How to report a section 179 expense recapture

by Intuit• Updated 6 months ago

For more Schedule C resources, check out our Tax topics page for Schedule C where you'll find answers to the most commonly asked questions.

Follow these steps to report Section 179 expense recapture in the Individual module:

- Under Input Return, select Income.

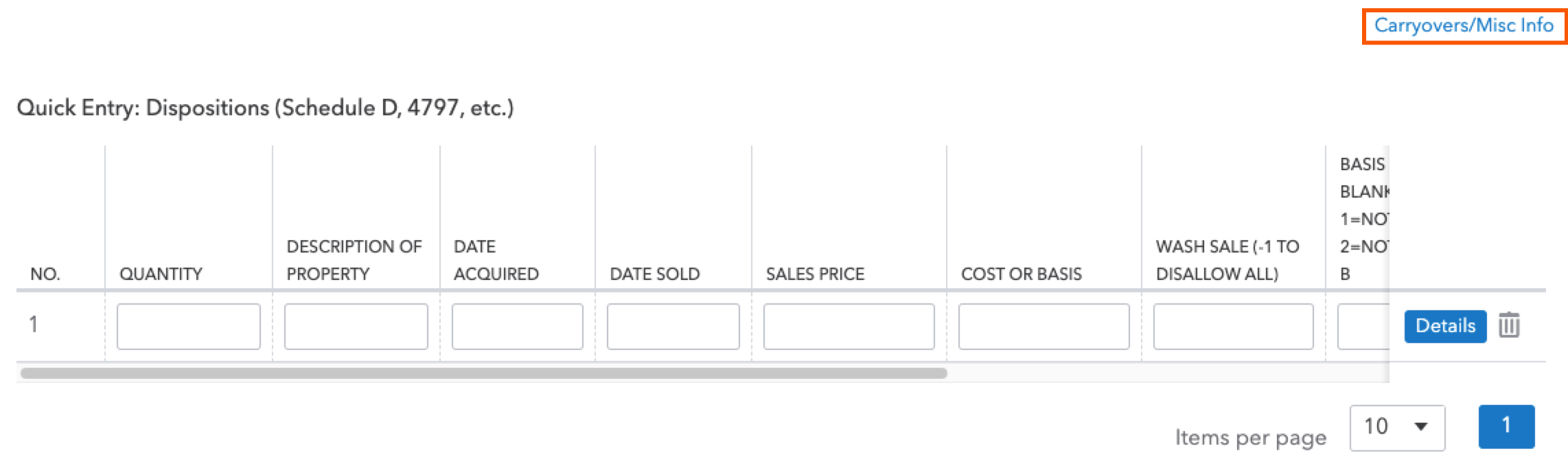

- Select Disposition (Sch D, etc.), then Schedule D/4797/etc.

- Select Carryovers/Misc Info.

- Select the 4797 Carryovers & Recap tab.

- Under the Form 4797 section, scroll to the Recapture 50% or Less Business Use subsection.

- Enter the section 179 expense you deducted when the property was placed in service in Section 179 expense deduction.

- Enter the regular Depreciation allowable on the section 179 property from the time it was placed in service through the current year.

- Enter this recapture amount as income where you originally claimed the 179 deduction. For example, here's how you'd enter it on Schedule C:

- Under Input Return, select Business Income (Sch C).

- Select the Income Statement tab.

- Under the Income section, enter the recapture amount in the Other income field.

A critical diag (ref. 2025063) will generate whenever you’ve entered an amount in the field from step 6 to remind you to enter the recapture amount as income on the appropriate activity. This diagnostic won’t prevent you from e-filing the return.