Level 8

03-18-2021

08:21 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

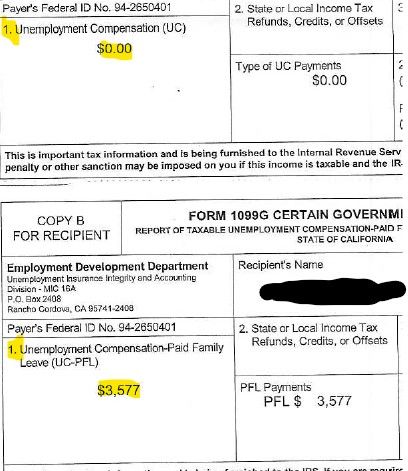

In California, EDD pays Paid Family Leave for new parents. It's taxable (only to IRS, not to CA FTB) & 1099-G's same as Unemployment Box 1.

I have a married couple client that had a baby late 2019. In 2020, husband got UI $15K & PFL. W got PFL.

With today's update, Lacerte is excluding $10.2K of H's UI and all $3,577 of W's PFL. Any thoughts?

Is this acceptable (I don't think it's right, but I could be misinformed)?

If it's wrong, should I override to re-add the PFL back to Sch 1?

*If this (or another answer/reply) solves your problem, please click "Accept as Solution" to get this post out of the "Unanswered" queue of posts.*

Best Answer Click here

Labels

TaxGuyBill

Level 15

03-18-2021

09:02 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, the taxable amount of the PFL is considered as Unemployment Compensation (Section 86 of the Federal Tax Code).

https://www.irs.gov/pub/irs-wd/0630017.pdf

Level 8

03-18-2021

10:26 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you!

*If this (or another answer/reply) solves your problem, please click "Accept as Solution" to get this post out of the "Unanswered" queue of posts.*