Completing New York state corporate Form CT-3.4 in ProSeries

by Intuit• Updated 10 months ago

This article will help you complete the Form CT-3.4 Net Operating Loss Deduction.

Most of the fields on the CT-3.4 will calculate automatically for you; however there are some areas to check to review transferred information:

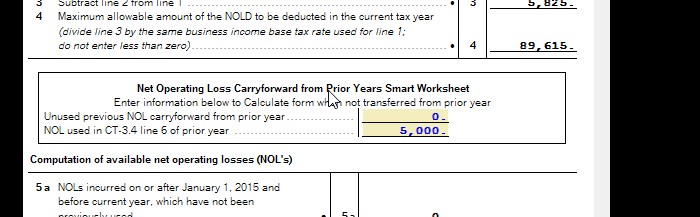

Net Operating Loss Carryforward from Prior Years Smart Workhseet:

If you are entering a new return that was not prepared in ProSeries last year you'll need to enter both of these items manually:

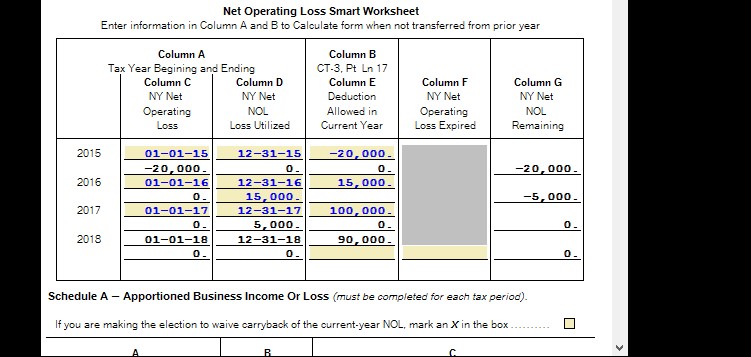

Net Operating Loss Smart Worksheet:

This smart worksheet falls under line 7 and should show the history of the NOL starting in 2015. This worksheet is here to help track your NOL carryovers

- Column A - Make sure that your tax year begin/end date are on the correct line

- Column B - Enter the amount from CT-3 Part 3 line 17. Enter losses with a negative

- Column C - Will calculate the amount from Column B if a loss

- Column D - Enter the amount of NOL used that year. Note there will only be an amount in column D if you have income, not a loss in Column B.

- Column G - Should show the loss remaining. Amounts will be 0 or a negative amount is a loss.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- How to resolve ProConnect Tax diagnostic ref. 47366/47367 (Form CT-3.3/CT-3.4)by Intuit

- How to resolve diagnostic ref. 47366/47367 (Form CT-3.3/CT-3.4)by Intuit

- Generating New York Consolidated or Combined Return CT-3-A in Lacerteby Intuit

- Generating estimated tax vouchers for an 1120 Corporationby Intuit