How To Aggregate Businesses Under Section 1.199A-4 in ProConnect

by Intuit•1• Updated 3 weeks ago

This article will help you link business income to show an aggregation of business operations as discussed in Section 1.199A-4 and generate an explanatory statement.

Future changes for tax year 2026

For tax years beginning after December 31, 2025, the One Big Beautiful Bill act will make changes to the make the QBI deduction permanent and increase the phase-in range. These changes will go into effect in tax year 2026.

Input Details

ProConnect Tax will aggregate all businesses for which you enter the same Aggregate Tax Identification Number. You only need to enter the explanation of aggregation on one of the linked activities in order to generate the required statement. Click on an income type below to learn how to aggregate it.

Results

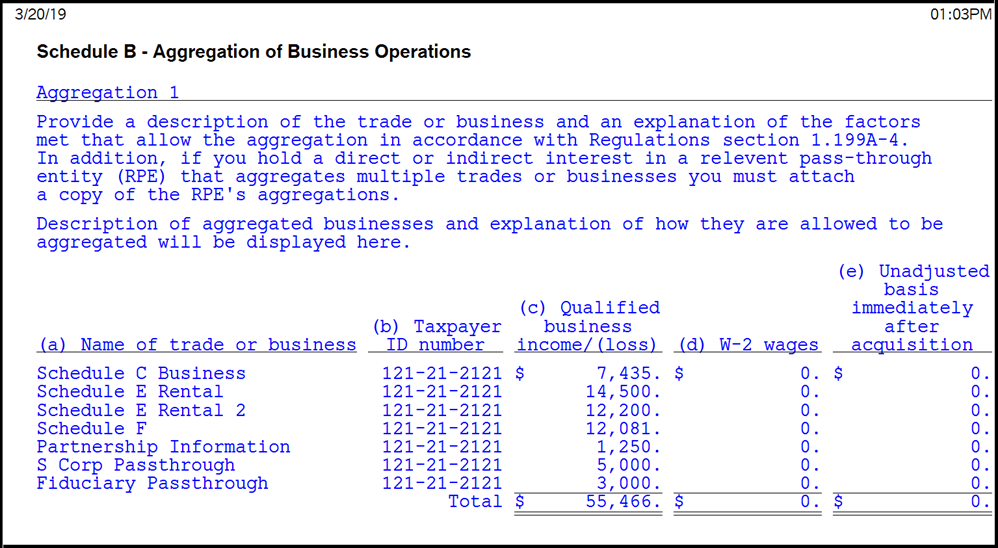

Once you complete the input, ProConnect Tax will generate a worksheet titled Schedule B - Aggregation of Business Operations. Each aggregation will be listed separately, if you have entered multiple aggregate business numbers. Like all worksheets, this will not be automatically e-filed with the tax return, and must be attached as a PDF.

More like this

- How to Show Aggregation of Business Operations (Section 1.199A-4) in ProSeriesby Intuit

- How to show aggregation of business operations Section 1.199A-4 in Lacerteby Intuit

- Lacerte Complex Worksheet Section 199A - Qualified Business Income Deduction for tax year 2018by Intuit

- Understanding qualified business income (QBI) reductionsby Intuit