Entering a third-party designee, if different in ProConnect

by Intuit•9• Updated 2 months ago

This article will assist you with entering a third-party designee in ProConnect Tax

If the taxpayer wants to allow someone in your firm (other than the preparer) to discuss the return with the IRS, select the other party in the firm to serve as the third-party designee.

Follow these steps to select another preparer in the firm as the third-party designee:

- Go to Input Return ⮕ General ⮕ Client Information.

- Scroll down to the Miscellaneous Info section.

- Using the field labeled Designee, if different select another preparer from the dropdown menu.

If the preparer selected doesn't have a designee PIN entered in the Settings > Preparer Information screen, you'll need to enter a PIN in the General > Misc. Info./Direct Deposit screen outlined below.

Follow these steps to enter a Designee, if different:

- Go to Input Return ⮕ General ⮕ Misc. Info./Direct Deposit.

- Select the Miscellaneous tab.

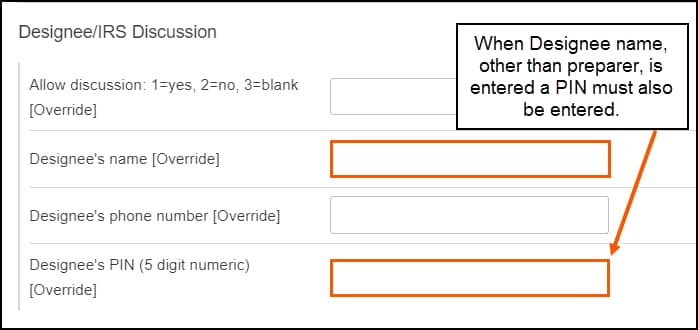

- Under the Miscellaneous section, enter the following fields:

- Allow discussion: 1=yes, 2=no, 3=blank [Override]

- Enter a 1 for this field.

- Designee's name [Override]

- This field is required.

- Designee's phone number [Override]

- Designee's PIN (5 digit numeric) [Override]

- This field is required.

- If you make an entry in this field, you must also assign a 5-digit, self-selected PIN to the preparer/designee in the Preparer's section of Options.

- If you leave this field blank, but instruct the "yes" box to be checked, the word "Preparer" prints as the third-party designee, per IRS instructions. The designee's phone number and PIN isn't required and won't print in this situation.

- Allow discussion: 1=yes, 2=no, 3=blank [Override]