Common questions for Individual Illinois Partner Schedule K-1-P in Lacerte

by Intuit• Updated 2 years ago

You can use the Illinois Schedule K-1-P (EF only) (IL) section in Screen 20.1, Partnership Information to create an electronic copy of the IL Schedule K-1-P.

Before you start:

- Entries in the (EF Only) sections are used to complete the IL K-1-P, which you can view on the Forms tab and is included with the e-filing of the tax return.

- The purpose of this is for you to recreate the K-1-P you received from the partnership or S corporation, like how you'd attach a paper copy to your mailed IL-1040 if you were paper filing.

- EF only entries don't affect the IL-1040 or IL-1040NR and may need to be entered elsewhere in order to reflect correctly on the tax return.

- Entries in IL Partner Share of Additions/Subtractions {IL} and Illinois Partner Share of IL Credits, Recapture and Payments {IL}—or any other sections that don't say (EF only) in the title—do flow to the tax return, as well as the e-file copy of the K-1-P. You don't need to re-enter these anywhere else on the return.

Follow these steps to generate IL Schedule K-1-P for an individual return:

- Go to Screen 20, Passthrough K-1's.

- Select Partnership Information or S Corporation Information in the Passthrough K-1's box on the left side of the screen.

- Select the appropriate K-1 in the Partnership or S Corporation box on the left side of the screen.

- Select Illinois Schedule K-1-P (EF only) (IL) from the left Sections box.

- Enter the Share percentage (XX.XXX) (MANDATORY) field.

- You must enter this field to generate IL Schedule K-1-P.

- Enter any other applicable information.

- Enter all applicable information in the following sections:

- Illinois Partner Share of IL Additions/Subtractions {IL}

- Illinois Partner Share of IL Credits, Recapture and Payments {IL}

Examples

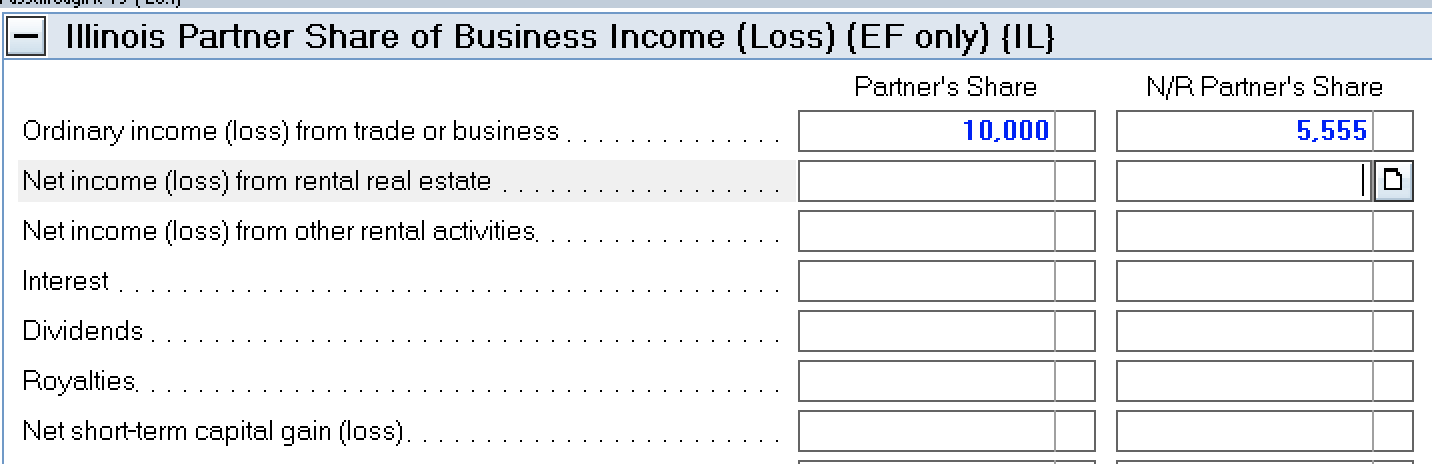

Using (EF Only) sections:

The information you enter shows on the K-1-P. However, it doesn’t flow anywhere else:

