How to generate Form 1040NR and Schedule NEC in Lacerte

by Intuit•19• Updated 2 weeks ago

To indicate a nonresident alien to generate a 1040NR follow these steps:

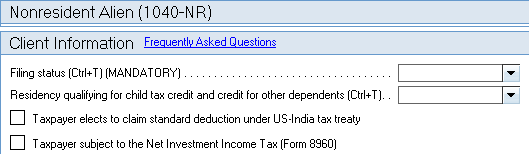

- Go to Individual module, Screen 58.1, Nonresident Alien (1040NR).

- In the Client Information section, select the Filing Status (Ctrl+T) (MANDATORY).

- This will generate the 1040NR in forms view.

- Select an option using the dropdown menu by the Filing status (Ctrl+T)[MANDATORY] section. This will generate form 1040NR in the forms view.

- If there's income needed for the Schedule NEC then scroll down to the Schedule NEC - Section called Tax on Income Not Effectively Connected with a US Trade or Business section.

- Enter income amounts in the appropriate 10%, 15%, and 30% columns for their tax rates.

- For other tax rates (column D), specify the tax rate you’re using in the Other percentage 1 (.xxxx) and Other percentage 2 (.xxxx) fields.

- Enter any other applicable fields in this section.

- Complete all other applicable sections for this form:

- Income,Credits, Taxes, and Adjustments

- Other Information

Where do I enter amounts for Schedule OI?

To enter amounts for Schedule OI in the program:

- Go to Screen 58.1, Nonresident Alien (1040-NR).

- Scroll down to the Other Information section.

- Enter any applicable fields.

How Do I Prepare a 1040 and 1040NR for a Dual-Status citizen in Lacerte?

Currently, Lacerte does not have the ability to generate both Forms 1040 and 1040NR in the same client file. Therefor a copy of the return should be made after the client information has been entered in screen 1. Prepare form 1040 in one copy, and form 1040NR in the other.

To enter text across the top of the return:

- Go to Screen 3, Miscellaneous Information/Direct Deposit.

- Enter "Dual-Status Return" or "Dual-Status Statement" in the field labeled Form 1040 Text as needed for each copy.

Note: The IRS e-file system will allow the transmission of a Dual-Status return provided a valid taxpayer SSN or ITIN has been entered in screen 1. If an SSN or ITIN are unavailable, the return must be filed on paper.