Generating Form 2441 in ProSeries

by Intuit•5• Updated 3 weeks ago

This article will help you:

- Enter dependent information.

- Enter expenses paid for qualified child care.

Future changes for tax year 2026

For tax years beginning after December 31, 2025, the One Big Beautiful Bill act will make changes to the applicable percentage and adjusted gross income thresholds for the 2441. These changes will go into effect for tax year 2026.

Entering the dependent and qualified dependent care expenses:

- Open the Federal Information Worksheet.

- Scroll down to the Part III - Dependent/Earned Income Credit/Child and Dependent Care Credit Information section.

- If not already entered, enter the dependent's name, Social Security number, relationship, date of birth, and Code.

- In the Qualified child/dep care exps incurred and paid 2025 field enter the amount of qualified expenses.

- ProSeries will assume any amount entered is qualified expenses, including if the dependent is 13 or older.

- If the dependent turns 13 during the tax year, enter only the amount of expenses up to their 13th birthday.

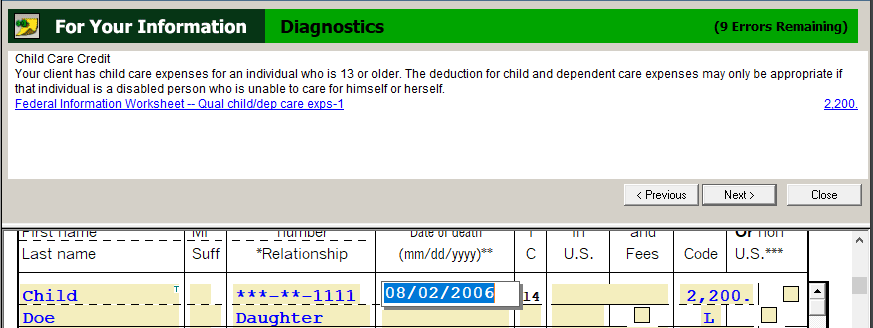

- If the dependent is 13 or older, ProSeries will generate a For Your Information - Diagnostic to review the qualifications.

- See the Instructions for Form 2441 for a full list of qualifications.

- Before continuing to the 2441 check the W-2 to see if anything was showing on box 10. If so, complete box 10 on the W-2 Worksheet.

Completing the 2441:

For tax year 2021 only:

- The expense limit has been raised to $8,000 for one individual, and to $16,000 for more than one.

- The maximum credit percentage has been increased to 50% and the credit itself is refundable.

- AGI phaseout has been significantly increased. This will be seen in the calculations on Form 2441.

- See the 2021 IRS Pub. 503 for more information.

This temporary increase was not extended for tax year 2022 returns.

Once the qualified child and dependent care expenses are entered the 2441 will automatically generate in the Forms In Use:

- Open the Form 2441 from the Forms In Use.

- In Part I complete one entry per provider or day-care facility, even if they provided care for multiple children.

- For e-file each provider a SSN or EIN must be entered.

- In the Amount paid box, enter the total amount paid to that provider. If there were multiple children cared for, combine the amounts.

- If the amount paid to the provider doesn't equal the qualified expenses, complete the Qualified Expenses paid in 2025 Smart Worksheet.

- In Part II, complete the Married Filing Jointly Smart Worksheet for Student/Disabled Person's Earned Income smart worksheet, if appicable.

- If the W-2 box 10 included any amounts, complete Part III of the 2441.

Special rules for Married Filing Separately returns:

In certain cases, a taxpayer with a filing status of Married Filing Separate (MFS) is allowed to claim the credit for Child and Dependent Care Expenses. According to the Form 2441 Instructions, if all of the following conditions apply, you're considered unmarried for purposes of calculating the credit and the exclusion on Form 2441. Those conditions are:

• You lived apart from your spouse during the last 6 months of the year.

• Your home was the qualifying person's main home for more than half of the year.

• You paid more than half of the cost of keeping up that home for the year.

When you run Final Review a diagnostic will remind you to review the requirements. On the 2441 scroll down to the Married Filing Separate Smart Worksheet below line 18 and check either box A or box B.

Related topics:

- Form 2441 Instructions

- IRS Publication 503, Child and Dependent Care Expenses

- IRS Publication 501, Exemptions, Standard Deduction, and Filing Information