How to show aggregation of business operations Section 1.199A-4 in Lacerte

by Intuit•7• Updated 1 year ago

This article will explain how to link your business income to show aggregation of business operations as discussed in Section 1.199A-4 and provide an explanatory statement.

For more Schedule C resources, check out our Tax topics page for Schedule C where you'll find answers to the most commonly asked questions.

Forms view and filing the return

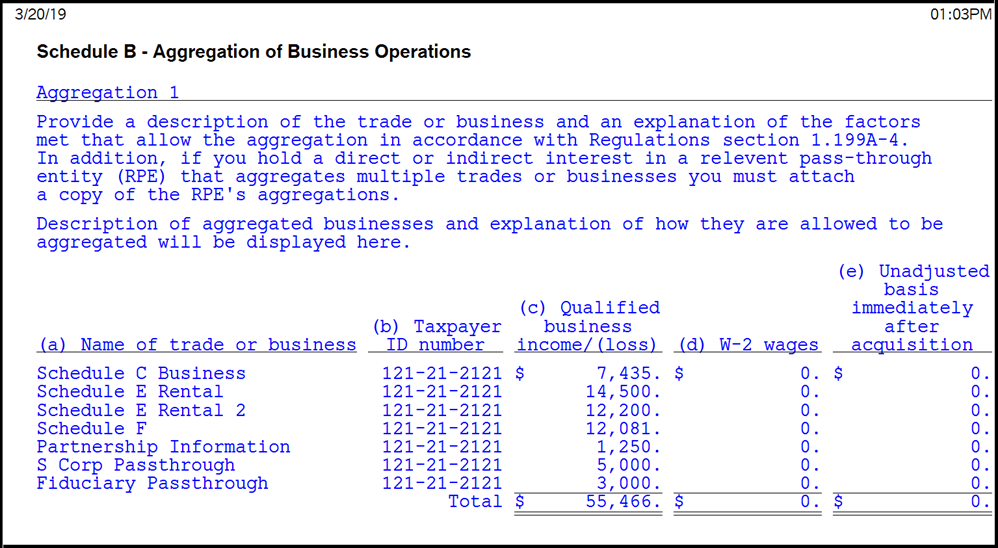

Worksheets Schedule B - Aggregation of Business Operations

Once complete, the aggregate income will be displayed in Forms view within the Worksheets. Each aggregate grouping will be listed separately. Example: Aggregation 1, Aggregation 2, etc.

The Schedule B - Aggregation of Business Operations worksheet is automatically included as a statement with the e-filing of the tax return. The Lacerte options to Auto Generate and Attach PDFs to E-Files should be set to yes for this to occur.

Once the e-file has been created within the e-file wizard, the following information will be displayed on the General Information page in Forms view.

Sample image of General Information page

More like this

- How to Show Aggregation of Business Operations (Section 1.199A-4) in ProSeriesby Intuit

- How To Aggregate Businesses Under Section 1.199A-4 in ProConnectby Intuit

- Rental real estate and Qualified Business Income in Lacerteby Intuit

- Lacerte Complex Worksheet Section 199A - Qualified Business Income Deduction for tax year 2018by Intuit