How to generate New Jersey midyear returns in ProSeries

by Intuit• Updated 10 months ago

This article will help you instal the New Jersey midyear fiscal returns in the Corporate or S-Corporate of ProSeries Professional.

Before you start:

- For tax year 2022 New Jersey Mid-Year returns are no longer on a Pay-Per-Return basis.

- For tax year 2021 to tax year 2013 and later fiscal year New Jersey Corporate and S-Corporate products are only available on a Pay-Per-Return basis. When first opening the New Jersey fiscal Corporate or S-Corporate return in a client's file, you'll be prompted for the Pay-Per-Return authorization.

- The midyear return installs into the prior year of ProSeries.

- For example: If you need New Jersey midyear forms for tax year 2023, you'd open ProSeries 2022 to access the return.

- The New Jersey PTE forms for midyear filers are currently not supported in ProSeries.

How do I install New Jersey midyear returns?

The instructions below are applicable for tax year 2022 and newer. For prior years click here.

Follow these steps to install NJ midyear products:

- Open ProSeries.

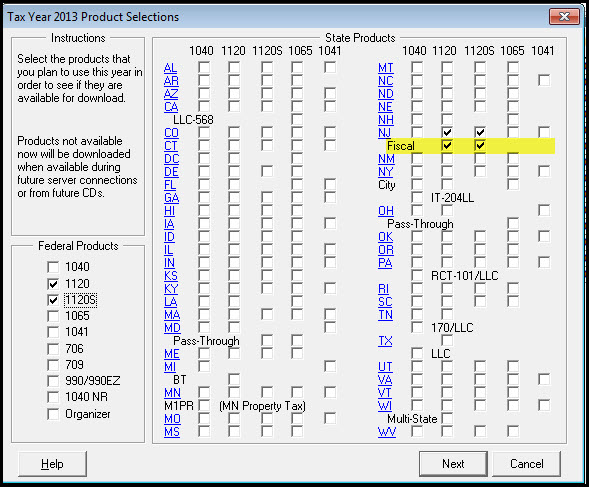

- From the Update menu, select Select and Download New Products...

- In the product selection window, locate the New Jersey (NJ) row

- Select the NJ 1120 and 1120S checkboxes.

- Click the Next button to begin the download and installation.

Generating New Jersey midyear returns:

- Open the prior year of ProSeries.

- Open the federal return.

- On the Information Worksheet scroll down to Part III Tax Year and Filing Information.

- Select Fiscal Year and enter the End Month.

- New Jersey midyear is applicable to fiscal years ending between July and November.

- From the File menu, select Go to State/City.

- Select New Jersey.

- When viewing the form midyear forms are indicated with MY in the forms list.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- Common questions on Form 1040NR in ProSeriesby Intuit•73•Updated 1 week ago

- Preparing state returns in ProSeriesby Intuit•46•Updated November 17, 2023

- Allocating income for multi-state returns in ProSeriesby Intuit•41•Updated 2 years ago

- E-filing prior-year returns in ProSeriesby Intuit•80•Updated November 21, 2023

- Generating Form 1045 in ProSeriesby Intuit•18•Updated 2 years ago