Entering business use of home - multiple businesses in one home

by Intuit•14• Updated 7 months ago

This article will show you how to enter the business use of a home where multiple businesses are run in the Individual module of Lacerte.

Follow these steps to enter one home office from which multiple businesses are run:

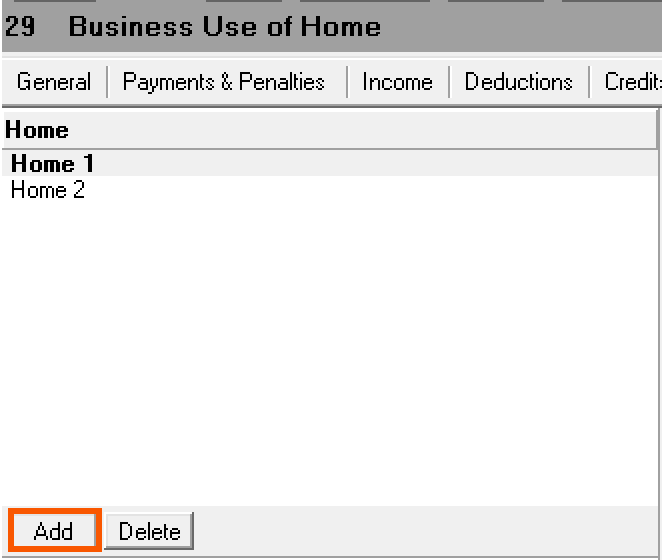

- Go to Screen 29, Business Use of Home (8829).

- Click Add in the left navigation panel to set up a separate Business Use of Home screen.

- In the Home list, you will have two homes listed.

- Select Home 1 from the left navigation panel.

- Scroll down to the Business Use of Home section.

- Enter the Total area of home (sq. ft.) and the Business use of home (sq. ft).

- Scroll down to 1 = use actual expenses, 2 = elect to use simplified method enter a 2 (default is the actual expenses).

- Scroll down to the Indirect Expenses section and enter any applicable fields.

- The indirect expenses for the home need to be split between the offices. In order to do so, enter the indirect expenses in full for each of the home offices on each screen.

- Scroll down to the Direct Expenses section and enter any applicable fields.

- For direct expenses, enter only the amount of expenses that are allowable for that specific business, as any direct expense will carry directly to the form and be allowed in full.

- Mortgage interest and real estate taxes input in the direct expenses section will be allowed in full for the home office and will not be allocated in any way.

- Scroll down to the Allocation section.

- Enter the Home office name or number entered first on (screen 29), if home used in more than one business as Home 1.

![]() When you repeat this step for Home 2, you should still select Home 1 for the Home office name or number entered first on (screen 29), if home used in more than one business field.

When you repeat this step for Home 2, you should still select Home 1 for the Home office name or number entered first on (screen 29), if home used in more than one business field.

- To override the automatic calculation, make an entry in the Percentage (.xx) of indirect expenses and business use area to apply to this business, if not 100%.

- The program will use the Total area of home (sq. ft.) and the Business use of home (sq. ft) inputs (Screen 29, codes 1 and 2) and the Percentage (.xx) of indirect expenses and business use area to apply to this business, if not 100% (Screen 29, code 512) to allocate the indirect expenses between each home office.

- Select Home 2 from the left navigation panel.

- Repeat steps 4-10 for Home 2.

The program adjusts the amount of indirect mortgage interest and indirect real estate taxes that carries to Schedule A so that only the non-business portion is reported on Schedule A.