How to enter taxable grants from Form 1099-G, box 6 in Lacerte

by Intuit•8• Updated 2 years ago

Follow these steps to enter taxable grants:

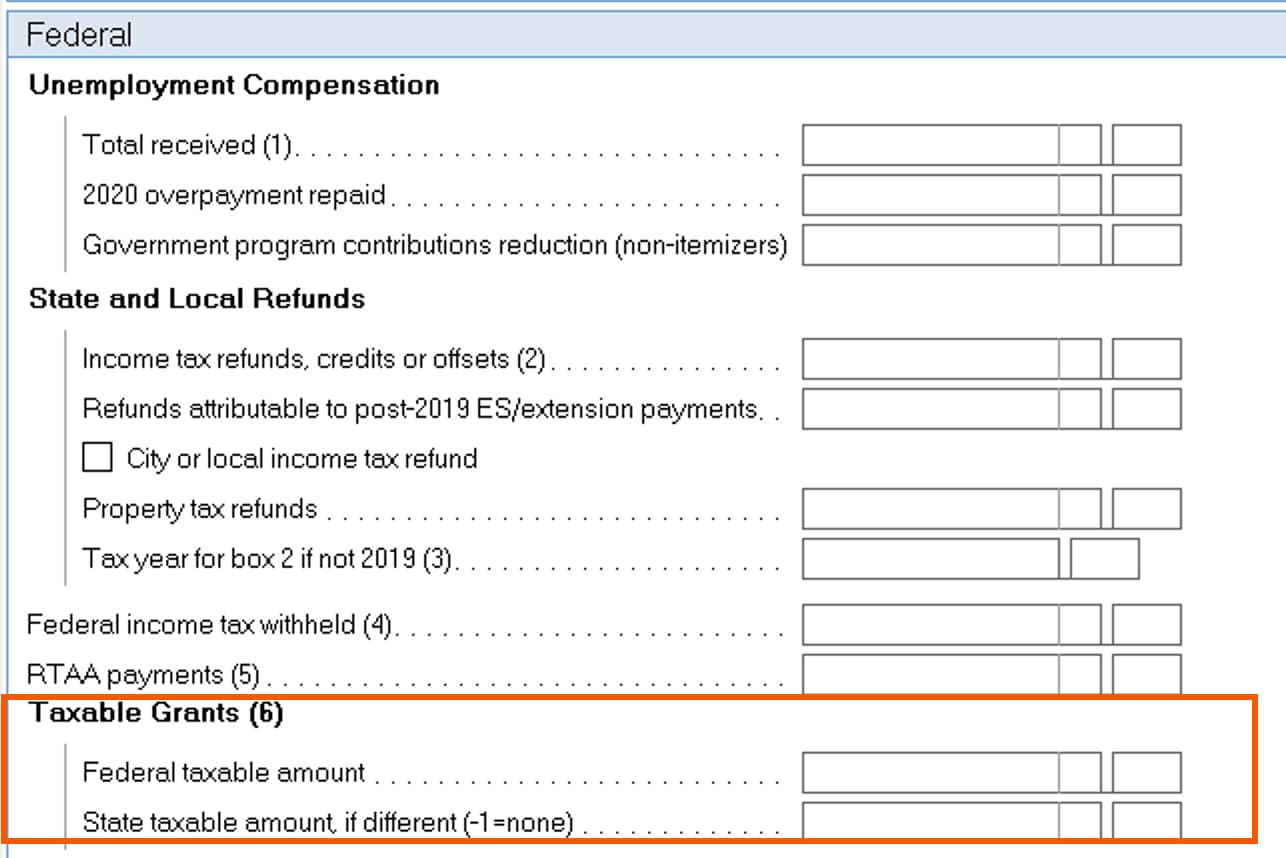

- Go to Screen 14.2, State Tax Refunds, Unemployment Comp. (1099-G).

- Select Add or select the appropriate Payer from the left panel.

- Enter the applicable information as reported on the Form 1099-G.

- Scroll down to the Federal section.

- Locate the Taxable Grants (6) subsection.

- Enter the Federal taxable amount.

- This amount will be included on Form 1040, Line 8.