Entering partnership Schedule K-1, Line 20, "Other" in an individual return in ProConnect Tax

by Intuit• Updated 1 week ago

ProConnect Tax doesn't have one specific entry field for Schedule K-1, Line 20, 'Other'. The firm that prepared the partner's K-1 should have included a description of the information and instructions on how to report the information on the partner's individual return. If the firm didn't include a description or instructions, you'll need to decide where the other information should be reported.

For a full list of items that could be represented on this line, refer to Partners Instructions for Schedule K-1.

The K-1 line 20 'other' has changed letters over the years:

- Tax year 2023: ZZ

- Tax year 2018-2022: AH

- Tax year 2013-2017: Z

- Tax year 2012 and prior: Y

Table of contents:

What's new for Schedule K-1 for tax year 2023:

For tax year 2023 the IRS has added multiple new codes to the Schedule K-1. Most changes involve new codes for Other Income, Other Deductions, Other Credits and Other Information to provide additional details for when the 1040 is completed. To see the Partnership codes, see here, to see the S-Corporation codes see here and scroll down to the code lists on the last pages of the instructions.

Some of the more common input items in ProConnect Tax are as follows:

If the other information is needed for a Disclosure Statement:

For tax year 2023, this is now code AW: Reportable Transactions.

- Go to Input Return ⮕ Miscellaneous Forms ⮕ Tax Shelter Statement (8886) to expand the dropdown menu.

- From the dropdown menu, select Tax Shelter Statement (8886).

- Enter all applicable information as reported on the Schedule K-1 to complete Form 8886.

For additional information on filling out the Form 8886 disclosure statement, see the here.

If the other information is Interest and additional tax on section 409A:

For tax year 2023, this is now code AI: Interest and tax on deferred compensation to partners.

- Go to Input Return ⮕ Taxes ⮕ Other Taxes to expand the dropdown menu.

- Select Schedule J, Recapture, Other Taxes from the dropdown menu.

- Scroll to the section Other Taxes.

- Select the input field for Other taxes (Click on button to expand).

- In the Description field, enter Section 409A.

- Enter the Amount.

- Select OK.

For additional information entering interest and additional tax, see the here.

If the other information is qualifying advanced coal projects:

For tax year 2023, this is now code AS: Qualifying advanced coal project property and qualifying gasification project property.

Starting in tax year 2023:

- Go to Input Return ⮕ Credits ⮕ General Business and Vehicle Cr.

- Select the Investment Credit (3468) section.

- Select the Investment & Research tab.

- Select the facility you need to generate the credit for.

- Use the Add button to add as many Facilities or properties as needed.

- Complete Part 1 for each Activity.

- Scroll down to the Part II and enter the required information.

- The credit flows from Form 3468 to Form 3800 to show on Form 1040.

You can input this information under General Business and Vehicle Credits of the Individual return. The credit flows from Form 3468 to Form 3800 to show on Form 1040.

For tax year 2022 and prior:

