Entering multiple codes for Form 8949, Column F in ProSeries

by Intuit•2• Updated 1 year ago

The program will automatically enter multiple codes in column F of Form 8949 in a 1040 return based on the entries made on the Schedule D and its worksheets. Any adjustment codes entered will automatically be put in alphabetical order, per IRS instructions.

In ProSeries 2020 and newer:

- Open the 1099-B worksheet.

- Enter the transaction details in the Quick Entry Table.

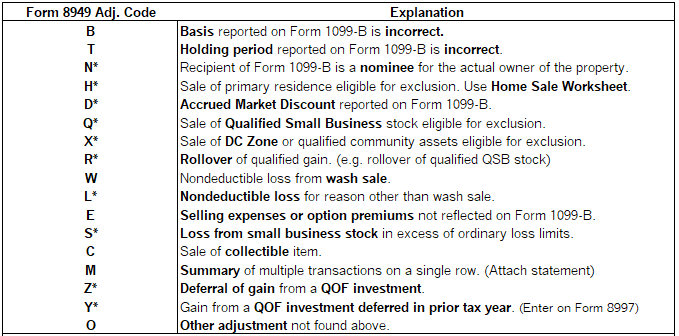

- Review the table for the available adjustment codes:

- If the adjustments do not have a * all adjustment codes can be combined and entered in the Quick Entry Table the Adjustment Code(s) field with the total needed adjustment in the Adjustment Amount field.

- If any of the adjustments have a * leave the Adjustment Amount and Adjustment Code field blank. Double click on the Property Description and enter the codes in Part II and/or Part III of the Capital gains and loss adjustment worksheet.

In ProSeries 2019 and prior:

- Open the Capital Gain and Loss Transaction Worksheet.

- Complete part I-IX as needed.

- In Part X an adjustment must be entered on line 7.

- Enter the adjustment codes on line 9.