Creating and e-mailing password protected PDFs to clients in Lacerte

by Intuit•18• Updated 1 year ago

Before you start:

- The email address that the email is sent to will be populated with the taxpayer's e-mail addresses from Screen 1, Client Information.

- On a joint return, if entered, both taxpayer and spouse emails will be listed to send the PDF to.

- In order for Lacerte to send the password-protected PDF email you need a supported email application. See Do I have the right email application installed below.

For more Print & PDF resources, check out our Troubleshooting page for Print & PDF where you'll find answers to the most commonly asked questions.

- Open Lacerte to the Client List.

- Highlight the client you need to email the PDF to.

- You can only have one client selected per email.

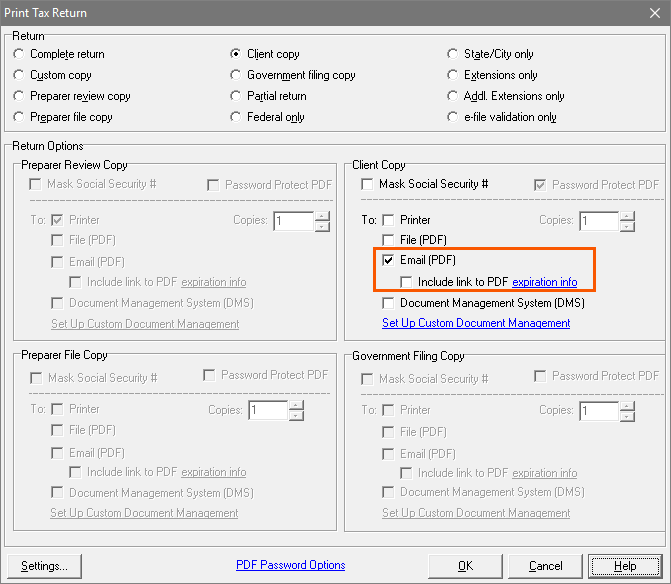

- From the Print menu, choose Tax Return.

- Select the Return print type you would like to send. The following print types support Email in tax year 2019:

- Client Copy

- Custom Copy

- Partial Return

- Preparer review copy

- Preparer file copy

- Government filing copy

- Extensions only

- Additional Extensions only

- K-1 package only

- Grantor package only - Fiduciary module

- Check the box for Email(PDF). Note: If Email (PDF) is grayed out then the Return type for printing may not be supported for the year of Lacerte you are in. Client Copy, Custom Copy and Partial Return have been the defaults since the feature became available in 2012.

- If, instead of a traditional PDF attachment, you'd like to have the PDF listed on a secure server the taxpayer can access from anywhere, check the box. Include link to PDF. The link to the taxpayer will expire on December 31.

- Select OK.

- Lacerte will calculate and generate a PDF of the return.

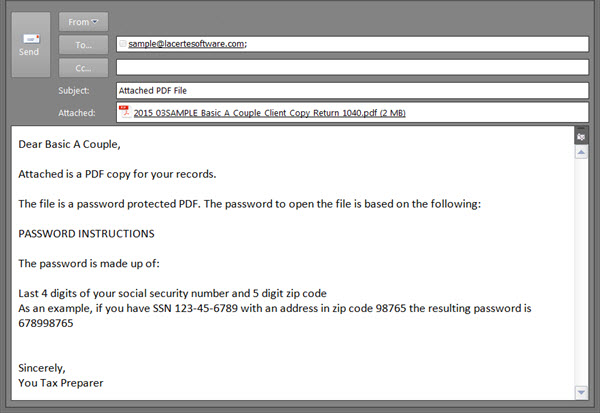

- Lacerte will open your default MAPI compliant email program for you to review and send.

- If the return is also marked for electronic filing, the validation process will occur for the PDF just as if the return were being printed.

- Select Options under the Settings menu.

- Click on the PDF Password Options section.

- Review the PDF Password Options:

- By default, both the Identification Number and Zip Code are required by the taxpayer to open the PDF. If neither option is selected the emailed PDF won't be password protected by Lacerte.

- Select OK to save the settings.

![]() This option will be inaccessible and grayed-out in the program for Standalone users with normal options

This option will be inaccessible and grayed-out in the program for Standalone users with normal options

If you would like to set a Firm Password, this will enable anyone in your firm with the password to be able to open the PDF's. This doesn't affect the taxpayer's password.

- From the Settings menu, choose Options. If you are using Lacerte on a network choose Primary Options.

- Select the Setup tab.

- Select the PDF Password Options section.

