Generating Pennsylvania City Returns in Lacerte

by Intuit• Updated 11 months ago

Before you start:

- Lacerte supports Pennsylvania City Returns. Please note all PA City Returns must be paper filed.

- The City/Municipality Return is found under the Forms tab as PA - Local Annual EIT (in prior years it was listed as PA- Generic).

- After following the above below, Lacerte will generate a client letter for each Local Annual EIT generated.

- To add more than one city for Pennsylvania, click Add under City on the left panel of Screen 54.053, Pennsylvania Cities Earned Income Tax and repeat the steps below. The additional forms can be found using the drop-down at the top of the Forms view, when the PA - Local Annual EIT form is selected.

To Generate a PA City Return:

- Go to Screen 1, Client Information.

- Click on Add Cities from the left navigation panel under Pennsylvania.

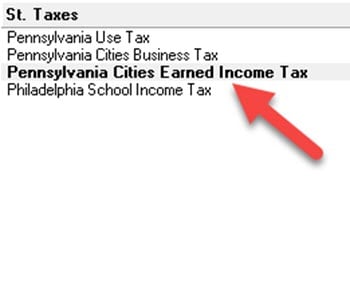

- Go to Screen 54.053, Pennsylvania Cities Earned Income Tax

- Select the Name of city from the drop down menu. Only cities added in Screen 1, Client information will appear in this list, but you can also Add a city here if not listed.

- Complete the other applicable information under the General Information section.

- The Income items will come from the appropriate screens (i.e.: Screen 10, Wages). There are overrides available in Screen 54.053, Pennsylvania Cities Earned Income Tax in the Income section if needed.

- For Wage income, Screen 10, Wages, Salaries, Tips - Under the State and Local section, complete the table Pennsylvania - Local Wages and Withholding Information for each applicable W-2.

- For Schedule C income, Screen 16, Business Income (Schedule C) - Under City Information, select the appropriate City name (Ctrl+E) and the appropriate amounts for allocating.

- For rents and royalties, Screen 18, Rental & Royalty Income (Schedule E) select the City name in the City Information section to allocate the income and expenses to that city.

- For Schedule F income, Screen 19, Farm Income (Schedule F / Form 4835) - Under City Information, select the appropriate City name (Ctrl+E) and the appropriate amounts for allocating.

- For Passthrough K-1's, Screen 20, Passthrough K-1's - Select the City Name under the City Information section.

- Enter any estimates paid in the Amount paid field for the applicable quarter under the 20XX Estimated Tax section.

- Enter any applicable information in the Other Payments and Credits section.

- Enter the City Tax Return Mailing Information to print on the city slip sheets, client letter, and filing instructions.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Pennsylvania cities earned income tax in Lacerteby Intuit•1•Updated 1 year ago

- Generating Ohio City tax returns in the Lacerte Individual Moduleby Intuit•13•Updated 2 weeks ago

- Generating Form 6781 in Lacerteby Intuit•679•Updated March 12, 2024

- Address autofill from ZIP code input in Lacerteby Intuit•24•Updated December 21, 2023

- How to generate or prepare a short year return in Lacerteby Intuit•169•Updated 1 week ago