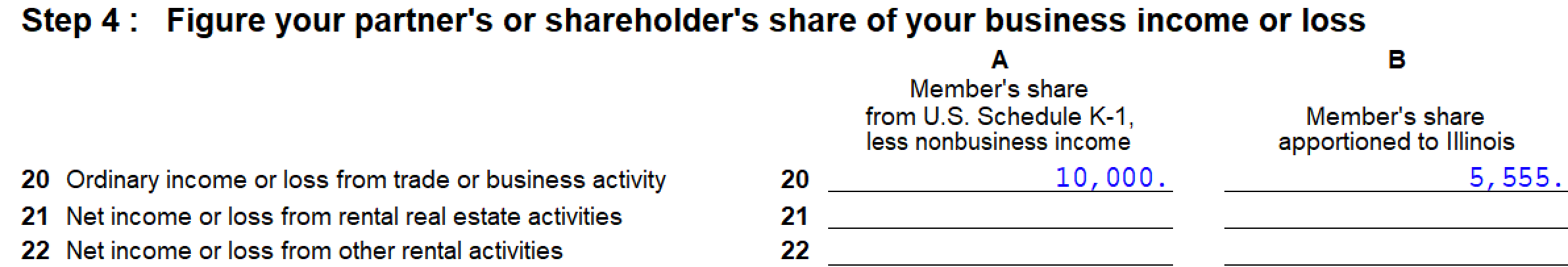

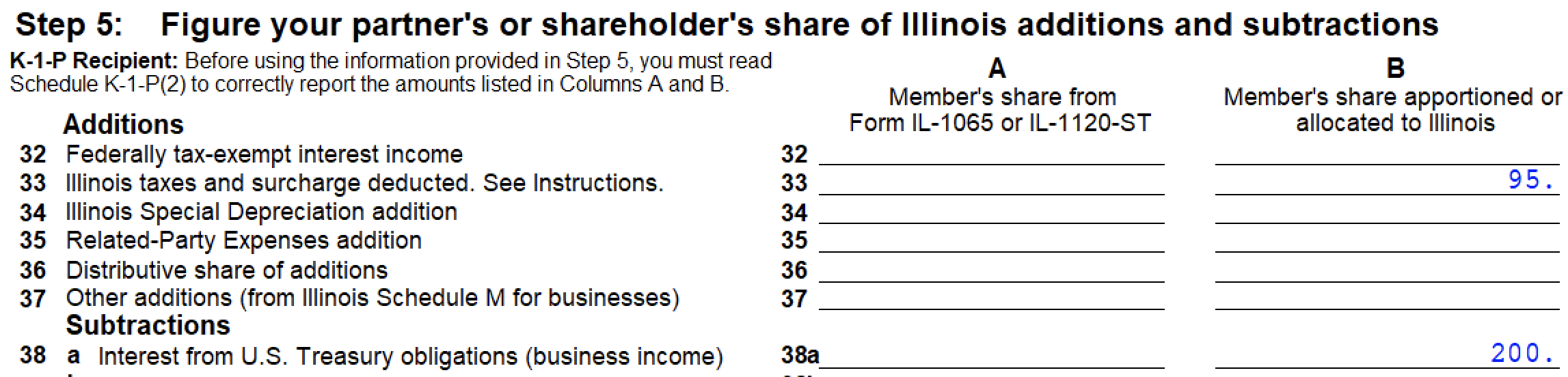

K-1-P output:

