How to generate Form 4852 in Lacerte

by Intuit•14• Updated 6 months ago

This article will assist you with generating Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRA's Insurance Contracts, Etc., in the Individual module of Lacerte.

How do I generate Form 4852 in the program?

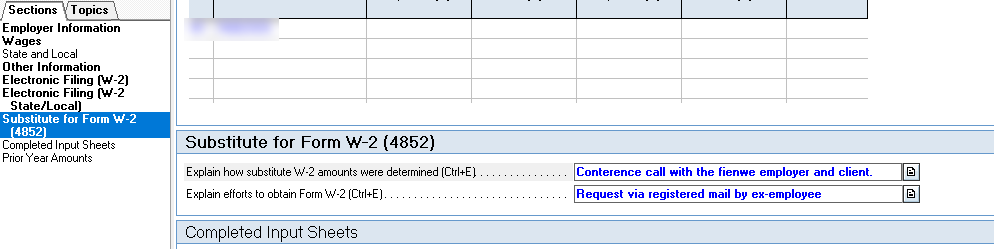

If you're substituting Form W-2:

- Go to Screen 10, Wages, Salaries, Tips.

- Scroll down to the Substitute for Form W-2 (4852) section.

- Enter the Explain how substitute W-2 amounts were determined field.

- Enter the Explain efforts to obtain Form W-2 field.

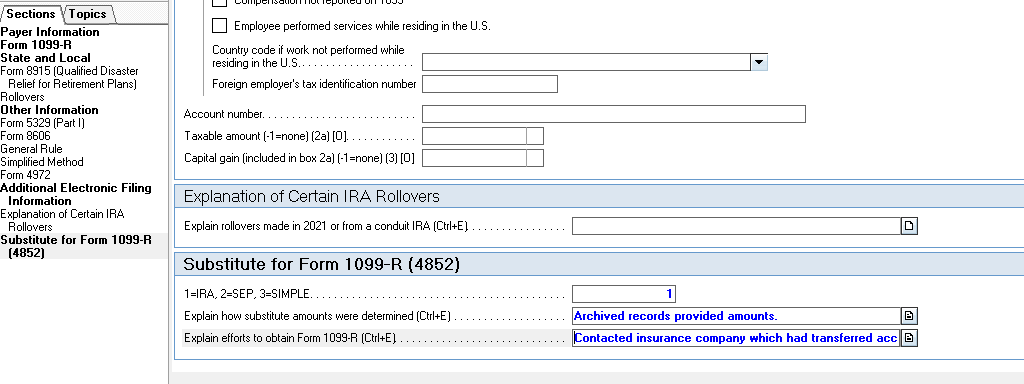

If you're substituting Form 1099-R:

- Go to Screen 13.1, Pensions, IRAs (1099-R).

- Scroll down to the Substitute for Form 1099-R (4852) section.

- Enter a 1, 2, or 3 in 1=IRA, 2=SEP, 3=SIMPLE.

- Enter the Explain how substitute amounts were determined field.

- Enter the Explain efforts to obtain Form 1099-R field.