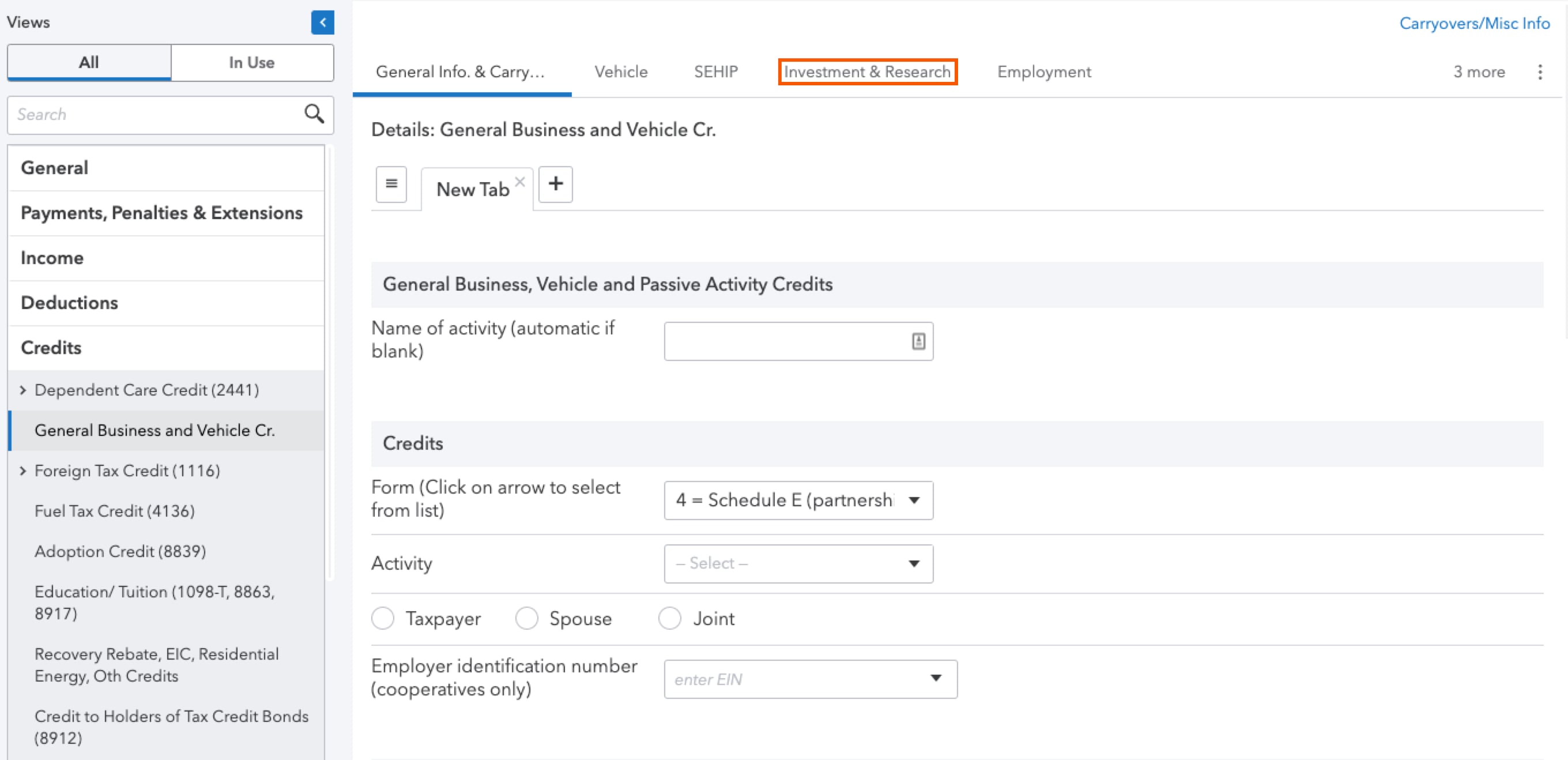

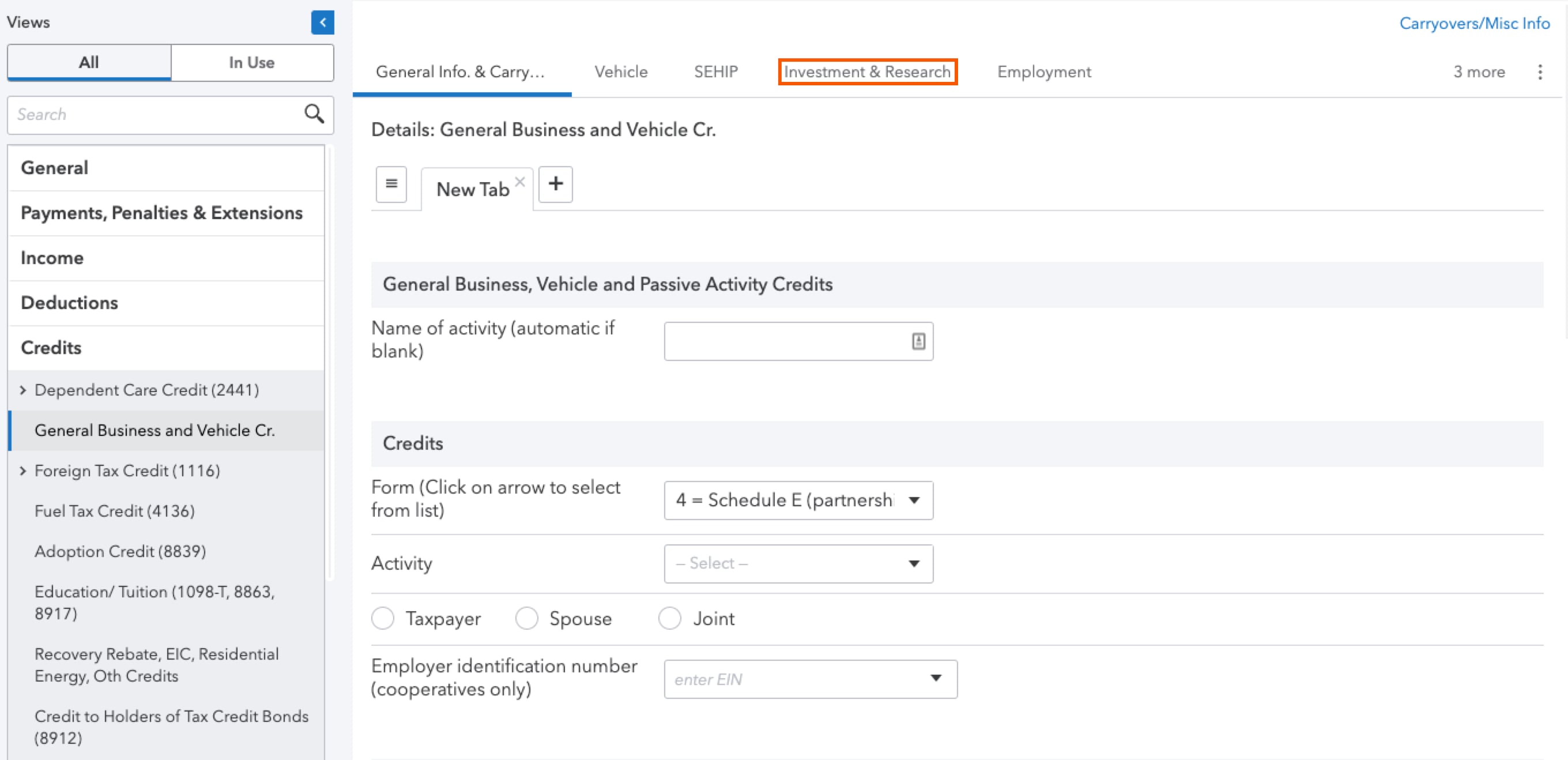

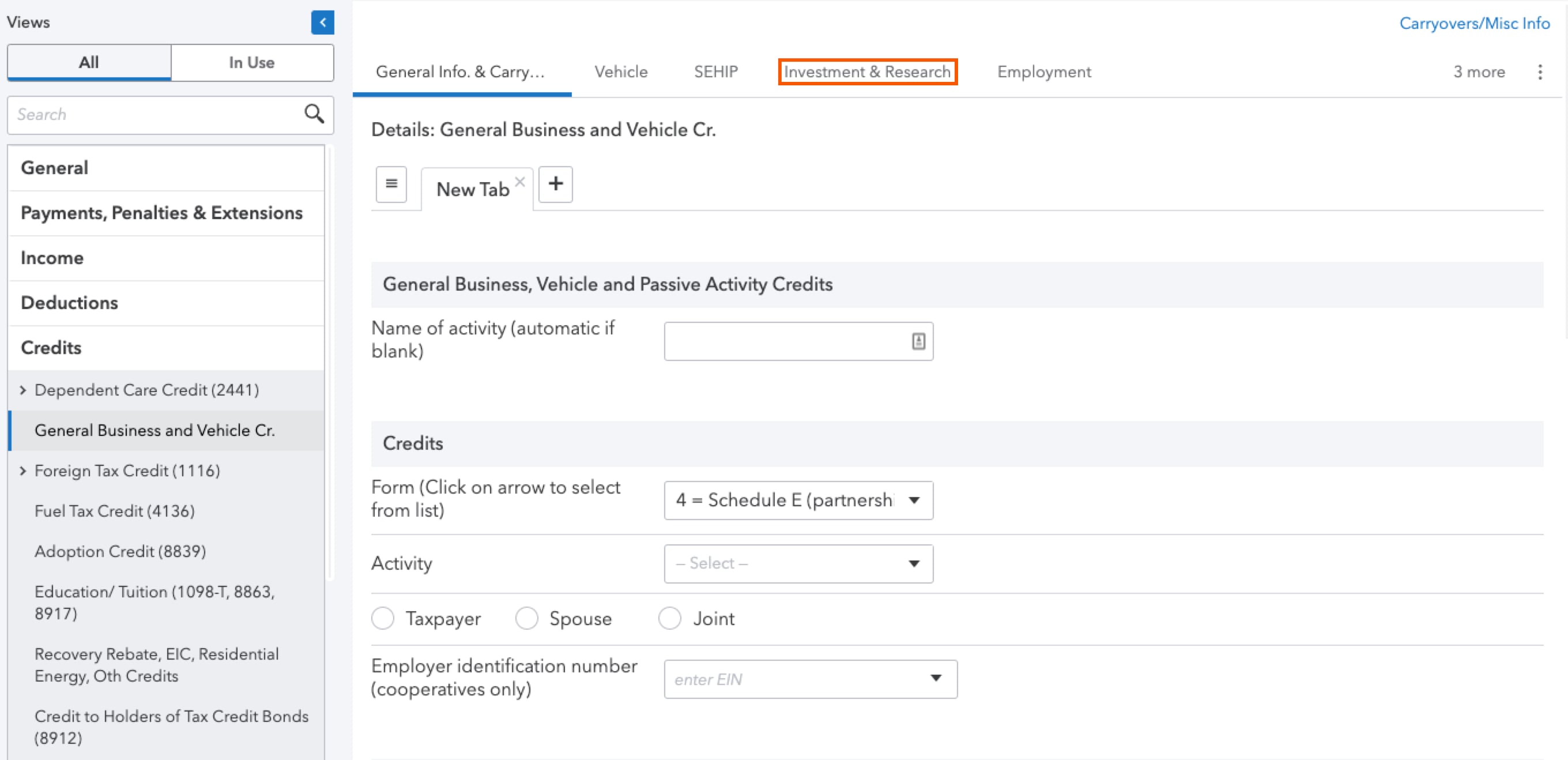

- Go to Input Return ⮕ Credits, General Business and Vehicle Cr.

- Under the section General Business, Vehicle and Passive Activity Credits, enter the Name of activity (automatic if blank).

- Under the section Credits in the field Form (Click on arrow to select from list), select 4 = Schedule E (partnership).

- In Activity, select the applicable activity.

- Select the Investment & Research tab.

- Under the section Investment Credit (3468), scroll to the Coal Project Credit subsection.

- Enter the applicable amounts from the K-1 for Form 3468, lines 5a–5c:

- Basis in integrated gasification cycle property (20%)

- Basis in investment in coal-based generating technology property (15%)

- Basis on investment in coal-based generation technology property (30%)

For additional information on entering a qualifying advanced coal project, see the here.

If the other information is qualifying gasification project property:

For tax year 2023, this is now code AS: Qualifying advanced coal project property and qualifying gasification project property.

Starting in tax year 2023:

- Go to Input Return ⮕ Credits ⮕ General Business and Vehicle Cr.

- Select the Investment Credit (3468) section.

- Select the Investment & Research tab.

- Select the facility you need to generate the credit for.

- Use the Add button to add as many Facilities or properties as needed.

- Complete Part 1 for each Activity.

- Scroll down to the Part II and enter the required information.

