Entering nondeductible expenses on Form 1065 in Lacerte

by Intuit•1• Updated 2 years ago

You can enter nondeductible expenses in 3 locations in the partnership module in Lacerte:

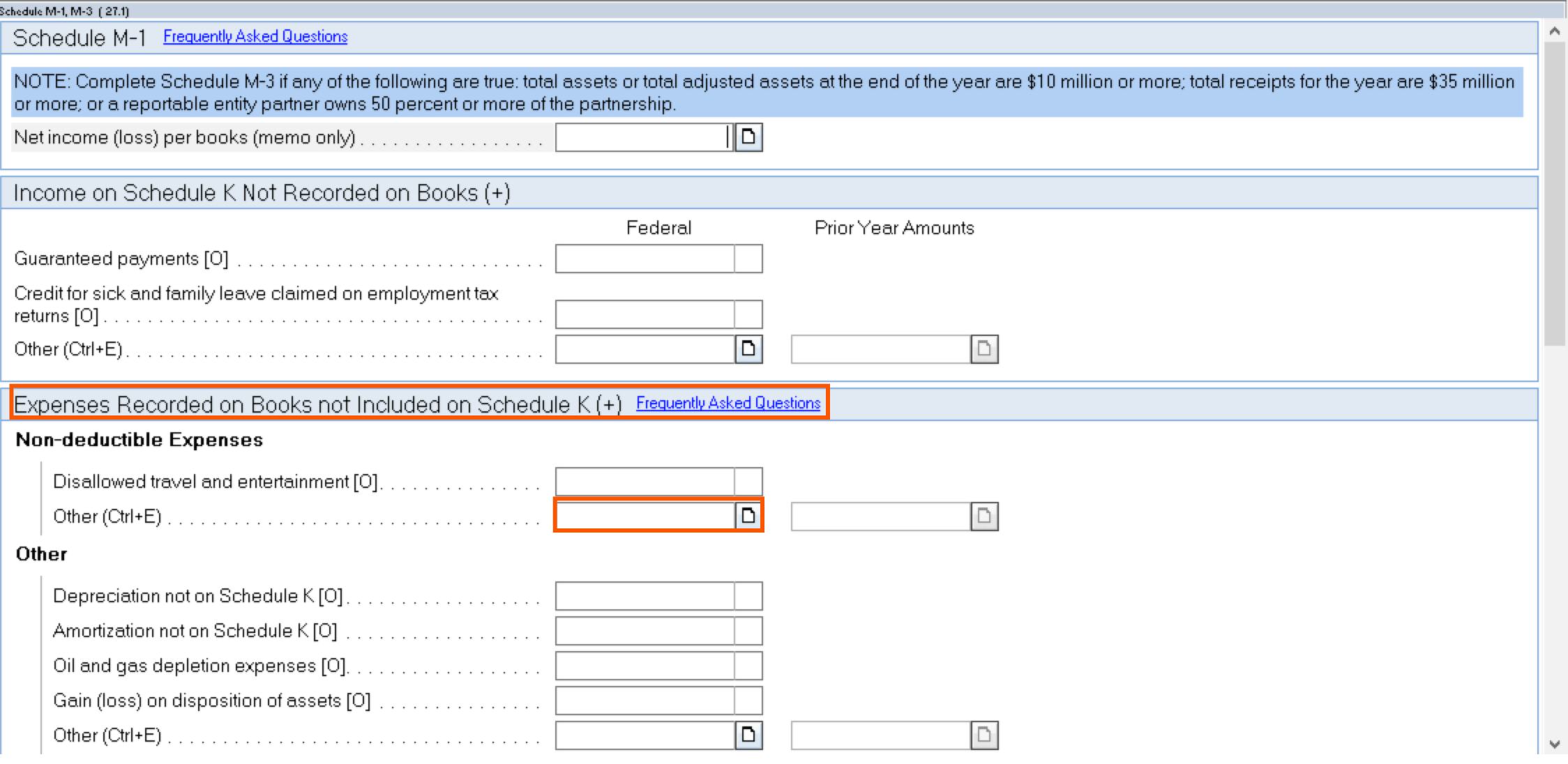

1. Enter nondeductible expenses on Screen 27, Schedule M-1, M-3

- In Detail, select Screen 27, Schedule M-1, M-3 (Book Tax Adj.).

- Under Expenses Recorded on Books not included on Schedule K, enter your nondeductible expenses in the Other field.

