How do I force New Hampshire Form DP-10 to generate for an individual client in ProSeries?

by Intuit• Updated 7 months ago

What is it?

The New Hampshire Form DP-10 is the Interest and Dividends Tax Return used by the state of New Hampshire.

This form is used by New Hampshire residents (and part-year residents) to report interest and dividend income that is subject to the state's Interest and Dividends Tax.

Who Needs to File?

You may need to file Form DP-10 if you meet the following criteria:

- Individuals: You are a New Hampshire resident or part-year resident and received more than $2,400 in gross interest and/or dividend income.

- Joint Filers: You and your spouse are both New Hampshire residents and received more than $4,800 in combined gross interest and/or dividend income, and you are filing a joint New Hampshire return.

- Trusts and Estates: Trusts and estates with interest and dividend income over $2,400 must also file.

To generate in ProSeries:

- Make sure you have New Hampshire state returns added to ProSeries.

- Open the tax return.

- Press F6 to bring up Open Forms.

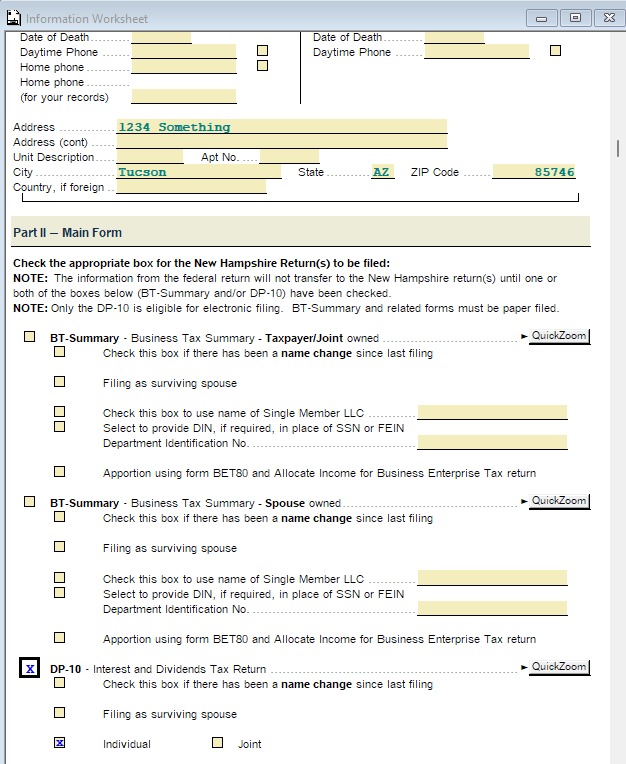

- Type Info to highlight Form DP-10 Info Wks (Information Worksheet) and select OK.

- Go to Part II - Main Form.

- Locate the checkbox DP-10 - Interest and Dividends Tax Return, and check this box.

- You should now see Form DP-10 in the Forms in Use section.