Reasons why the full section 179 expense may not be allowed in ProConnect Tax

by Intuit•1• Updated 9 months ago

You may see a lower section 179 deduction than you expected due to the Business Income Limitation. This is how it works:

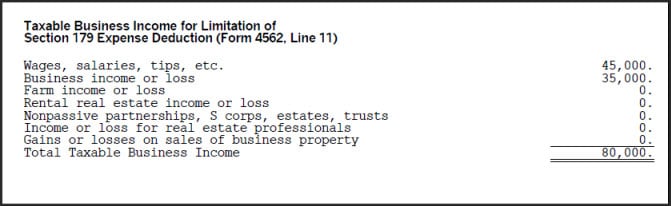

- The total qualified section 179 cost that can be deducted is limited to your taxable income from the active conduct of a trade or business during the year. This business income limitation is calculated on Form 4562, line 11.

- If the business income isn't large enough for the full section 179 expense amount to be deducted, a section 179 carryover is calculated on line 13.

- A worksheet will generate for Form 4562, line 11, that shows the different types of income from the active conduct of a trade or business and their respective amounts.

![]() Refer to the Instructions for Form 4562 for more information about the business income limitation.

Refer to the Instructions for Form 4562 for more information about the business income limitation.

Related topics

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Form 4562 Line 12 - The total allowable Section 179 does not match the sum of allowable Section 179 in ProSeriesby Intuit

- State Conformity for Special Depreciation Allowance and Section 179by Intuit

- Screens for Depreciation Direct Input (4562) in Lacerteby Intuit

- How to enter business use of home expenses for single or multiple businesses in ProConnectby Intuit