Entering a NOL carryover in the Corporate module of Lacerte

by Intuit•4• Updated 9 months ago

This article will assist you with entering a NOL carryover in the Corporate module of Lacerte.

For most taxpayers, NOLs arising in tax years ending after 2020 can only be carried forward. See Net operating losses for more information.

Follow these steps to enter a NOL carryover in the program:

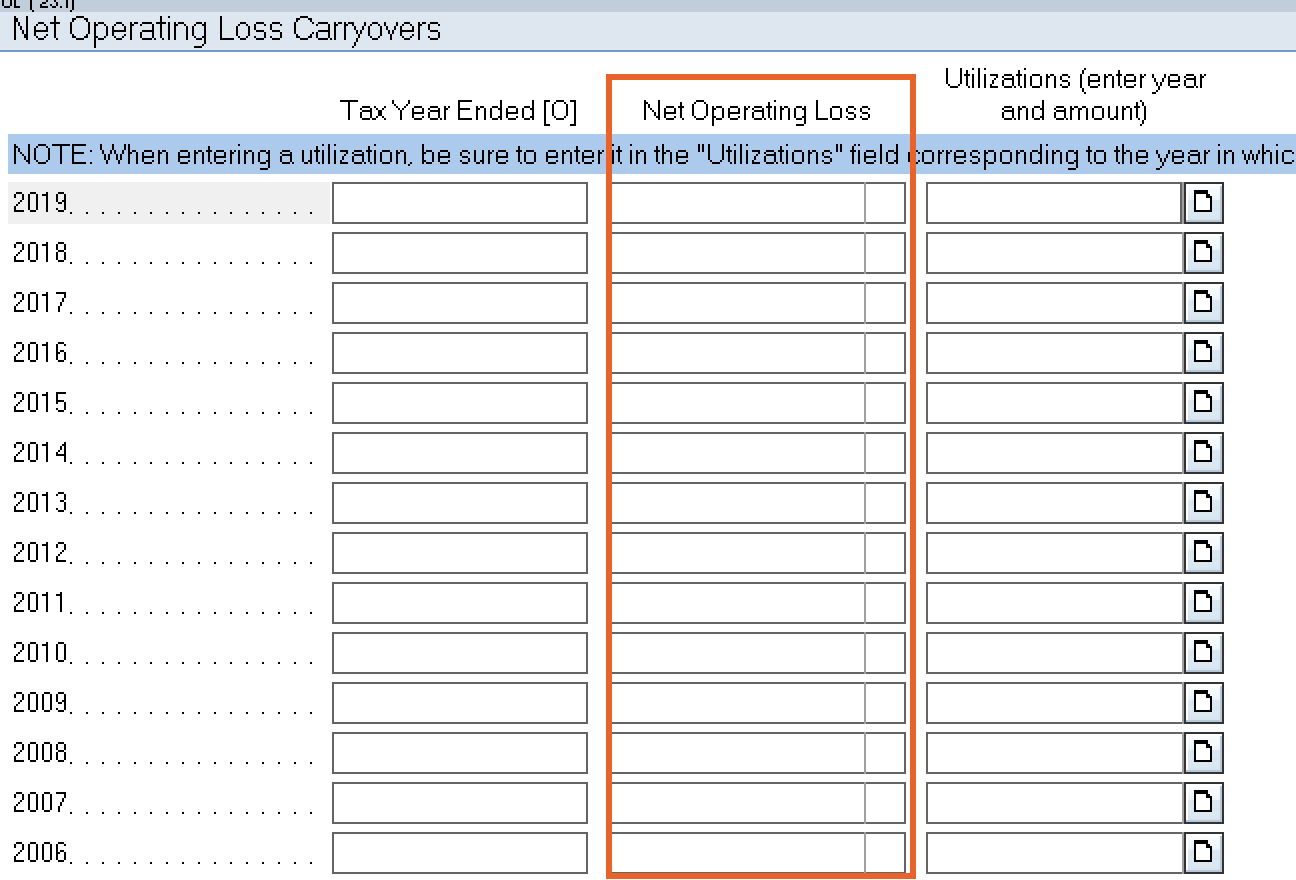

- Go to Screen 23, Net Operating Losses.

- Scroll down to the Net Operating Loss Carryover section.

- Enter the amount under the Net Operating Loss column for the year that the loss incurred.

- Repeat step 3 for each year a loss was incurred.

