Completing the Form 990 Schedule O in ProSeries

by Intuit•1• Updated 2 years ago

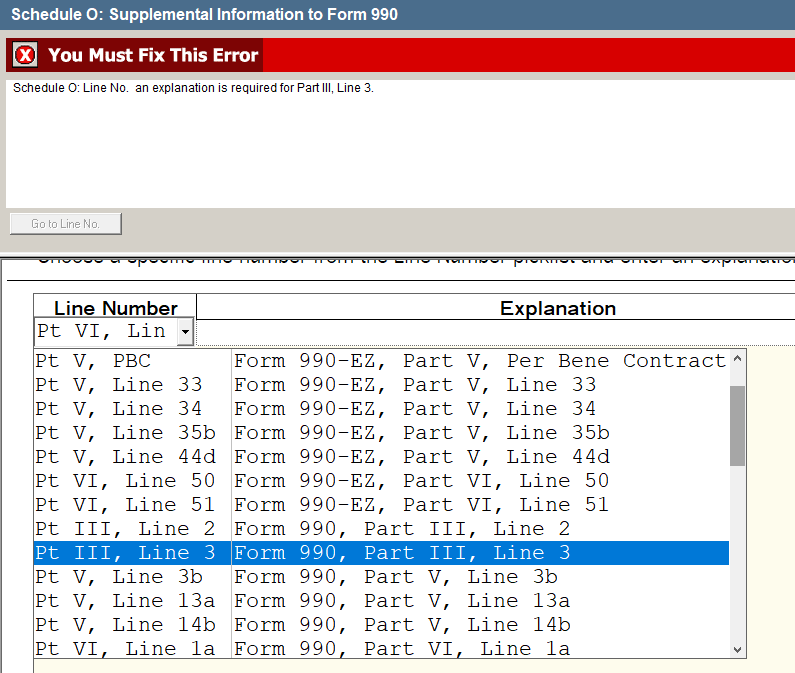

When completing a 990 return, the IRS may require additional explanation for information on the Schedule O. ProSeries displays an error for each field that requires an explanation.

To enter the required information:

- Run ProSeries Final Review.

- Click Next until you see errors for Schedule O.

- From the Line Number drop-down menu select the Form, Part and Line number that matches the Final Review message.

lr

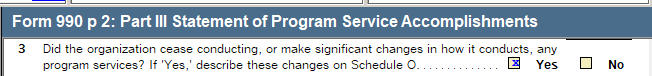

lr - Review the 990 form and form instructions for an overview on what explanation is required. For example the Form 990, Part III, Line 3:

- On the Schedule O enter the required explanation.

- In Final Review click Next to see if any additional lines require an explanation.