How to enter information for Form 3800 in ProSeries

by Intuit•1• Updated 1 month ago

This article will assist you with entering information for Form 3800 in ProSeries for individual and business returns.

For tax year 2023 and newer:

The 3800 form has been restructured to contain 8 pages, use the table below to determine which page the credit will show on:

| Page | Content | Additional details |

|---|---|---|

| 1 | Part I: Current Year Credits Not Allowed Against Tentative Minimum Tax | |

| 1 | Part II: Figuring Credit Allowed After Limitations | |

| 2 | Part II: Figuring Credit Allowed After Limitations | |

| 3 | Part III: Current Year General Business Credits (GBCs) | Current year credits from Forms: 3468 Part II, 7207, 6765, 3468 Part III, 8826, 8835 Part II, 7210, 7720, 8874, 8881 Part 1, 8882, 8864, 8896, 8906. 3468 Part IV, 8908, 8910, 8911, 8830, 7213 Part II, 3468 Part V, 8932, 8933, 8936 Part II, 8936 Part V, 8904, 7213 Part I, 8881 Part II, 8881 Part III, 8864 line 8, other credits. |

| 4 | Part III: Current Year General Business Credits (GBCs) continued | Current year credits from Forms: 8844, 3468 Part VI, 5884, 6478, 8586. 8835 Part II, 8846, 8900, 8941, 6765 ESB credit, 8994, 3468 Part VII, 7218 Part II, 3468 Part V, 7211 Part II other specified credits. |

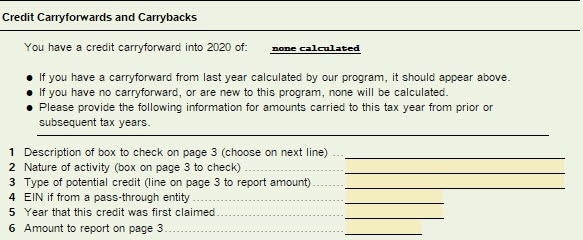

| 5 | Part IV: Carryovers of General Business Credits (GBCs) or Eligible Small Business Credits (ESBCs) | Credits carried over to tax year 2023 from: Form 3468 Part II, 7207, 6765, 3468 Part III, 8826, 8835 Part II, 7210, 8820, 8874, 8881 Part I, 8882, 8864, 8896, 8906, 3468 Part IV, 8908, 8910, 8911 Part II, 8830, 7213 Part II, 3468 Part V, 8932, 8933, 8936 Part II, 8936 Part V, 8904, 7213 Part I, 8881 Part II, 8881 Part III, 8864, other. Credits for which only carryfowards are allowed: Form 5884-A, 8586, 8845, 8907, 8909, 8923, 8834, 8931, 1065-B, 5884, 6478, 8846 |

| 6 | Part IV: Carryovers of General Business Credits (GBCs) or Eligible Small Business Credits (ESBCs) continued | Credits carried over to tax year 2023 from: Form 8900, 5884-A 5884-B, 8847, 8861, 8884, 8942. Specified credits from: 3468 Part VI, 5884, 6478, 8586, 8835, 8846, 8900, 8941, 6765 ESB, 8994, 3468 Part VII. |

| 7 | Part V: Breakdown of Aggregate Amounts on Part III for Facility-by-Facility, Multiple Pass-Through Entities, etc. | |

| 8 | Part VI: Breakdown of Aggregate Amounts in Part IV |

Select your tax type to jump to instructions for that return:

Where do I enter general business credits for an Partnership or S Corporation return?

The Form 3800 itself is only required when the entity is making an Electing Payment or Credit Transfer. For most entities the credit amounts will pass through to the K-1's to be entered on the 1040 return.

- Complete the credit form if applicable, for example the 3468.

- ProSeries will automatically flow the allowable credit amounts to the K-1 and the General Business Credit Worksheet.

- If the entity is making an Electing Payment or Credit Transfer open the 3800 Pt 3.

- For the applicable line complete columns A-I.

- If the line is not enterable this credit form does not apply to the 1120S or 1065 return.

Where do I enter general business credits for an Corporation?

- Complete the credit form if applicable, for example the 3468.

- ProSeries will automatically flow the allowable credit amounts to the General Business Credit Worksheet and the 3800.

- Open the Form 3800 Pt3.

- For the applicable line and review columns A-I.

- If the entity is making an Electing Payment or Credit Transfer be sure to enter columns G and H.

Where do I enter general business credits for an Individual?

- Complete the credit form if applicable, for example the 3468.

- ProSeries will automatically flow the allowable credit amounts to the Form 3800 Worksheet and the 3800.

- To access the 3800 worksheet, press F6 and type 3800 W. Select OK to open the 3800 Worksheet.

- Review the amounts transferred to the 3800 Worksheet. If any of the credits were from a passive activity enter the amount that was from the passive activity on line 2 or check the box if the full amount was from a passive activity.

- To enter the Credit Transfer Election scroll to the bottom of the 3800 Worksheet to the Credit Transfer Elections section.

- On line 1 select the applicable credit.

- On line 2 enter a valid Transfer Registration Number.

- On line 3 enter the EIN if from a pass through entity.

- On line 4 enter the amount transferred in or out.

- Enter the amount transferred by you to another entity as a negative number.

- If you are a transferee, enter the amount transferred to you as a positive number.

New for Form 3800 for tax year 2023:

- If you intend to make an elective payment election or a transfer election on Form 3800, you must complete a pre-filing registration before you file your tax return. See here for more information.

- Elective payment election: Certain applicable entities and electing taxpayers can elect to treat certain IRA 2022 business credits, or CHIPS 2022 credits as elective payments. Any overpayments may result in refunds.

- Transferring credits: Taxpayers may make an election to transfer all or a portion of certain IRA 2022 credits.

- See IRS instructions for 3800 for more information.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- How to enter information for Form 3800 in Lacerteby Intuit

- How to enter information for Form 3800 in ProConnect Taxby Intuit

- How to generate Form 6765 partnership Increasing Research Credit in ProSeriesby Intuit

- Distributing Form 3800 credits to the beneficiaries of a 1041 return in ProConnect Taxby Intuit