Entering wash sales in ProSeries

by Intuit•4• Updated 1 month ago

Follow these steps to enter a full or partial wash sale in tax year 2025 and newer:

- Open the Schedule D.

- Select the QuickZoom to Capital Asset Sales Worksheet.

- Enter the Broker name and click Create.

- If a 1099-B was not received for the transaction check the box Transactions were not reported to IRS.

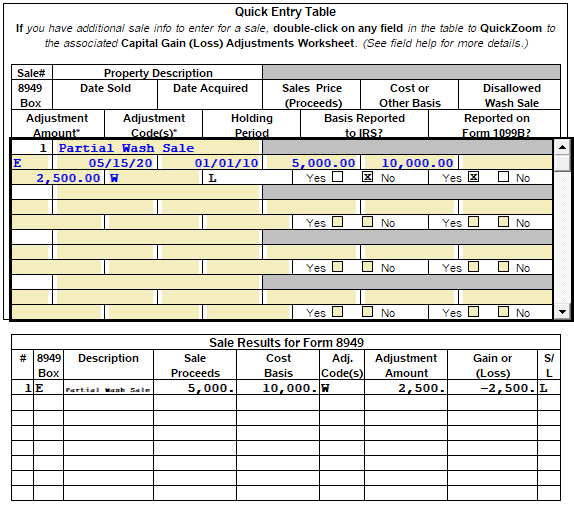

- Use the Quick Entry Table to quickly enter the transaction.

- In the Adjustment Amount field enter the adjustment amount.

- In the Adjustment Code(s) field enter a W for Wash Sale.

Follow these steps to enter a full or partial wash sale in tax year 2020 to 2024:

- Open the Schedule D.

- Select the QuickZoom to Go to Form 1099-B Worksheet.

- Enter the Broker name and click Create.

- If a 1099-B was not received for the transaction check the box Transactions were not reported to IRS.

- Use the Quick Entry Table to quickly enter the transaction.

- In the Adjustment Amount field enter the adjustment amount.

- In the Adjustment Code(s) field enter a W for Wash Sale.

For a complete list of Adjustment Codes and the 8949 Box codes, see Methods for entering stock transactions for the Schedule D.