Generating TX Franchise Returns for a SMLLC in the Individual Module

by Intuit• Updated 2 years ago

To Generate a TX Franchise Return in the Individual Module:

- In Screen 54, State Taxes, select on Texas Franchise Tax from the top left navigation panel. (This will take you to Screen 54.431)

- In the General section enter the following:

- Enter the LLC name (MANDATORY).

- Enter the State taxpayer #.

- Enter the TX Secretary of State #.

- Enter the 6 digit NAICS code.

- Enter the 4 digit SIC code.

- Enter any applicable information on this screen.

- Select Add from the middle left navigation panel to add additional SMLLCs and Repeat Steps 4-9 for each SMLLC.

- Click on Texas Business Activity from the top left navigation panel. (This will take you to Screen 54.432.)

- Select the LLC name from the drop-down menu.

- Select the Business activity from the drop-down menu.

- Select the Business activity name or number from the drop-down menu.

- Click Add from the bottom left navigation panel to add additional SMLLCs.

Viewing the forms :

- Click on the Forms tab.

- Click on TX from the top left navigation panel.If you have multiple SMLLCs:

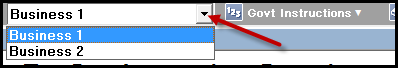

- Click on the drop-down menu next to the Govt Instructions window.

- Click on your other SMLLCs listed to toggle between their forms.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Generating and e-filing SMLLC returns in Lacerteby Intuit•86•Updated October 27, 2023

- Common questions about Tennessee SMLLC franchise and excise tax returns in Lacerteby Intuit•3•Updated November 30, 2023

- Understanding Texas Franchise Tax formsby Intuit•17•Updated May 08, 2024

- Reporting Form 1099-SA Distributions From an Archer MSA in Lacerteby Intuit•93•Updated almost 2 years ago

- Entering a partnership Schedule K-1, line 20 in the Individual moduleby Intuit•945•Updated 3 weeks ago