Using the TSJ Indicators in ProSeries

by Intuit•55• Updated 3 months ago

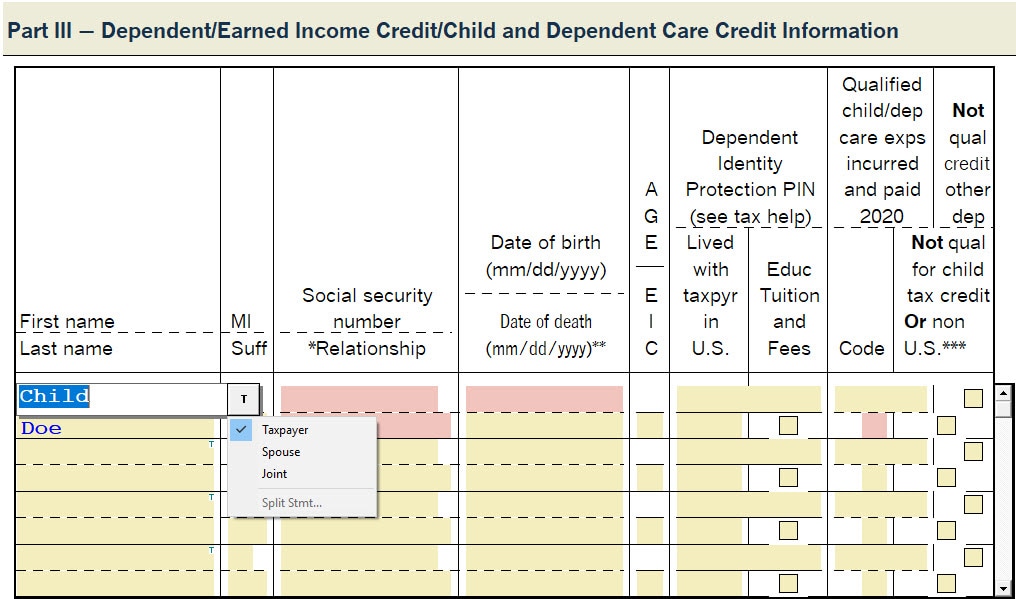

TSJ indicators are used in ProSeries Professional and ProSeries Basic that lets you to assign entries to the taxpayer, souse or jointly. This can help if you need to do any projections for future tax situations or if you are looking at splitting the tax return to married filing seperatly.

Turning on TSJ indicators:

- Open a 1040 return.

- From the Tools menu, select Options.

- Under Form Indicators check the Show TSJ Indicators checkbox.

Turning off TSJ indicators:

- From the Tools menu, select Options.

- On the left navigation screen, select General.

- Under Form Indicators, uncheck the box labeled Show TSJ Indicators.

- Click OK to save your changes.

- If the indicators don't disappear, there may be fields with S for Spouse or J for Joint already selected. This can also be caused by transferring a client file that was previously checked to use TSJ indicators.

To use the TSJ indicators:

- Open the Married Filing Jointly tax return.

- TSJ indicators will show on most fields that aren't already specific for the taxpayer or spouse.

- The default TSJ indicator is T. Select the T to choose a different entry: