Arizona Small Business Income tax in ProConnect

by Intuit• Updated 2 years ago

Arizona now allows small business owners to calculate a flat tax on a portion of their income and modifications using an SBI return. Intuit ProConnect will calculate the regular tax without this income, then compute the SBI tax based on the SBI amounts you enter.

This article will help you:

- Enter Arizona Small Business Income (SBI) amounts

- Generate Form 140-SBI

- Compare the results

How it works

The SBI return is optional and may produce an overall tax that's lower or higher for your clients. With that in mind, we designed the input to easily toggle the SBI return on or off and compare which option is best for your client's bottom line.

1. Enter income normally

Enter the full amounts of your client's income and deductions as you would have in prior years, using the regular input screens.

2. Activate the SBI return

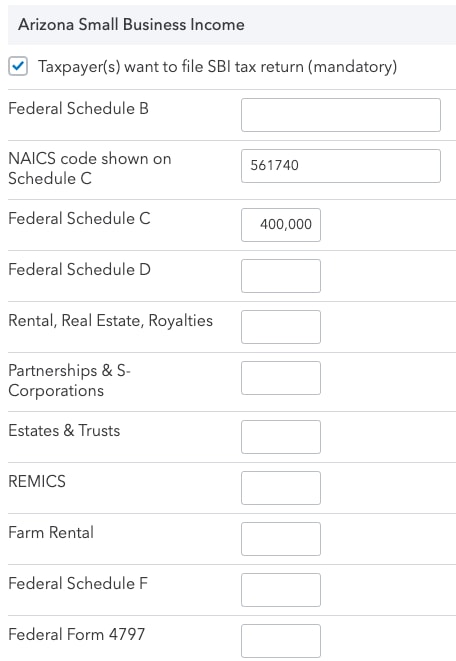

- From State & Local, under Income, go to AZ SBI Tax.

- Check the Taxpayer(s) want to file SBI tax return (mandatory) box to activate the SBI return.

- Enter the amounts you want to print on lines 4-9 of Form 140-SBI:

- Make sure to enter net amounts, as your entries are carried directly to the form.

3. Enter AZ modifications and credits

- Depending on what you'd like to do:

- From State & Local, under Modifications, go to AZ Modifications

(and/or) - From State & Local, under Other Credits, go to AZ Credits.

- From State & Local, under Modifications, go to AZ Modifications

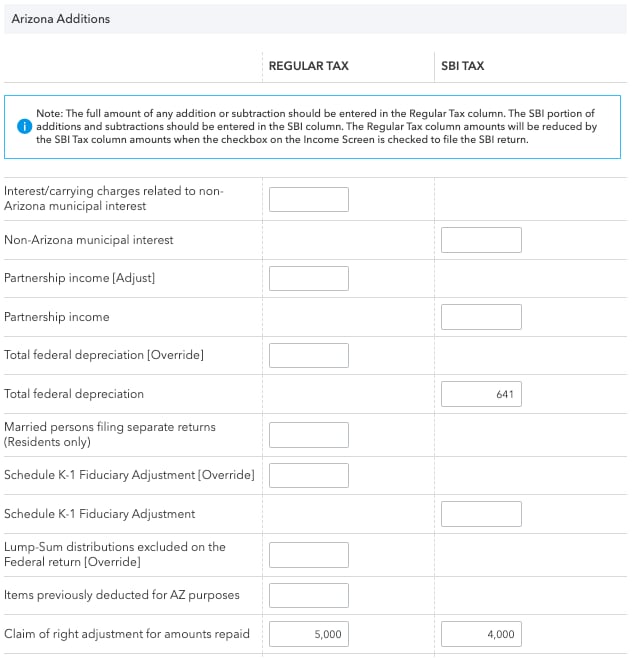

- Enter the full amount (including SBI) of any modifications, credits, or recaptures in the Regular Tax column as you normally would.

- We recommend you let the program calculate the regular tax amount for lines marked [O].

- Enter the SBI portion of the regular tax amount in the SBI Tax column. This may be equal to or less than the regular tax amount.

- The program won't calculate the SBI Tax amount for any items automatically. Any items marked as an override [O] or adjustment [A] refer only to the regular tax columns.

4. Review and compare

Now you can see what your client's overall tax burden is with the SBI return active. From the Check Return tab, after selecting Forms from the menu on the left, you can toggle between the regular return and the 140-SBI to view how much tax is calculated on both forms.

- Make a note of the total tax shown on the 140 and 140-SBI.

- On the Input Return tab, from State & Local, under Income, return to AZ SBI Tax.

- Un-check the box to file the SBI return.

- On the Check Return tab, under Forms on the left, review the tax calculated on form 140 when not filing SBI.

If filing the SBI return results in a higher tax for your client, just leave the box un-checked. Lacerte will ignore all SBI entries and calculate the 140 normally.

