Entering Form 1095-C in Lacerte

by Intuit•175• Updated 4 months ago

Form 1095-C reports an employee’s health insurance coverage offered by an employer. In {ProductTaxYear}, you can use this form in {ProductName} to confirm coverage information for certain state returns. While it isn’t required to be filed with a federal return, it may help you verify state-level health coverage requirements.

For current tax returns

No federal 1095-C entry is needed since the Shared Responsibility Payment, or health coverage penalty, has been reduced to $0.

For states with health coverage requirements, the 1095-C data doesn't have to be entered into the program - but you can use it to help determine whether your client had health coverage throughout the year. Click here for more information on entering minimum essential coverage for California returns.

For tax year 2018 and earlier returns

Forms 1095-B and 1095-C are issued to taxpayers for information purposes only and aren't required to be entered in the return.

- Part III input is provided to conveniently calculate the Individual Shared Responsibility Payment penalty if some or all of the household members don't have full-year coverage.

- This input can also be made on Screen 39.1 under the "Minimum Essential Coverage not Indicated Elsewhere" section. Only one entry is required.

- If all members of the household were covered all year, go to Screen 39.1 enter a 1 for entire household covered for all months. No additional input is required.

To enter Form 1095-C:

- Go to Screen 39, Affordable Care Act Subsidy/Penalty.

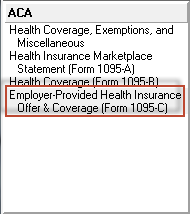

- Select on Employer-Provided Health Insurance Offer & Coverage (Form 1095-C) from the left navigation panel to open Screen 39.4.

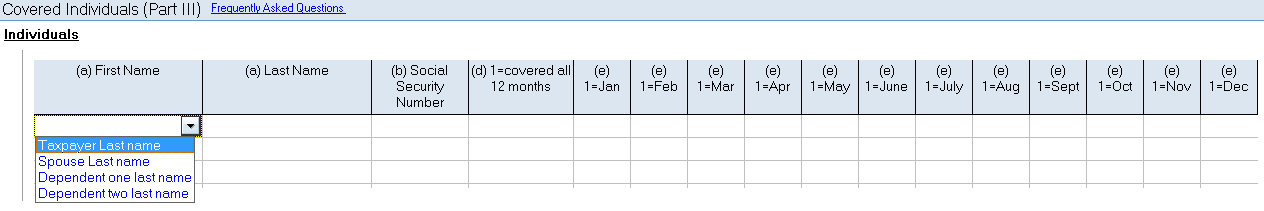

- Scroll down to the Covered Individuals (Part III) section.

- Select the (a) First Name of the individual from the dropdown menu.

- If you select the covered individuals name from the dropdown menu, Lacerte will populate the (a) First Name, (a) Last Name, and (b) SSN as entered on Screen 1, Client Information or Screen 2, Dependents. If the Covered Individual isn't entered on Screen 1 or Screen 2 you'll need to manually enter their information.

- If you select the covered individuals name from the dropdown menu, Lacerte will populate the (a) First Name, (a) Last Name, and (b) SSN as entered on Screen 1, Client Information or Screen 2, Dependents. If the Covered Individual isn't entered on Screen 1 or Screen 2 you'll need to manually enter their information.

- Complete the applicable information:

- If the individual was covered for all 12 months: enter a 1 in (d) 1= covered all 12 months.

- If the individual was only covered part of the year: enter a 1 for each month the individual was covered.

- If the taxpayer received mutliple 1095-C forms select Add from the left navigation panel for each additional form needed.