- The credit flows from Form 3468 to Form 3800 to show on Form 1040.

For tax year 2022 and prior:

- Go to Input Return ⮕ Credits, General Business and Vehicle Cr.

- Under the section General Business, Vehicle and Passive Activity Credits, enter the Name of activity (automatic if blank).

- Under the section Credits in the field Form (Click on arrow to select from list), select 4 = Schedule E (partnership).

- In Activity, select the applicable activity.

- Select the Investment & Research tab.

- Under the section Investment Credit (3468), scroll to the Coal Project Credit subsection.

- Enter the applicable amounts from the K-1 for Form 3468, lines 6a-6b:

- Basis of property qualifying for gasification project credit, incl. CO2 sequestration (30%)

- Basis of property qualifying for gasification project credit (20%)

For additional information on entering a qualifying gastrification project property, see the here.

If the other information is qualifying advanced energy project property:

What's new for Form 3468 for tax year 2024:

- For tax years beginning after January 1, 2024, eligible filers can claim the clean electricity investment credit under section 48e in Part V.

- Note: This applies primarily to fiscal-year filers with tax years ending in 2025 (e.g., partnerships and S corporations filing Form 1065 or 1120S). For calendar-year filers (primarily individuals filing Form 1040), this credit is generally available for property placed in service after December 31, 2024.

- If you are claiming a rehabilitation credit and you completed Part VII, lines 1i or 1j, you also need to complete lies 1k(i) and 1k(ii). Both lines are now required.

- The IRS established a pre-filing registration process that must be completed prior to electing payment or transfer of the investment credit. You can register here.

This applies primarily to fiscal-year filers with tax years ending in 2025 (e.g., partnerships and S corporations filing Form 1065 or 1120S). For calendar-year filers (primarily individuals filing Form 1040), this credit is generally available for property placed in service after December 31, 2024.

Starting in tax year 2023:

- Go to Input Return ⮕ Credits ⮕ General Business and Vehicle Cr.

- Under the section General Business, Vehicle and Passive Activity Credits, enter the Name of activity (automatic if blank).

- Under the section Credits in the field Form (Click on arrow to select from list), select 4 = Schedule E (partnership).

- Select the Investment Credit (3468) section.

- Select the Investment & Research tab.

- Select the facility you need to generate the credit for.

- Use the Add button to add as many Facilities or properties as needed.

- Complete Part 1 for each Activity.

- Scroll down to the part pertaining to this specific energy credit investment and enter the required information.

- The credit flows from Form 3468 to Form 3800 to show on Form 1040.

For tax year 2022 and prior:

- Go to Input Return ⮕ Credits, General Business and Vehicle Cr.

- Under the section General Business, Vehicle and Passive Activity Credits, enter the Name of activity (automatic if blank).

- Under the section Credits in the field Form (Click on arrow to select from list), select 4 = Schedule E (partnership).

- In Activity, select the applicable activity.

- Select the Investment & Research tab.

- Under the section Investment Credit (3468), scroll to the Coal Project Credit subsection.

- Enter the applicable amounts from the K-1 for Form 3468, line 7:

- Basis of investment in advanced energy project

If the other information is conservation reserve program payments:

For tax year 2023, this is now code AQ: Conservation reserve program payments.

- Go to Input Return ⮕ Taxes ⮕ Other Taxes.

- Select Self-Employment Tax (Schedule SE).

- Under the section Self-Employment Tax (Schedule SE), enter the Conservation reserve payments not subject to SE tax.

For additional information on entering conservation reserve program payments, see the here.

For more Schedule K-1 resources, check out our Tax topics page for Schedule K-1 where you'll find answers to the most commonly asked questions.

More like this

- Entering a partnership Schedule K-1, line 20 in ProConnect Taxby Intuit

- Entering partnership Schedule K/K-1 - Other deductions and Other income (loss) in ProConnectby Intuit

- How to enter self-employment income for a partnership K-1 in ProConnect Taxby Intuit

- How to generate Form 6765 partnership Increasing Research Credit in ProSeriesby Intuit