Form 4562 Line 12 - The total allowable Section 179 does not match the sum of allowable Section 179 in ProSeries

by Intuit•1• Updated 1 year ago

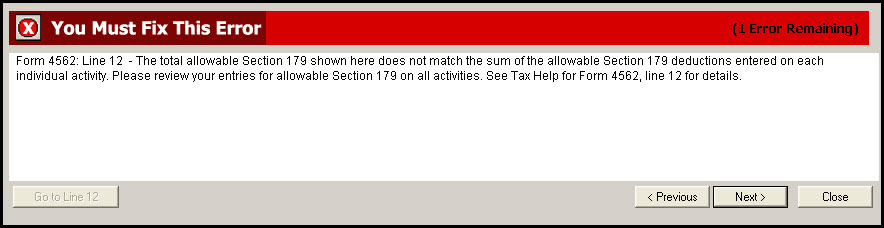

This article will help you resolve the following final review error:

- Form 4562: Line 12 - The total allowable Section 179 shown here does not match the sum of the allowable Section 179 deductions entered on each individual activity. Please review your entries for allowable Section 179 on all activities. See Tax help for Form 4562, line 12 for details.

This error is usually caused by taking less section 179 than what is allowed. To resolve this error:

See how much is allowed this year:

- Open the 4562.

- Review the amount on line 12. This is the amount we'll need to make sure all the activities match.

- Open the activities that contain section 179 and/or section 179 carryover to make sure the Section 179 deduction allowed per current year Form 4562 across all activities equals the amount from the 4562 line 12.

Checking section 179 from a Partnership K-1:

- Press F6 to bring up Open Forms.

- Type P and select OK to open the Schedule K-1 Worksheet for partners.

- If you have more then on, select the one that had 179 carryovers.

- Scroll down to Line 12, Section 179 deduction.

- Select the QuickZoom to enter state Section 179 information to bring up additional 179 details.

- Review and adjust Line 2 Section 179 deduction allowed per current year Form 4562 as needed.

Checking section 179 from a S Corporation K-1:

- Press F6 to bring up Open Forms.

- Type S and select OK to open the Schedule K-1 Worksheet for shareholders.

- If you have more then on, select the one that had 179 carryovers.

- Scroll down to Line 11, Section 179 deduction.

- Select the QuickZoom to enter state Section 179 information to bring up additional 179 details.

- Review and adjust Line 2 Section 179 deduction allowed per current year Form 4562 as needed.

Checking section 179 from a Schedule C, Schedule E, or Schedule F:

- Press F6 to bring up Open Forms.

- Type 4562 and select OK.

- Select the type of activity that had the section 179.

- Select the specific business name the one that had 179 carryovers.

- Scroll down to the Form 4562, Line 12 Smart Worksheet.

- Review and adjust Line B Section 179 deduction allowed, if different as needed.

Once all of the allowed Section 179 amounts are equal the amount on the 4562 line 12, the error will be cleared.

More like this

- "Section 179 on multiple activities being limited" error message on Individual returnby Intuit

- Entering section 179 depreciation directly on the 4562 in ProSeriesby Intuit

- Calculating section 179 business income limitation in ProConnect Taxby Intuit

- Screens for Depreciation Direct Input (4562) in Lacerteby Intuit