- Create a Firm Password.

- Open Lacerte to the Client List.

- Select the client you need to email the PDF to.

- You can only have one client selected per email.

- From the Print menu, choose Tax Return.

- Choose the return type and make sure Email (PDF) is selected.

- Select Settings.

- Select Customize Email where you can customize the Subject, Salutation, Email Body and Closing.

- Select Preview Email.

- To save your changes for all clients select Save & Close.

- Select OK in Print Settings.

- Select OK on the Print Tax Return window to email the password protected PDF.

- Supported Email Applications:

- All 32-bit versions of Outlook 2007 or later

- Thunderbird

- Unsupported Email Applications:

- All 64-bit versions of Outlook, Outlook Express, and Windows Mail

- All web-based versions of Outlook, Outlook Express or Windows Mail

- All webmail services (such as Outlook.com, Outlook 365, Gmail, Yahoo, AOL, etc.)

Not sure if your version of Outlook is 32-bit or 64-bit? Click here for instructions on how to check.

If you are using a webmail service, you may be able to configure it for access through the MAPI email client installed in Windows. Our support agents cannot assist with setup of your email application. Please contact your local IT professional for further assistance, and let them know that you’ll need a 32-bit, ExtendedMAPI-Compliant email client application to use this feature in Lacerte. SimpleMAPI-compliant email clients may not function correctly.

Attached is a PDF copy of your Tax Return.

The file is a password protected PDF. The password to open the file is based on the following:

PASSWORD INSTRUCTIONS

The password is made up of:

Last 4 digits of your social security number and 5 digit Zipcode

As an example, if you have SSN 123-45-6789 with an address in zip code 98765 the resulting password is 678998765

IF YOU DO NOT HAVE A PDF READER

If you do not have a PDF reader, you can download the latest Adobe Reader by clicking on the link below. If clicking does not work, copy/paste the URL into your browser window.

https://get.adobe.com/readerSincerely,

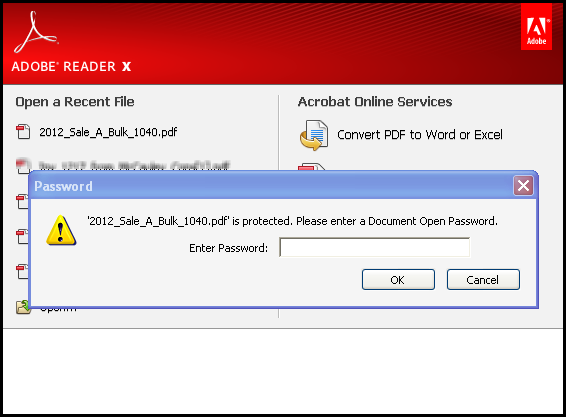

After your client opens the email, they will be prompted to enter a password with the instructions you provided. After entering the password, the return will be available for the client to print

The following rules apply:

- Only up to the first five characters of the zip code are used.

- If the zip codes contain anything that is not a number (ignoring dashes), it will not be used in the password.

- The SSN must be at least four digits long before it is used in the password.

- If the SSN contains anything that is not a number (ignoring dashes), it will not be used as the password.

- SSN dashes are ignored when creating passwords.

- If the SSN is less than 9 digits, it is not used as a password.

Important Information about PDF Password Protection:

- Is the password-protected PDF encrypted? Yes, using AES 128-bit encryption similar to Adobe PDF encryption.

- Can this PDF be hacked? Any security can be hacked given a sufficient length of time and the right tools. The password methodology is hackable but allows for relative ease of opening by the Taxpayer. There is always a continuum between security and ease of use. At one end are no encryption and high ease of use. At the other end is complex passwords like ?24bsde$%f*QW43**F!?, sent separately to the recipient, to create high security, but low ease of use. The password methodology was based on feedback from our Tax Preparer customers.

- Is there anything else I should do to protect my client's tax data? We recommend you also mask the SSN on the PDF return.

- Is emailing a password-protected PDF as safe as using a portal to deliver tax returns? Portal security can be very high or not so high, again, depending on how it is set up. However, it is easier to give high security with reasonable ease of use with a portal.

- Can I use a different password methodology to protect PDF's? No

Lacerte uses the default email client configured in the Windows Operating System. The email client must be Extended MAPI compliant program for compatibility. See How To Change Default Email Client, or contact a local IT professional, for more information on changing Windows default programs.

The Email (PDF) option doesn't support batch printing for multiple clients. As a result, when selecting clients for batch printing, the Email(PDF) function isn't available.