Entering IRA contributions in a 1040 return in ProSeries

by Intuit• Updated 4 months ago

![]() Calculations and limitations addressed in this article may be impacted by inflation adjustments for the year. To see the IRS annual inflation adjustments for tax year 2021 and 2022 see here.

Calculations and limitations addressed in this article may be impacted by inflation adjustments for the year. To see the IRS annual inflation adjustments for tax year 2021 and 2022 see here.

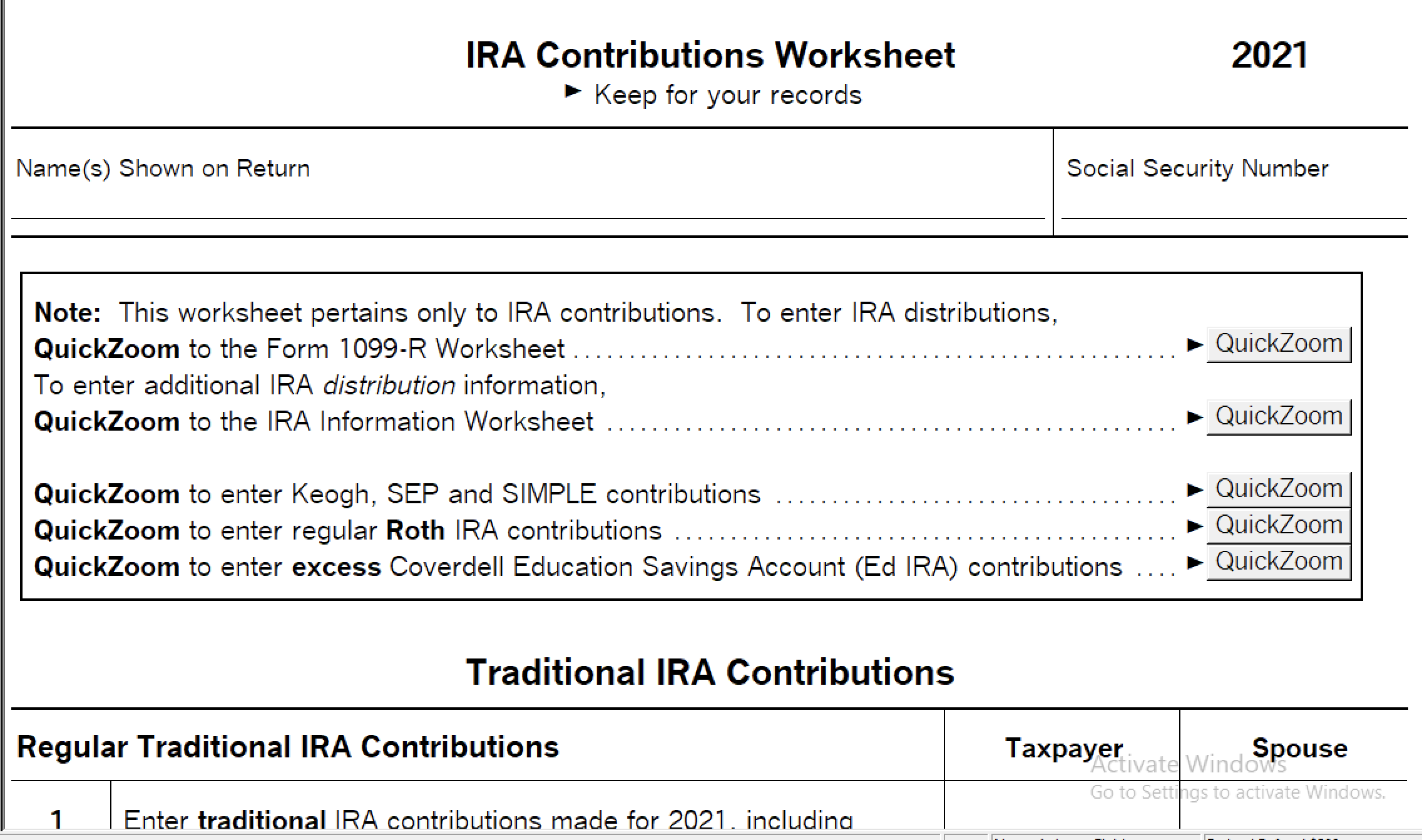

To enter traditional IRA contributions:

- Open the tax return.

- Press F6.

- Type in IRA and press Enter to open the IRA Contribution Worksheet.

- Traditional IRA Contributions are entered on lines 1-11.

- Lines 12-18 will show you the deductible and nondeductible portions of the contributions.