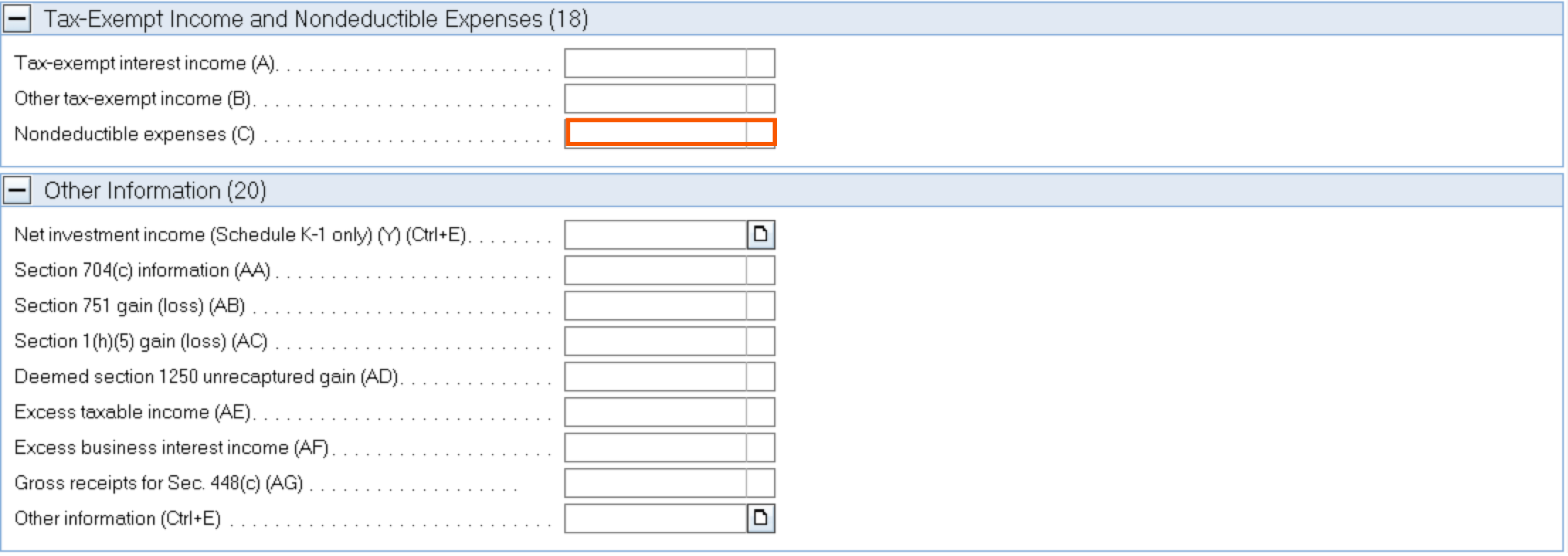

2. Enter nondeductible expenses on Screen 20, Passthrough K-1's:

- In Detail, select Screen 20, Passthrough K-1's.

- Under Line 18, Tax-Exempt Income and Nondeductible Expenses, enter your nondeductible expenses in the Nondeductible expenses (C) field.

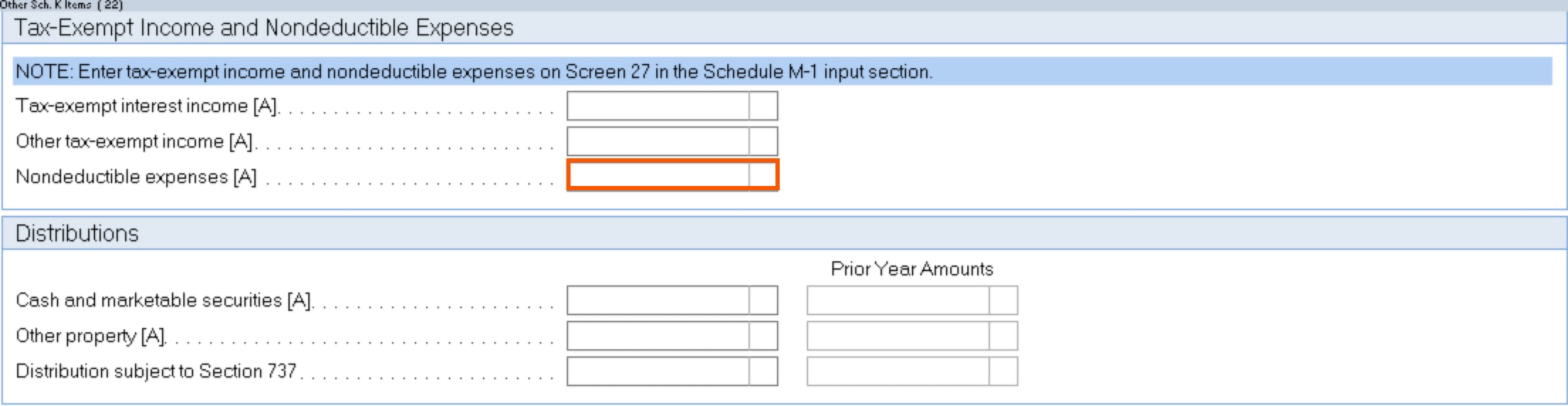

3. Enter nondeductible expenses on Screen 22, Other Schedule K Items

- In Detail, select Screen 22, Other Schedule K Items.

- Under Tax-Exempt Income and Nondeductible Expenses, enter your nondeductible expenses in the Nondeductible expenses [A] field.

More like this

- Entering nondeductible expenses on Form 1065 in ProConnect Taxby Intuit

- Common questions about Fiduciary Passthrough K-1 Tax Exempt Income in Lacerteby Intuit

- Entering Nondeductible Expenses for an S-Corporation in Lacerteby Intuit

- Common questions about Fiduciary Passthrough K-1 Tax Exempt Income in ProConnect Taxby Intuit