How to report partnership K-1, Box 13 code ZZ on an individual return in Lacerte

by Intuit•3• Updated 1 month ago

![]() Lacerte doesn't have a specific entry field for Box 13, code ZZ, since this box is used for various other deductions. The firm who prepared the partner's K-1 should have included a description of what the deductions are, and instructions on how to report the deductions on the partner's individual return. Refer to the Partners instructions for Schedule K-1 for Schedule K-1 for a complete list of deductions that may be reported in Box 13 with code ZZ.

Lacerte doesn't have a specific entry field for Box 13, code ZZ, since this box is used for various other deductions. The firm who prepared the partner's K-1 should have included a description of what the deductions are, and instructions on how to report the deductions on the partner's individual return. Refer to the Partners instructions for Schedule K-1 for Schedule K-1 for a complete list of deductions that may be reported in Box 13 with code ZZ.

For more Schedule K-1 resources, check out our Tax topics page for Schedule K-1 where you'll find answers to the most commonly asked questions.

To report Schedule K-1, Box 13, code ZZ without having descriptions or instructions about the deductions:

- Go to Screen 20, Passthrough K-1's.

- Select Partnership Infomation from the left menu.

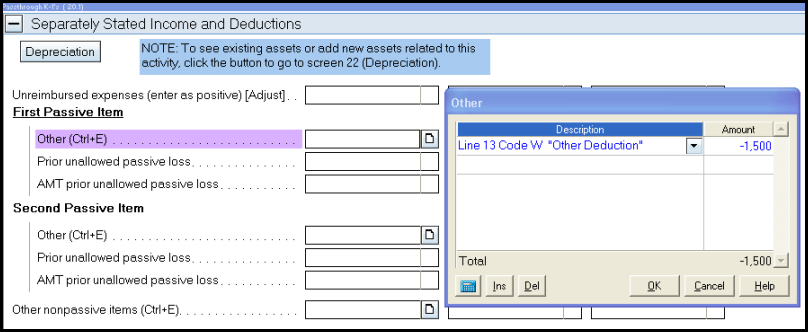

- Scroll down to the Separately Stated Income and Deductions subsection.

- To report the deduction as passive:

- Locate the First Passive Item subsection.

- In the field Other (Ctrl+E) enter Ctrl+E or select the expander icon to open the input box.

- Enter the Description.

- Enter the Amount as a negative number.

- Select OK.

- If the loss is allowed after passive limitations are applied, the entry will flow to the Schedule E, Page 2, Line 28 column (f), Passive loss allowed (attach Form 8582 if required).

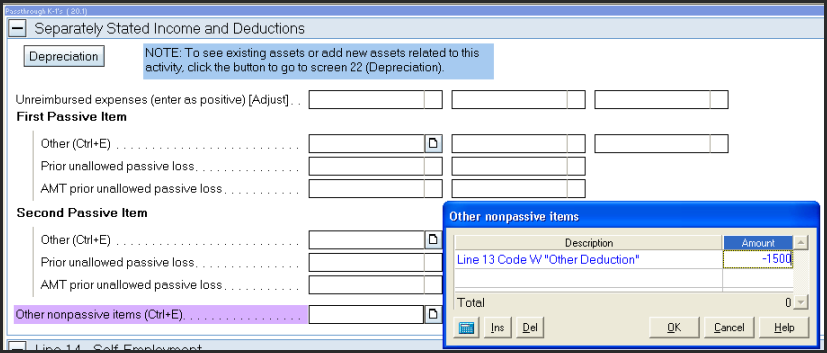

- To report the deduction as nonpassive:

- In the field Other nonpassive items (Ctrl+E) enter Ctrl+E or select the expander icon to open the input box.

- Enter the Description.

- Enter the Amount as a negative number.

- Select OK.

- This entry will flow to the Schedule E, Page 2, Line 28 column (h) Nonpassive loss from Schedule K-1.

- To report the deduction as passive:

If the partnership provided details on Box 13, code ZZ amounts, you can find additional information on codes by selecting the Frequently Asked Questions link in the Line 13 - Other Deductions section bar, or by referring to Understanding partnership Schedule K-1, box 13 codes for individual returns in Lacerte.

For Box 13, code ZZ amounts that are not specifically listed here, use the Partners instructions for Schedule K-1 to decide where the item should be reported on the partner's 1040.

More like this

- How to report partnership K-1, Box 13 code ZZ on an individual return in ProConnect Taxby Intuit

- Understanding partnership Schedule K-1, box 13 codes for individual returns in Lacerteby Intuit

- Understanding partnership Schedule K-1, box 13 codes for individual returns in ProConnect Taxby Intuit

- Common questions about entering passthrough entity K-1 information in Lacerteby Intuit