Common questions about Pennsylvania Schedule O deductions in ProConnect Tax

by Intuit•1• Updated 8 months ago

Below, you'll find answers to frequently asked questions about Pennsylvania Schedule O in ProConnect Tax:

How do you enter the 529 plan contribution information so that it flows to Schedule O and to the front page of PA 40?

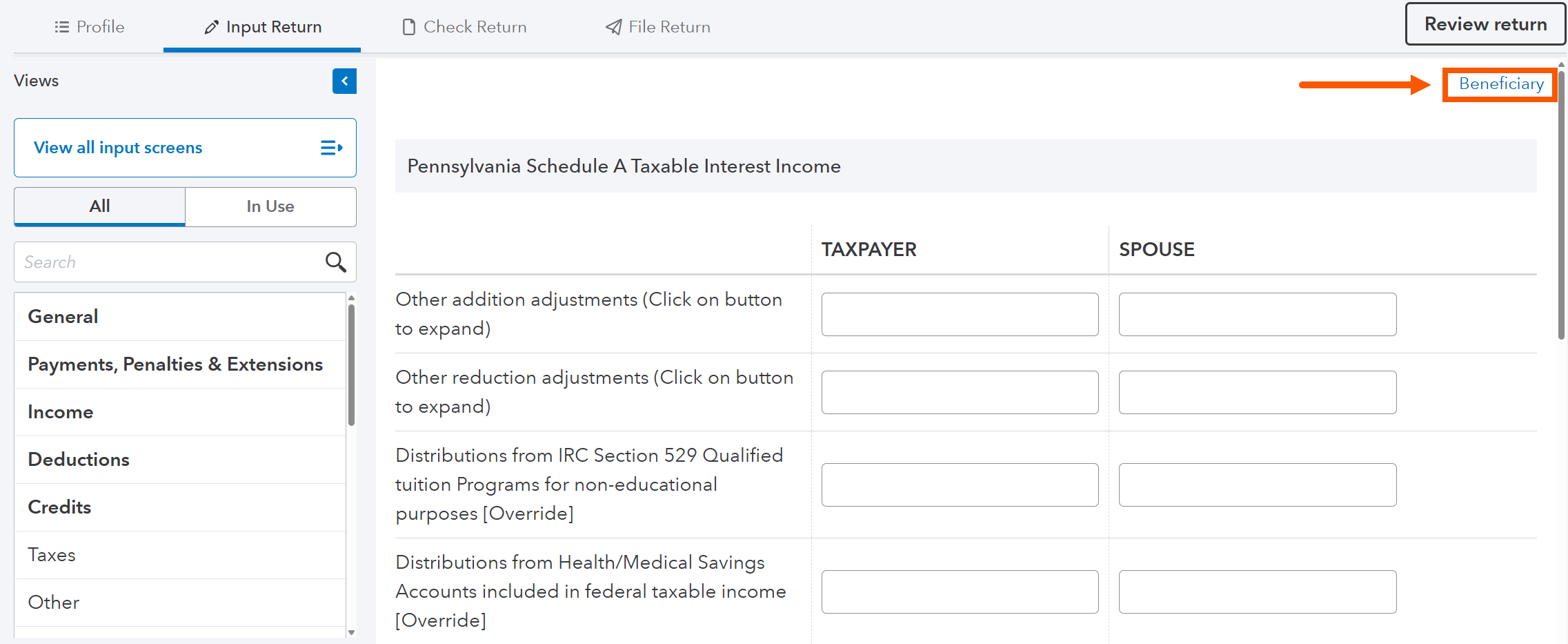

- From the Input Return tab, go to State and Local ⮕ Income ⮕ PA Modifications (Sch. A/B/O).

- Select Beneficiary on the top right corner.

- Under the section Pennsylvania Schedule O Deductions, enter the Beneficiary name, Beneficiary SSN, and Contribution

Schedule O, page 1 will now populate and put the resulting Deduction on line 10, page 1 of PA-40.

There's a maximum limit of $15,000 per beneficiary per taxpayer-spouse.

More like this

- Common questions about Pennsylvania Schedule O deductions in Lacerteby Intuit

- Common questions about allocating individual part-year or nonresident Pennsylvania wages in ProConnect Taxby Intuit

- Common questions about Form 8903 and domestic production activities deductions in ProConnect Taxby Intuit

- Generating Schedule O for Form 990 in ProConnect Taxby Intuit