How to enter stimulus payments and figure the Recovery Rebate Credit in ProSeries

by Intuit• Updated 9 months ago

This article will help you complete the Recovery Rebate Credit Worksheet and ensure your clients get the full amount of stimulus payment they’re eligible for. For answers to frequently asked questions about the Recovery Rebate Credit and economic impact payments (also referred to as EIP or stimulus), click here.

To calculate the Recovery Rebate Credit:

- Open the Recovery Rebate Credit Worksheet.

- You can find this by pressing F6 to bring up Open Forms. Type Recov and press Enter, or locate Recov Rebate Cr in the list and double-click to open it.

- Scroll down to line 13 of the worksheet.

- Enter the amount of EIP 3 received, or enter 0 if your client didn't receive any payment.

Once you enter the stimulus amount your client received, ProSeries will use the tax information from the rest of the return to calculate the appropriate credit amount.

Economic impact payments for dependents

Enter the economic impact payments the IRS issued to the taxpayer (and spouse, if applicable) here. This includes any increased EIP the taxpayer received for qualifying children based off prior year tax filings.

Taxpayers who didn't receive any EIP because they were claimed as a dependent in prior years, and who were no longer dependents in 2021, may be able to claim a Recovery Rebate Credit. These taxpayers should not enter any EIP amounts that were received by another individual. Enter 0 to indicate none.

Returns with deceased individuals

Taxpayers who died during calendar year 2021 or 2022 are considered eligible for the full amount of Recovery Rebate Credit. This includes taxpayers who died in 2021 and 2022.

Regardless of an individual's date of death, they may still claim the Recovery Rebate Credit if they didn't receive the full amount of EIP 3 and they meet the other requirements for the credit.

What if my client isn’t sure how much stimulus they received?

Use Letter 6475 to confirm the amount of EIP 3 and plus-up payment your client received. The IRS will send Letter 6475 in early 2022 to taxpayers who received EIP 3.

Additionally, you can refer to Notice 1444-C. The IRS sent this notice to taxpayers who received EIP 3 - the only economic impact statement issued in 2021. If your client didn’t keep the notice, they may need to review their bank statements (for records of direct deposit payments or deposited checks), or view past notices at IRS.gov/account. If you can't confirm the exact amount of payment received, enter your best estimate. The IRS will confirm and adjust any Recovery Rebate Credit amounts before issuing the credit.

To have ProSeries assume your clients received their full EIP

If most of your clients already received their full stimulus amounts, you can change the program’s default behavior so that you’re not required to enter the EIP received on each return.

- Open a 1040 client.

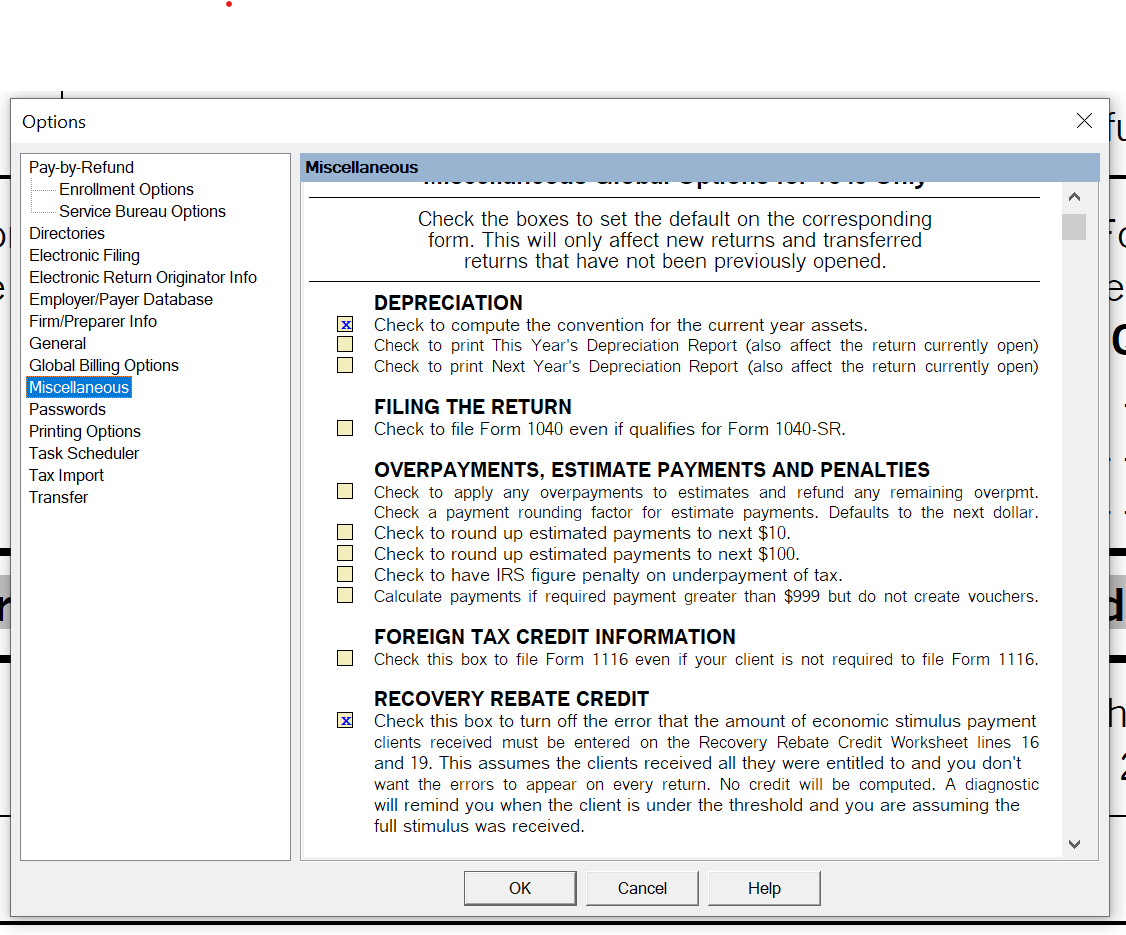

- From the Tools menu, select Options.

- Click on Miscellaneous.

- Check the box labeled Recovery Rebate Credit.

With this option enabled, the Recovery Rebate Credit Worksheet won’t be added to your returns automatically.

During final review, a diagnostic will generate informing you that stimulus payments should be entered if the client didn’t receive all EIP they were entitled to. You can always add the worksheet to a return by pressing F6 on your keyboard.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Common questions about the Recovery Rebate Credit and economic impact paymentsby Intuit

- How to enter stimulus payments and figure the Recovery Rebate Credit in ProConnectby Intuit

- How to enter stimulus payments and figure the Recovery Rebate Credit in Lacerte (For Tax Years 2020 and 2021)by Intuit

- COVID-19 relief: How to apply changes to returns in ProSeriesby Intuit