Common questions about individual Schedule C in Lacerte

by Intuit•22• Updated 1 month ago

Schedule C (Form 1040) reports profit or loss from a sole proprietorship. Lacerte supports Schedule C entries for income, expenses, cost of goods sold, vehicle use, and the home office deduction so you can confirm the return calculates as expected. Use the sections in this article to resolve common questions and see where to enter details in Lacerte.

For more Schedule C resources, check out our Tax topics page for Schedule C where you'll find answers to the most commonly asked questions.

Table of contents:

Follow these steps to generate Schedule C in the Individual module:

- Go to Screen 16, Business Income (Sch. C).

- Locate the Business Income (Schedule C) section.

- Complete the applicable information about the business.

- Scroll to the General Information section.

- Complete any applicable information.

- Scroll down to the Income section:

- Enter Gross receipts or sales

- Enter Returns and allowances

- Enter Other income (Ctrl+E)

- Scroll to the Cost of Goods Sold section.

- Complete any applicable information.

- Scroll down to the Expenses section.

- Enter the applicable expenses that pertain to this business.

- Scroll down to the Other Information section.

- The Other Information section was added in Lacerte Tax 2013. In prior years, these entries can be found under the General Information section.

- The Lacerte program assumes that the taxpayer materially participate in the business. If they did not materially participate, check "Did not "Materially participate" (code 22).

- Complete any applicable information about this business.

Where do I enter line 9 - Car and truck expenses?

You can enter vehicle expenses on Screen 16, Depreciation and link them to this Schedule C.

If you're deducting actual expenses, rather than the standard mileage rate, the depreciation portion is reported on line 13, and lease payments will flow to line 20a.

To verify where expenses are being reported:

- Select WKS: Vehicle Expenses.

- Scroll down to the Vehicle Expense Allocation.

To force the standard mileage rate or actual expenses:

- Select the vehicle on Screen 22, Depreciation.

- Scroll down to the Automobiles and Other Listed Property section.

- Under Automobile Mileage, enter a 1 or 2 in 1=force actual expenses, 2=force standard mileage rate.

Why isn't depletion calculating on line 12?

Deductions for oil and gas depletion are subject to certain income limitations, particularly when claiming percentage depletion. If you enter the info for both percentage and cost depletion, Lacerte will optimize the calculation to take the greatest allowable deduction.

Follow these steps to see the calculation for the limitation:

- Go to the Forms tab.

- Go to the Oil & Gas Sch.

- Under Description in the left navigation panel, select Inc. Limitation for Depletion.

- This worksheet shows the calculation for the income limitation.

How does Lacerte calculate depreciation and section 179 expense for line 13?

When you have multiple assets linked to the same Sch C, the fastest way to review their depreciation is on the current year Federal Depreciation Schedule the program produces.

To override current-year depreciation on a single asset:

- Go to Screen 22, Depreciation.

- Select the applicable Asset from the left of the screen.

- Locate the Asset Information section.

- Scroll down to the Regular Depreciation subsection.

- Enter the override in Current depreciation/amortization [O].

- Use this field only for a single-asset override. If you overrode total depreciation on the Schedule F screen, this field won’t change results.

How do I enter benefit programs for line 14?

- Go to Screen 16, Business Income (Sch. C).

- Scroll to the Expenses section.

- Enter the applicable amount in Employee benefit programs.

The amount you enter in Employee benefit programs will be reduced by any amount entered in Health insurance premiums reduction for Form 8941 credit before it prints on the return, per form instructions.

How do I report lease payments on line 20a?

- Go to Screen 22, Depreciation.

- Scroll to the Automobiles and Other Listed Property section.

- Locate the Actual Vehicle Expenses subsection.

- Enter the lease payments in Vehicle rent or lease payments.

- If the amount still doesn’t appear on Schedule C, line 20a, the vehicle is likely using the standard mileage rate. To report lease payments separately, force actual expenses in Screen 22, Depreciation > Automobile Mileage > 1=force actual expenses"

How do I fill out the square footage of a home on Schedule C?

These lines will be blank if your client is taking a deduction for actual expenses rather than the simplified method.

If you want to force the simplified method:

- Go to Screen 29, Business Use of Home (8829).

- Enter a 2 in the field 1=use actual expenses (default), 2=elect to use simplified method.

For more information about using the simplified method, refer to this article.

How do I mark the "All investment at risk" checkbox on Schedule C, line 32a?

The program won't check either box under Schedule C, line 32a unless there's a loss on the Schedule C. The text under Schedule C, line 31 says that you shouldn't complete line 32a when there's a profit.

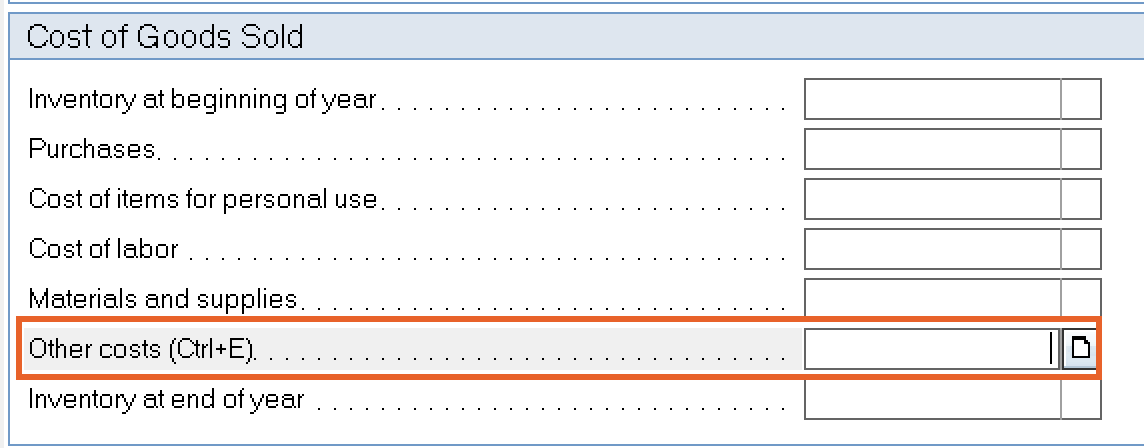

Where do I enter line 39 - Other costs?

- Go to Screen 16, Business Income (Sch. C).

- Scroll down to the Cost of Goods Sold section.

- Enter the Other costs (Ctrl+E) field.

Why isn't vehicle information printing on Schedule C, Part IV, line 43?

Schedule C, Part IV is only completed when the business isn’t required to file Form 4562. If Form 4562 generates for this activity, vehicle details appear on Form 4562, Part V instead.

Usually, when vehicle information isn't printing on Schedule C, Part IV, it's because a Form 4562 is generating for this Schedule C. Part IV of the Schedule is only filled out when the business doesn't have to file a Form 4562.

If the business is required to file a Form 4562, you can view the vehicle information on Form 4562, Part V.

For more information, refer to this article.

How do I generate Schedule C for a statutory employee?

To generate Schedule C for a statutory employee:

- The W-2 Wages must be entered into Screen 10.

- A Schedule C activity must exist in Screen 16.

- The Wages and Schedule C activity must be linked.

Verify the wages have been correctly entered into screen 10 and that they have been linked to the correct Schedule C activity. When correctly linked, Lacerte prints Statutory Employee wages on Line 1 of the specified Schedule C.

If Schedule C still doesn't generate, verify the activity has not been suppressed:

- Go into Screen 16, Business Income (Schedule C).

- Scroll to the General Information section.

- If there's an entry in the field 1=Delete this year, 2=Delete next year, remove that entry.