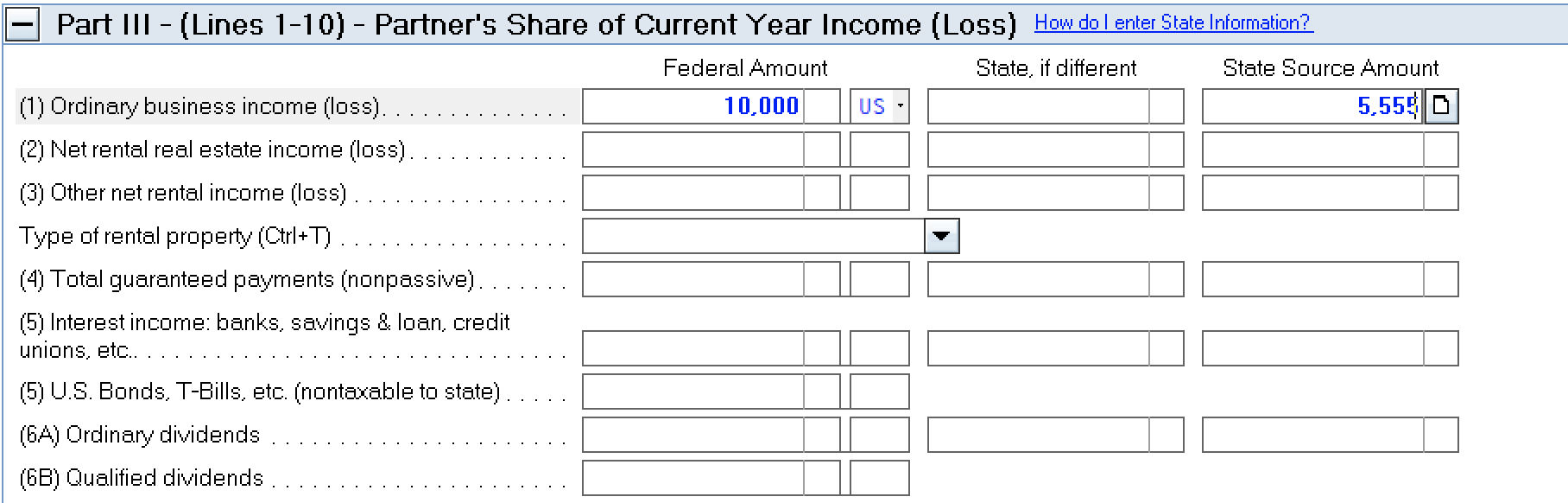

If you want these amounts to affect the tax return, you'd also enter them here:

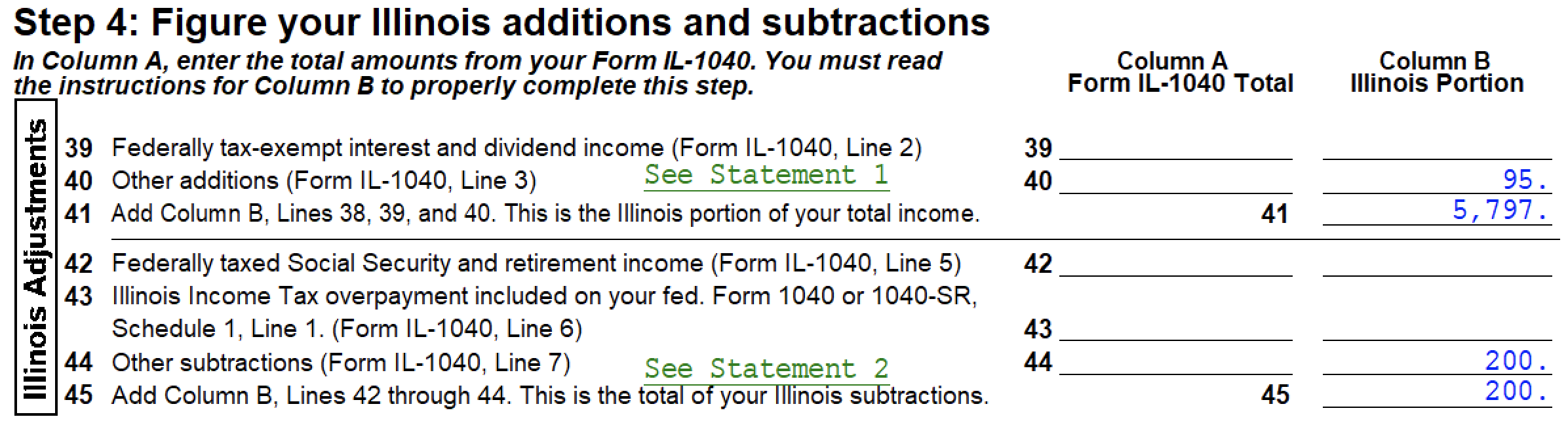

In this example, the K-1 belongs to an Illinois nonresident, so these entries flow to the Sch NR:

