How to enter Form 1116 Schedule B in ProConnect Tax (ref #56669)

by Intuit•4• Updated 1 month ago

This article will help you enter foreign tax credit carryovers, resolve diagnostic ref. #56669, and attach Form 1116 Schedule B as a PDF for e-filing.

How do I attach this PDF for e-filing?

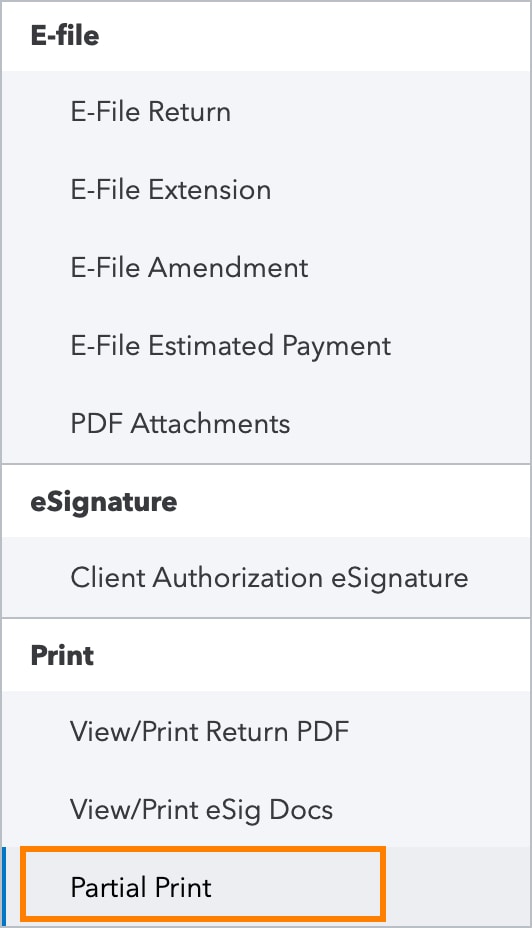

- Go to the File Return tab.

- On the left-side menu, select Partial Print.

- Check the box for 1116 Sch B.

- Press Create PDF, then click Download PDF.

- The PDF will open in a new tab where you can save it. You may want to rename or move the downloaded file so you can easily identify it on your computer later.

