Entering Sale of Capital Assets in tax year 2019 and prior in ProSeries

by Intuit•6• Updated 8 months ago

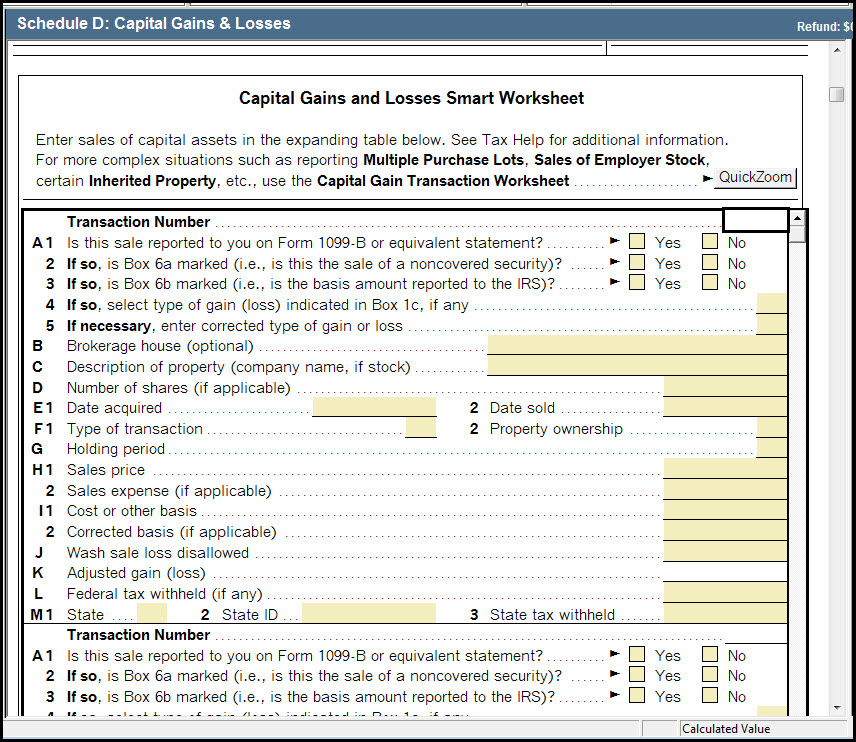

This article will help you enter Schedule D and 1099-B information in ProSeries 2019 and prior. For details on entering transactions for ProSeries 2020 see Methods for entering stock transactions for the Schedule D

