Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- Pay-By-Refund

- :

- Pay-by-Refund Discussions

- :

- Cash/Refund Advance Deadline for Tax Year 2022

Cash/Refund Advance Deadline for Tax Year 2022

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Employee

03-15-2023

08:35 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

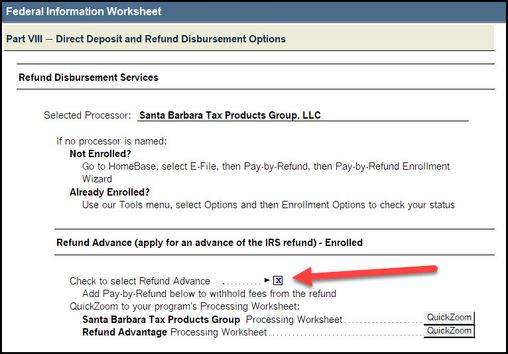

The deadline to file a return with the Cash/Refund Advance option for tax year 2022:

- Santa Barbara Tax Products Group, LLC is 3/17/2023

- Refund Advantage is 3/15/2023

Please ensure all returns intended to have the Cash Advance offering are filed on or before these dates.

After these dates, please ensure if a return had the opt in for Cash Advance and they have failed application, the check box on the Federal Information Worksheet Part VIII will need to be unchecked.