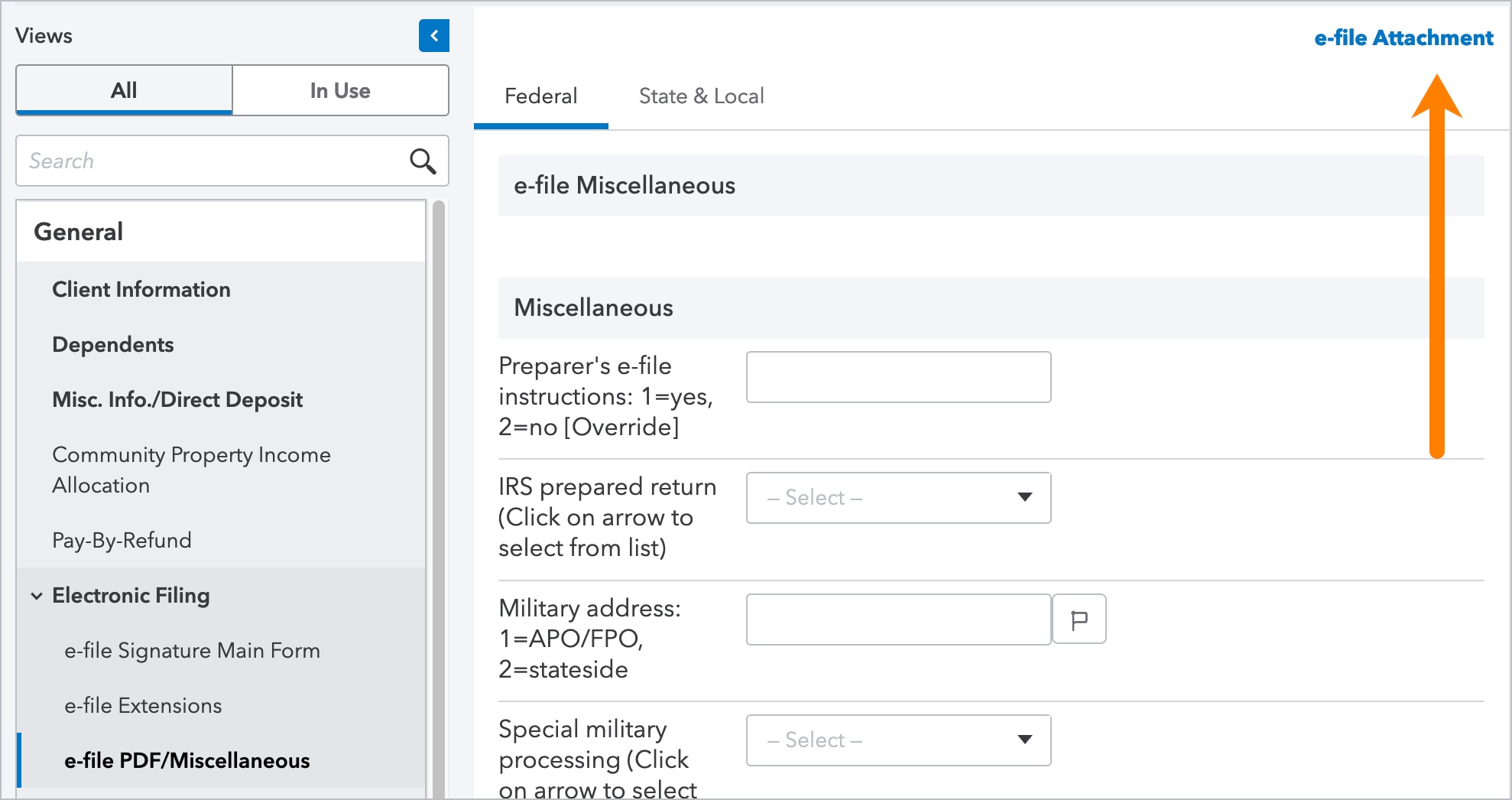

- Go to the Input Return tab.

- On the left-side menu, select General.

- Click on Electronic Filing to expand.

- Select the e-file PDF/Miscellaneous screen.

- Click on the e-file Attachment hyperlink at the top right of the input.

- Press Attach PDF to open your computer's file browser and locate the file.

- In the Link to form drop-down, select 59=Form 1116 Schedule B.

- Make sure that "Send PDF attachment with federal return?" is set to Yes.

Note: The PDF attachment must be linked to the appropriate form in order to clear diagnostic reference #56669 and successfully e-file the return.

Where do I enter foreign tax carryovers for Schedule B?

ProConnect will automatically proforma, or roll over, prior year carryovers to next year's tax return. Follow these steps to enter a foreign tax credit carryover if your client's previous return wasn't filed through ProConnect.

Go to Input Return ⮕ Credits ⮕ Foreign Tax Credit (1116). This screen has the following three sections:

- Foreign Tax Credit (1116)

- Foreign Tax Credit Carryovers - Regular Tax (1116)

- Foreign Tax Credit Carryovers - AMT Tax (1116)

An entry in Foreign Tax Credit (1116) for Name of foreign country and Category of income (Click on arrow to select from list) must be entered to generate the Form 1116.

Carryover information is entered in Foreign Tax Credit Carryovers - Regular Tax (1116) or Foreign Tax Credit Carryovers - AMT Tax (1116), depending on if the figures are subject to Regular or AMT taxes. Each of these two screens is divided into sections according to Type of Income.

Each section has several rows for prior years, starting with the most recent prior year:

- Foreign Taxes Paid

- Foreign Taxes Disallowed

- Foreign Taxes Claimed

- Foreign Tax Carryover

Entries must be made in each of the four columns for each applicable year in order for the software to properly calculate the applicable Foreign Tax Carryover amount.

If there was only one prior year in which the Foreign Taxes carried over, then the amount entered in Foreign Tax Carryover for that year will be the primary figure used in calculating the Form 1116, showing on page 2, line 10. Otherwise, all applicable years and columns must have entries.