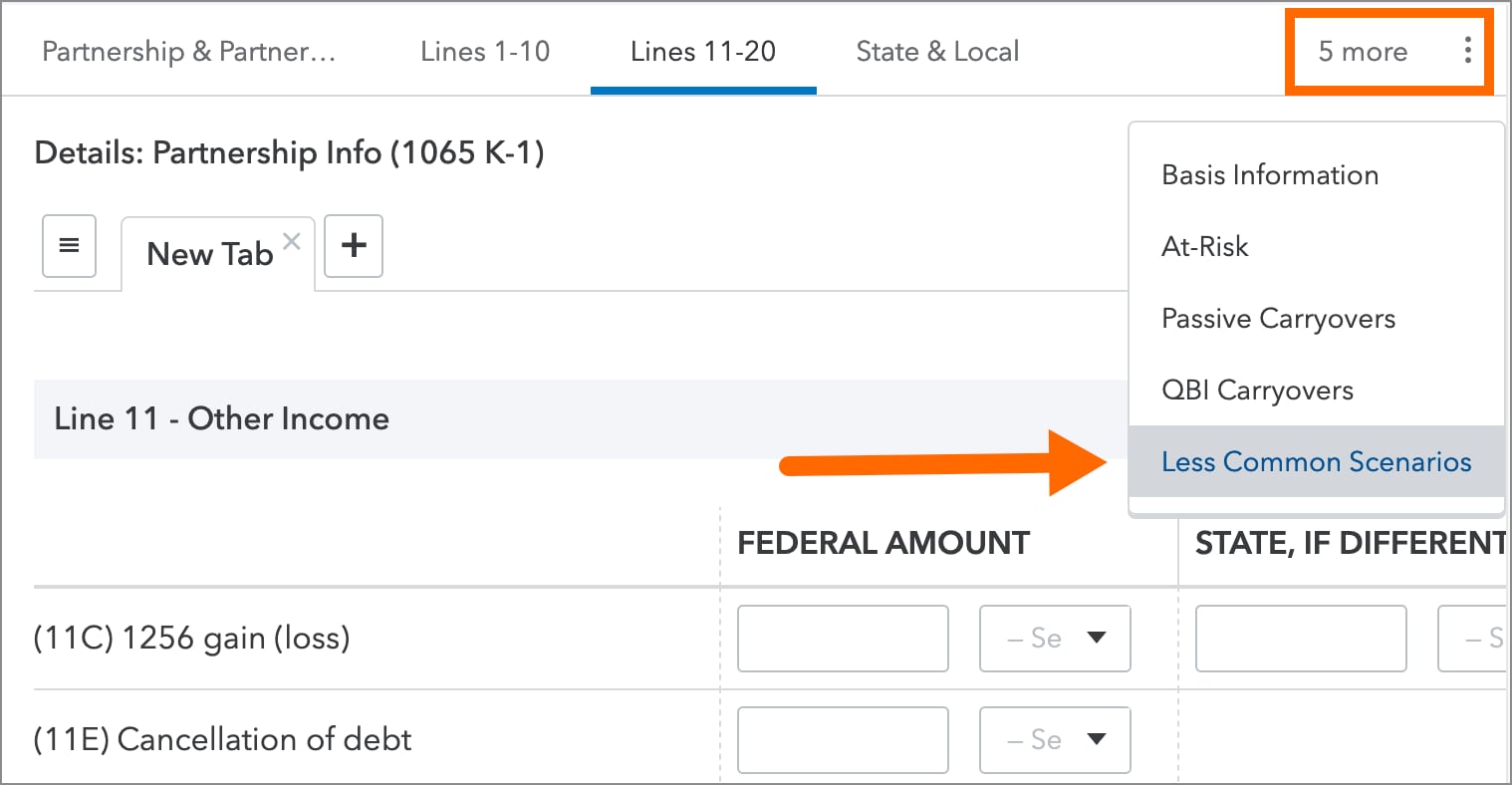

- Select the Partnership Info (1065 K-1) screen.

- Choose the Less Common Scenarios section along the top of the input.

- Enter the amount in Unreimbursed expenses (enter as positive) [Adjust].

Basis carryovers

Basis carryovers from prior year unreimbursed expenses can be entered on this screen, too - just select the Basis Information section along the top of the input, then scroll down to the Unreimbursed expenses field.

Linking expenses to the K-1

Besides direct entries, the program can calculate any of the following deductions as UPE long as you link your input to Schedule E (partnership):

- Allowable expenses for Business Use of Home

- Vehicle expenses

- Unreimbursed expenses such as meals and entertainment

- Current depreciation or special depreciation allowance for qualified property

Follow these steps to have ProConnect calculate UPE:

- Select Deductions from the left-side menu.

- Choose the appropriate screen:

- Depreciation or Direct Input (4562),

- Business Use of Home (8829), or

- Vehicle/Emp. Bus. Expense (2106) to enter meals, entertainment, or vehicle expenses when not depreciating the vehicle.

- In the Form (Click on arrow to select from list) field, choose Schedule E (partnership).

- Select the applicable partnership's name in Activity name or number.

- Complete any other entries that apply.

The calculated allowable expenses will print on Schedule E, line 28, column (i) for nonpassive activities, or column (g) for passive activities that are not required to file Form 8582. See the IRS Instructions for Schedule SE for additional guidance.