Example

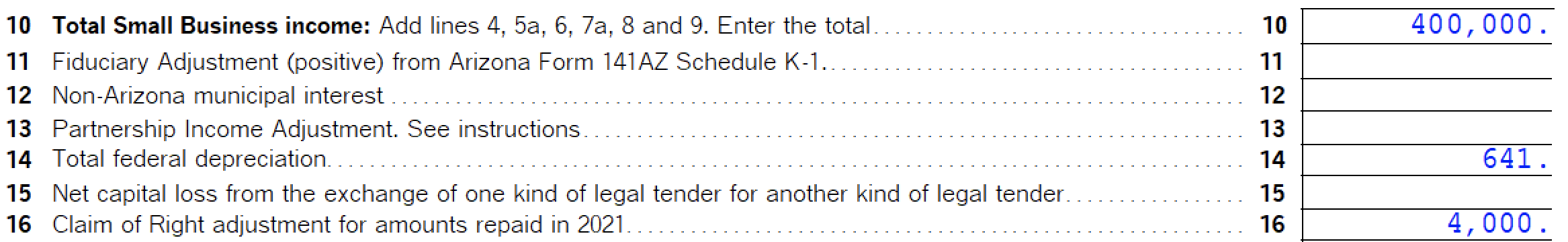

This client has:

- $641 of federal depreciation being calculated by the program, all of which is attributed to SBI; and

- a $5,000 claim of right adjustment - but only $4,000 of the adjustment is attributable to SBI.

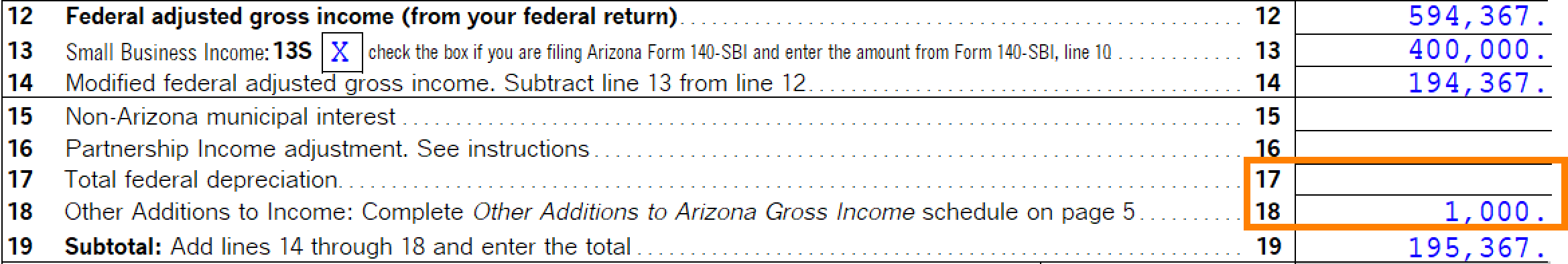

With the SBI return activated:

Lacerte subtracts the SBI amounts from the regular tax amounts to determine what should still be reported on the Form 140.

- The total federal depreciation is $0, since all of it is reported on the SBI return.

- The claim of right is only $1,000, since the remaining $3,000 is on the SBI return.

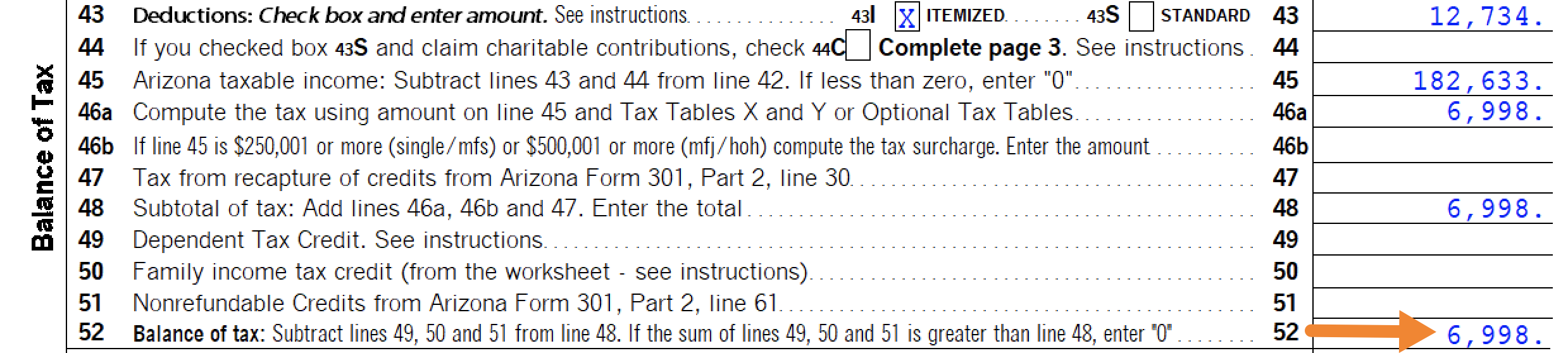

- The tax calculated on Form 140 is $6,998.

When we switch to the SBI forms, we see:

- line 10, total small business income matches line 13 of Form 140;

- total federal depreciation of $641; and

- a claim of right adjustment of $4000.

The 1040-SBI calculates a tax of $14,140. So if filing an SBI return, this client's overall Arizona tax would be $21,138.

When the SBI return is inactive:

When we go to AZ SBI Tax and un-check Taxpayer(s) want to file SBI tax return:

- Lacerte reports the full regular tax amounts on Form 140.

- The SBI amount entries are ignored.

- Form 140 calculates $25,177 in tax.

Filing the SBI return will reduce this client's Arizona tax by $4,039.