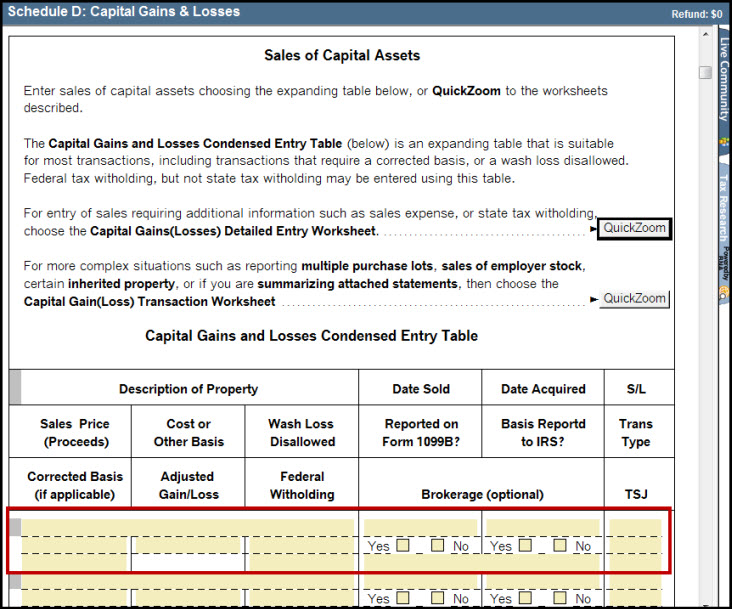

Capital Gains and Losses Condensed Entry Table

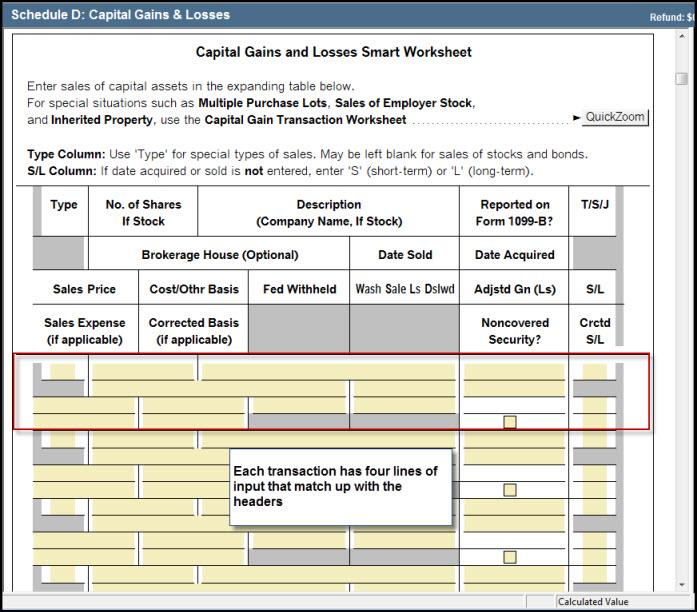

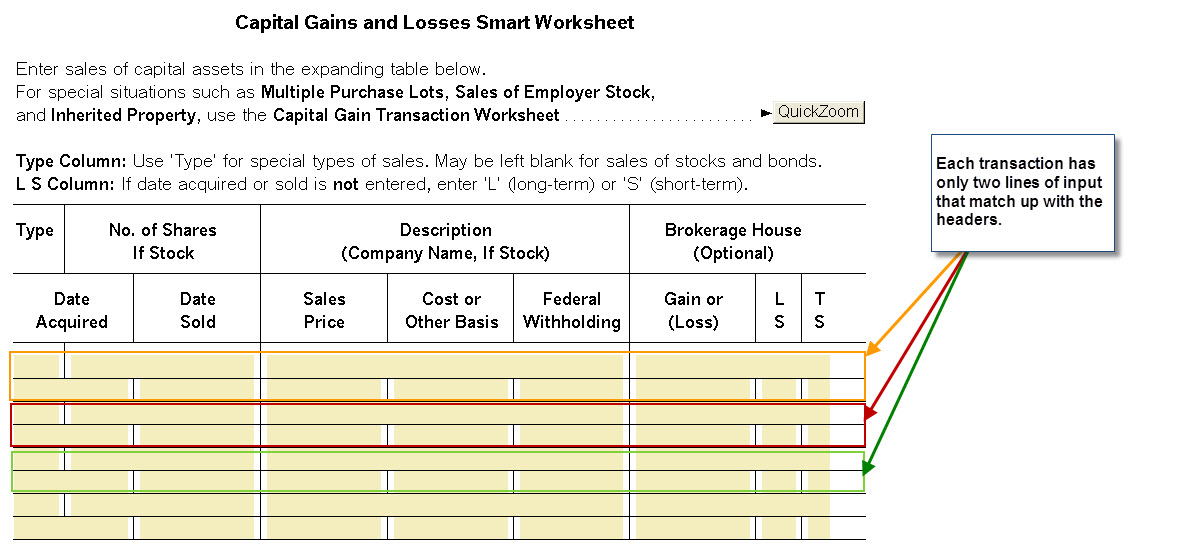

Each sale will have three rows of entries in the table:

Use this worksheet to enter sales of investments and other capital assets not related to a specific activity. The program will report each transaction entered here on Form(s) 8949, Part I line 1 or Part II line 1, as applicable.

For transactions that require additional detail, such as state tax withholding, or sales expense, enter sales of investments using the Capital Gains (Losses) Detail Entry Worksheet.

For special situations such as multiple Purchase Lots and sales of Employer Stock, the Capital Gain (Loss) Transaction Worksheet may be used to take advantage of additional computational capabilities provided on that worksheet.

Complete one record in the expanding table for each sale. If a sale has both long and short-term components, it must be divided into two parts: the long-term component entered in one record, and the short-term component entered in a second record.