.png)

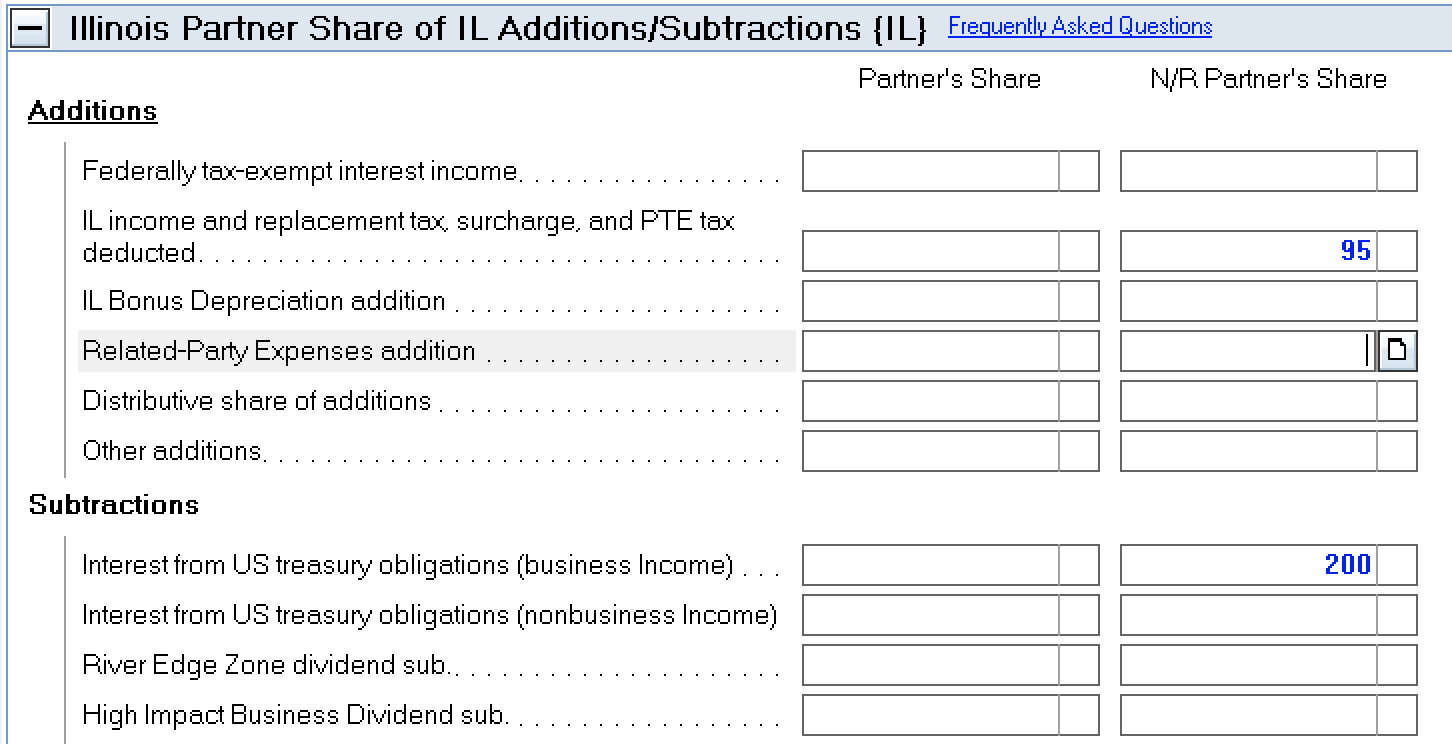

Using sections that aren't (E-File Only):

The information you enter here results in output both on the (E-File Only) K-1-P and the Schedule NR:

K-1-P output:

Schedule NR output:

Related topics

More like this

- Common questions for Individual Illinois Partner Schedule K-1-P in ProConnect Taxby Intuit

- Entering individual Illinois partner share of IL additions/subtractions in Lacerteby Intuit

- Common questions about Illinois Shareholder Schedule K-1-P in Lacerteby Intuit

- How to resolve Lacerte diagnostic ref. 13392 - Form IL 1040 Line 28 cannot exceed pass-through entity paymentsby Intuit