Generating a New Hampshire BET return in Lacerte

by Intuit• Updated 1 year ago

Form BET, Business Enterprise Tax return is required for some Schedule Cs (which may be single-member LLCs) that exceed the gross receipts or enterprise value tax base threshold.

Follow these steps to generate Form BET in the Individual module:

- Go to Screen 16, Business Income (Sch. C).

- Enter information for each Schedule C and mark as Taxpayer, Spouse, or Joint.

- Go to Screen 54, Taxes.

- Under St. Taxes in the left navigation menu, select New Hampshire BT - Summary Return.

- Under BT - Summary in the left navigation menu, select Sole Proprietorship.

- Under Sole Proprietorship Entity, choose one of the following options for Return Type:

- blank=separate entities: this will create two Form BETs for both the taxpayer and the spouse.

- 1=taxpayer: any Schedule C marked Taxpayer (and half of those marked Joint) will be included on a single Form BET.

- 2=spouse: any Schedule C marked Spouse (and half of those marked Joint) will be included on a single Form BET.

- 3=joint: all Schedule Cs will be included on a single Form BET.

Follow these steps to view the taxpayer and spouse versions of Form BET:

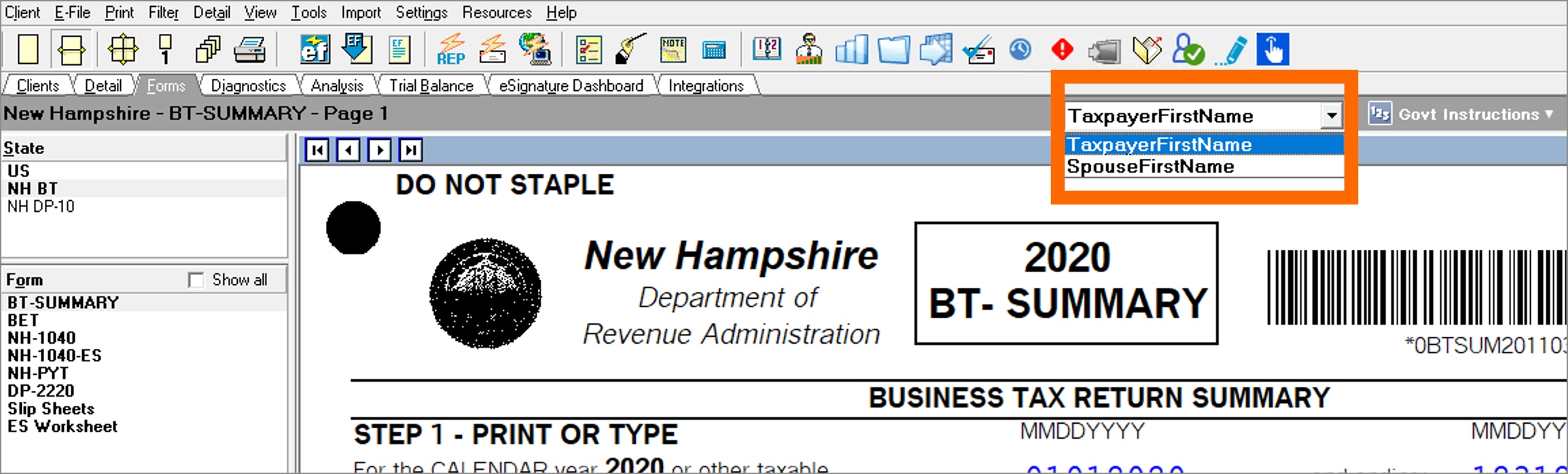

- Go to the Forms tab.

- Under State, select NH BT.

- Click the unlabelled dropdown in the gray bar above the form.

- Choose the applicable taxpayer or spouse.

![]() Screen 54.311, NH Business Return Information contains additional data entries for business information in separate columns for taxpayer and spouse versions of Form BET.

Screen 54.311, NH Business Return Information contains additional data entries for business information in separate columns for taxpayer and spouse versions of Form BET.

Follow these steps to e-file Form BET:

- Go to Screen 1, Client Information.

- Check the New Hampshire BT-Summary box.

- Go to Screen 54, Taxes.

- Under St. Taxes in the left navigation menu, select New Hampshire BT - Summary Return.

- Make sure all of the mandatory information has been entered.

- Lacerte will e-file all of the Form BET returns by default. For any returns you want to paper file, check the Do Not e-File box under the General Information section.

- Go to the Diagnostics tab.

- Review and clear any e-file critical diagnostics.

- Press Ctrl+U on your keyboard to launch the Electronic Filing Wizard.

- Follow the prompts displayed to e-file the return.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Entering gambling winnings and losses in Lacerteby Intuit•499•Updated 2 years ago

- How to generate or prepare a short year return in Lacerteby Intuit•169•Updated 1 week ago

- Generating Pennsylvania City Returns in Lacerteby Intuit•62•Updated August 07, 2023

- Generating Form 6781 in Lacerteby Intuit•679•Updated March 12, 2024

- Entering and allocating guaranteed payments in Lacerteby Intuit•224•Updated 2 years ago