Form 1099-B or Equivalent Statement

Brokers report sales of stock, mutual funds, etc. on Form 1099-B, or on a substitute or consolidated statement that provides information equivalent to that provided by that form. For such transactions, transcribe the information on the form or statement received from the broker to this worksheet using one record for each reported transaction.

However, do not enter into this worksheet sales that must be reported on Form 6781, Gains and Losses from Section 1256 Contracts. Use Form 6781 when Form 1099-B or its equivalent has entries in Boxes 9, 10, 11, or 12.

Description (Company Name If Stock) Enter here the name of the company, mutual fund, or other asset sold.

Date Sold Enter the date of sale in mm/dd/yyyy format (for example, enter September 4, 2013 as "09/04/2013"). The IRS does not allow "Various" as a date sold; enter a specific current-year sales date, even if reporting an aggregate short-term or long-term sale summarizing an attached statement. When applicable, "Worthless" or "Bankrupt" are permissible entries for date of sale.

Date Acquired Enter the date of acquisition in mm/dd/yyyy format (for example, enter May 8, 2009 as "05/08/2009"). "Various" may be entered if multiple dates of acquisition apply. "Inherited" may be entered for sales of inherited property, but only if the applicable holding period is long-term. (Use the Capital Gain (Loss) Transaction Worksheet for sales of inherited property to which a short-term holding period applies.)

Holding Period The holding period reported for the transaction is determined to be short-term (S) or long-term (L) as follows.

- If "N" is selected for Transaction Type, "S" calculates here; otherwise, if "Inherited" is entered for Date Acquired, "L" calculates here.

- Otherwise, if "Yes" is NOT marked on "Reported on Form 1099-B?":

- a selection must be made here (a) if "Various" is entered on Date Acquired, or "Worthless" or "Bankrupt" is entered on line Date Sold, or (b) to force the transaction to be reported as short-term or long-term;

- this line may be left empty if valid dates are entered on both Date Acquired and Date Sold, in which case the holding period is governed by the inclusive period between the dates (short-term if, and only if, less than a year and a day, and long-term otherwise.)

Sales Price Enter here the proceeds received as a result of this sales transaction. If the transaction is reported on Form 1099-B or equivalent statement, transcribe the amount from Box 2. Note: Box 2 also indicates whether the reported proceeds are Gross Proceeds or Net Proceeds (after reduction by selling expenses such as commissions and option premiums.)

Cost or Other Basis Enter here the cost or other basis of the asset sold. If this transaction is reported on Form 1099-B or equivalent statement, transcribe the amount from Box 3, if present; usually this is the purchase price plus any purchase expenses plus any selling expenses not included in Form 1099-B, Box 2. IRS Publication 550 or IRS Publication 551 may help determine the proper cost or other basis amount, if necessary.

Wash Sale Loss Disallowed Enter here any amount of loss disallowed due to wash sale restrictions. If this transaction is reported on Form 1099-B or equivalent statement, transcribe the amount from Box 5, if present. Entering an amount here will cause " W" to be calculated on Transaction Type (if that line is empty).

Reported on Form 1099-B or Equivalent Statement? Mark "Yes" if this transaction was reported on Form 1099-B or on a substitute or consolidated statement; otherwise, mark "No".

Basis Reported to IRS? If "Yes" is marked on "Reported on Form 1099-B?", mark "Yes" or "No" here to indicate whether the received form or statement shows that the cost or other basis for this asset has been reported to the IRS. If "No" is marked on "Reported on Form 1099-B?", make no entry here.

Transaction Type A selection on this line is optional for typical sales of stocks and other assets not requiring any special treatment. The available transaction indicators are as follows.

- S - Stock or other sale not requiring special treatment. When "S" is selected here, the transaction will be reported on Form 8949 with neither adjustment code nor adjustment amount.

- W - Wash sale loss disallowed. When "W" appears here, the transaction is reported on Form 8949 with Code W and an adjustment in the amount entered on Wash Loss Disallowed (if any), or if Wash Loss Disallowed is empty, in the amount of the entire reported loss (if any). If Wash Loss Disallowed is empty and the sale does not result in a loss, selecting "W" here produces no effect. If no selection is made here and an amount is entered on line Wash Loss disallowed, "W" is calculated on this line.

