Setting up employees with multiple state taxes in EasyACCT

by Intuit• Updated 2 years ago

Down below we'll go over how you can set up an employee working in multiple states in the program.

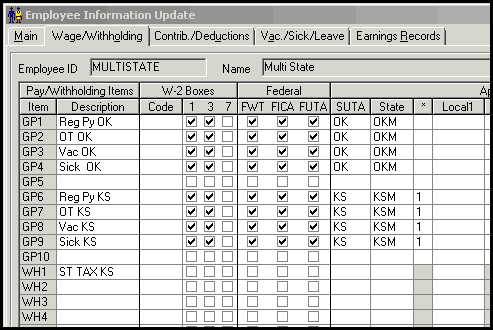

How to set up employees working in multiple states

- Go to Batch Payroll, Update Company Files, Company Information.

- Select SUTA Rates/Limits.

- Enter the two-digit ZIP code. Enter the assigned SUTA rate for the company.

- Enter the Company's ID number for state filing purposes.

- Repeat for each state where SUTA will be payable.

- Go to the Employee Information, Wage/Withholding tab.

- Set up a GP item representing the resident state (For example, AZ).

- Select the correct Form W-2 boxes, federal taxes, and applicable state and local tax codes for the resident state.

- Set up a GP item for the second state.

- Select the correct Form W-2 boxes, federal taxes, and applicable state and local tax codes for the second state.

- In the * column next to the State column enter a number corresponding to the next available WH item (For example, WH1).

- In the WH field indicated in the * column (WH1), enter the description for the second state's tax (For example, KSTAX).

- Set up a GP item representing the resident state (For example, AZ).

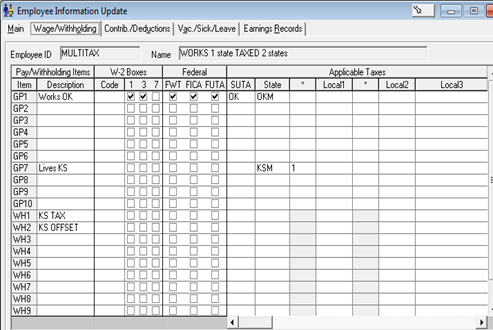

How to enter employees working in one state and subject to multiple state taxes

- Go to Employee Information and switch to the Wage/Withholding tab.

- Set up a GP item representing the first state (For example, AZ).

- Select the correct Form W-2 Boxes, federal taxes, and applicable state and local tax codes for withholding.

- Set up a GP item for the second state (For example, KS).

- GP State2 is used only to calculate the state withholding required for the second state.

- Don't select any W-2 codes, FWT, FICA or FUTA boxes.

- Only enter the State code for withholding for the second state.

- In the * column next to the State column enter a number corresponding to the next available WH item (For example, WH1).

- Set up a GP item representing the first state (For example, AZ).

- In the WH field indicated in the * column (WH1), enter the description for the second state's tax (For example, KSTAX).

- Set up another WH field to use as an offset to the second state wages entered for GP item assigned to State2.