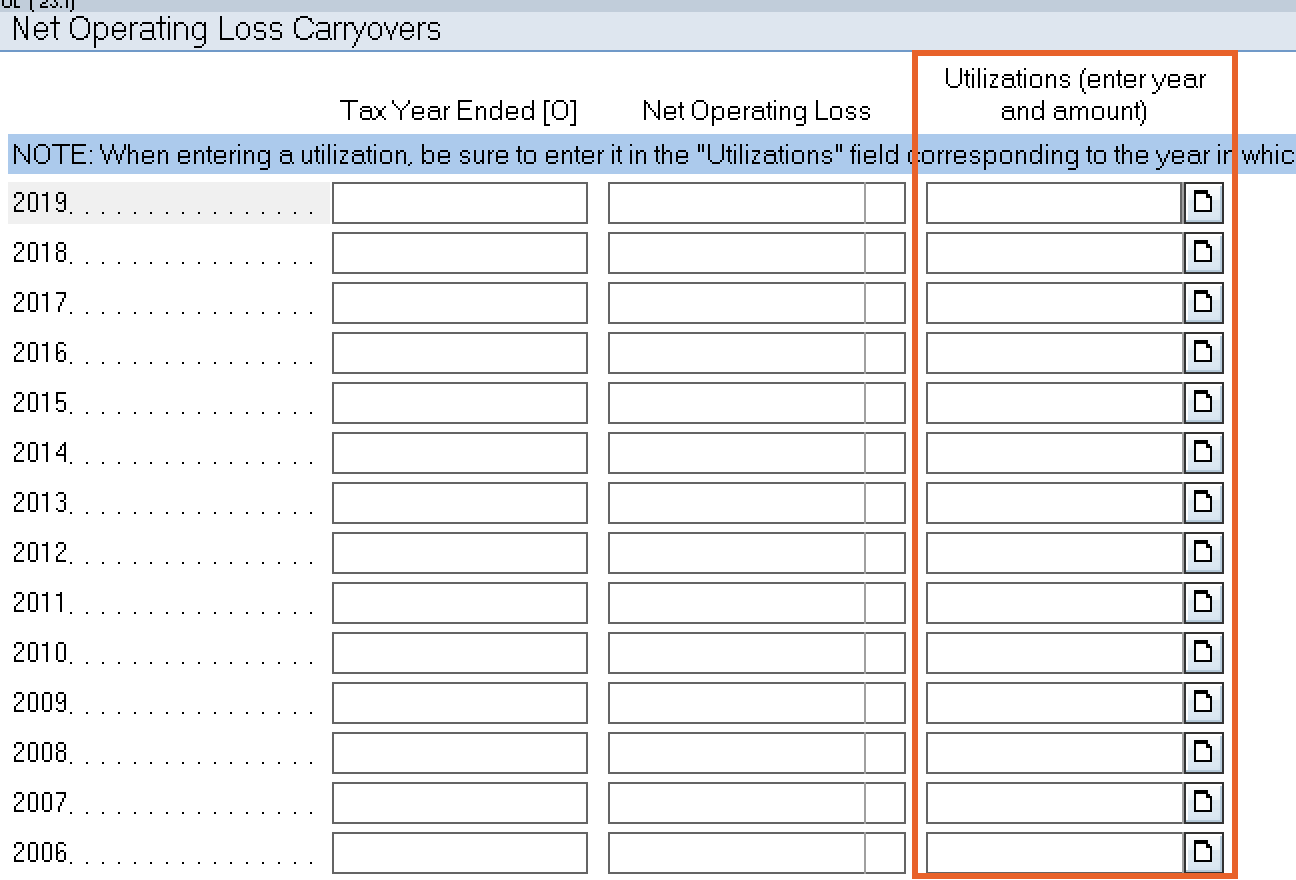

- To have Lacerte correctly calculate the NOL carryover for the current year, you need to enter utilizations in the same year they were incurred.

- In the Utilizations (enter year and amount) column, hold down Ctrl+E in the year the NOL was incurred.

- Enter the amount utilized in the Amount column.

- Enter the year the amount was actually used in the Description column.

- Repeat steps 5-7 for each utilization until the amount utilized is completely used up.

- The information entered will print on a statement on Form 1120, line 29a and reflect any amount of NOL available to be used in the current year.

- Any current NOL carryover and utilization will proforma to the next tax year.

More like this

- Common questions about corporate net operating loss (NOL) in Lacerteby Intuit

- Common questions about Net Operating Losses(NOLs), Form 172 and diagnostic ref 61199 in Lacerteby Intuit

- Common questions about corporate net operating loss (NOL) in ProConnect Taxby Intuit

- Common questions about Corporate Contribution Carryovers in Lacerteby Intuit