- M - 28% Tax Rate on Capital Gain. When "M" is selected here, a tax rate of 28% is applied to long-term capital gain resulting from the transaction. If the sale does not result in a gain, or the transaction's holding period is short-term, selecting "M" here produces no effect. Assets to which this rate applies include collectibles and section 1202 stock meeting qualifying conditions.

- P - Loss on personal non-investment property. When "P" is selected here, the transaction is reported on Form 8949 with Code L and an adjustment in the amount of the entire reported loss (if any). If the sale does not result in a loss, selecting "P" here produces no effect.

- X - Expired options. The selection "X" may be made here when reporting options that have expired without being exercised. Enter zero either on Sales Price or Cost, depending respectively on whether the option was purchased or granted (i.e., written). In either case, the transaction will be reported on Form 8949 with neither adjustment code nor adjustment amount.

- O - Worthless securities. The selection "O" may be made here when reporting securities that have become completely worthless during 2013. On Date Sold, enter either "12/31/2013" or "Worthless". Enter zero on Sales Price. The transaction will be reported on Form 8949 with neither adjustment code nor adjustment amount.

- K - Bankrupt stock. The selection "K" may be made here when reporting on security transactions resulting from an issuer's bankruptcy during 2013. "Bankrupt" may be entered on Date Sold. The transaction will be reported on Form 8949 with neither adjustment code nor adjustment amount.

- N - Write-off of non-business bad debt. When "N" is selected here, the transaction is reported on Form 8949 as a short-term loss. Enter zero on Sales Price.

- E - Section 1042 election to postpone gain on the sale to an ESOP or eligible worker owned cooperative of qualified securities held 3 years or more, if qualified replacement property was bought within the specified period. When "E" is selected here and the period between dates entered on Date Sold and Date Acquired is 3 years or more, the transaction is reported on Form 8949 with Code R and an adjustment in the amount of the entire reported gain (if any). If the sale does not result in a gain, or the period between acquisition and sales dates is less than 3 years or cannot be determined from the entries on Date Sold and Date Acquired, selecting "E" here produces no effect. (To elect section 1042 postponement of gain when the period between acquisition and sales dates is 3 years or more, but cannot be determined from the entries on Date Sold and Date Acquired, use the Capital Gain (Loss) Transaction Worksheet instead of this Smart Worksheet.) See IRS Publication 550 for details on additional statements that must be attached to the return when making this election.

Corrected Basis (if applicable)

If this transaction is reported on Form 1099-B or equivalent statement, with an incorrect basis amount in Box 3, enter the correct basis amount here. (Enter the incorrect amount on Cost or Other Basis) The program will report this transaction on Form 8949 with adjustment Code B, and include an adjustment equal to the amount on Cost or Other Basis less the amount on this line.

Adjusted Gain (Loss) The program computes a tentative gain or loss equal to Sales Price less Cost or Corrected Basis (if cost differs from corrected basis).

Then:

- if a non-negative amount appears in Wash Loss Disallowed, this line equals the sum of that amount plus the tentative gain (loss); otherwise,

- if "W" or "P" is selected on Transaction Type and there is a tentative loss, this line equals zero; otherwise,

- if "E" is selected on Type of Transaction and there is a tentative gain, this line equals zero, but only if valid dates are entered on Date Acquired and Date Sold and the period between the dates is three years or more; otherwise,

- this line equals the tentative gain (loss).

Federal Tax Withheld If federal income tax was withheld from the proceeds of this transaction, enter the withheld amount here.

Brokerage House Use of this line is optional. If an entered transaction includes a broker's name on this line, the sales proceeds and any federal tax withheld for that transaction will be included in a separate tally identified by that broker's name in the Form 1099-B Reconciliation Smart Worksheet below.

Property Ownership (TSJ) For sales of taxpayer-owned property, select "T" or make no selection. Select "S" for sales of property owned by the spouse, or "J" for sales of jointly-held property. A selection made here will not affect the federal income tax return. However, some state income tax returns require separate disclosure of capital gains and losses for taxpayer and spouse. See the Tax Help for Schedule D for additional information. To access the help for Schedule D press the F1 key while on Schedule D.