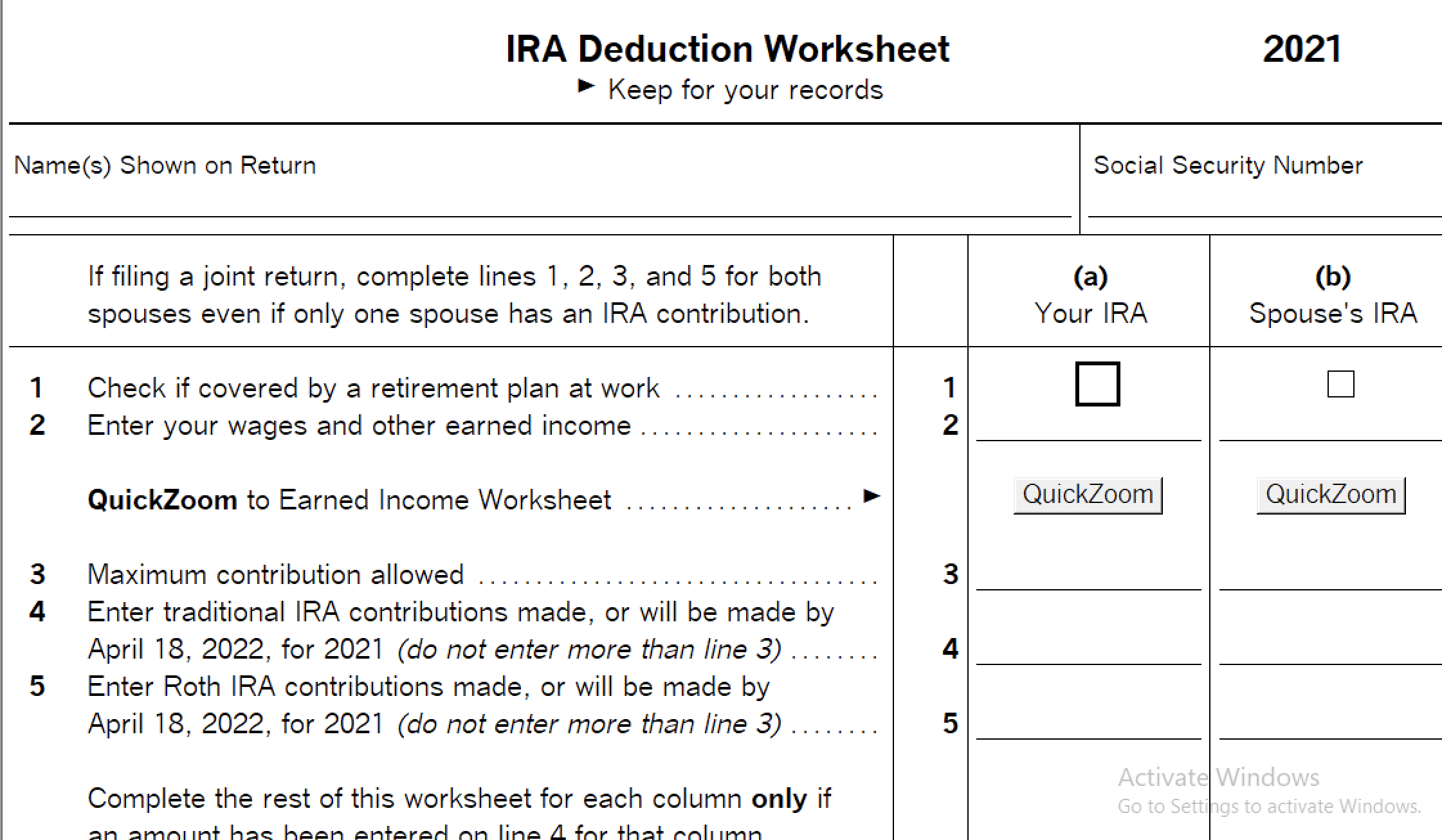

- Select the QuickZoom from line 13 to see how the deductible portion is calculated.

To enter Roth IRA contributions:

- Open the tax return.

- Press F6.

- Type in IRA and press Enter to open the IRA Contribution Worksheet.

- Roth IRA Contributions are entered on lines 19-27.

- Any Excess Roth IRA contributions will show on line 30.

Related topics

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Entering charitable contributions for the 1040 in ProSeriesby Intuit•181•Updated over 1 year ago

- Entering IRA basis and year-end valueby Intuit•30•Updated May 16, 2024

- Entering Form 1099-R in a 1041 in ProSeriesby Intuit•141•Updated 2 years ago

- Entering Form 1099-R in ProSeriesby Intuit•217•Updated December 20, 2023

- Entering charitable contributions on Form 1120S in ProSeriesby Intuit•37•Updated May 14, 2024