Manually generating Form 1116, Foreign Tax Credit in ProConnect Tax

by Intuit• Updated 7 months ago

Form 1116 will generate if foreign taxes paid are entered in the appropriate income screen (interest, dividends, and Schedule K-1). For information on entering those foreign taxes paid see Entering Foreign Taxes paid and generating Form 1116 Foreign Tax Credit in ProConnect. However, input for Form 1116 can also be entered directly if you have foreign taxes from a different source, like a 1099-B.

If you are looking for how to enter K-1 foreign taxes on an individual return (Form 1040), see here.

To enter Form 1116 information directly:

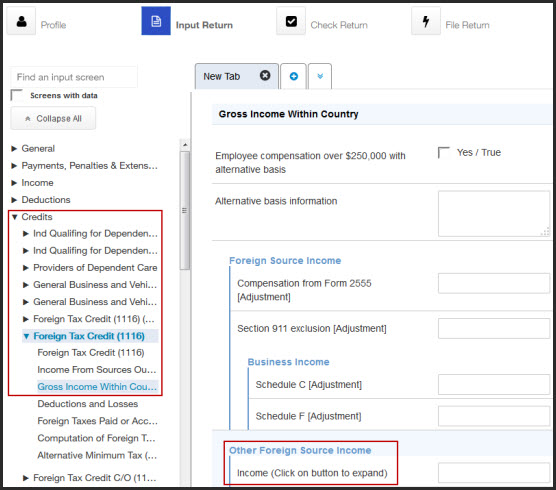

- Go to the Input Return tab > Credits, then select Foreign Tax Credit (1116).

- Select the Name of foreign country from the dropdown list.

- Select the Category of income from the dropdown list.

- Scroll to the section Gross Income Within Country then to the Other Foreign Source Income subsection.

- Enter the amount in the Income (Click on button to expand) field.

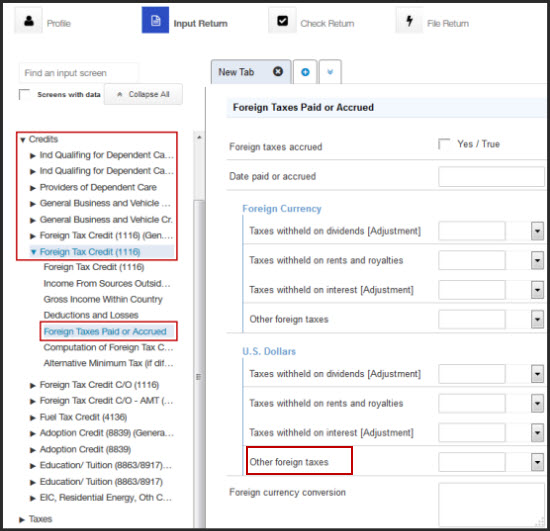

- Scroll to the section Foreign Taxes Paid or Accrued and make the applicable entries for foreign taxes paid or accrued (U.S. dollar entries must be made for credit calculations).

- Enter the withholding amount in the U.S. Dollars subsection in Other foreign taxes.

- Entries in the Foreign Currency section will not generate a credit, and ProConnect won't automatically convert amounts entered here; conversion will need to be done manually.

- Entries in the Foreign Currency section will not generate a credit, and ProConnect won't automatically convert amounts entered here; conversion will need to be done manually.

More like this

- Foreign Tax Credit regular tax carryovers on Form 1116 in Lacerteby Intuit

- Generating Form 1116 Foreign Tax Credit for an individual return in Lacerteby Intuit

- Common questions about the Form 1116 calculation in ProConnect Taxby Intuit

- Common questions about Form 1116, Foreign Tax Credit in Lacerteby Intuit